2019-09-25 15:33:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, and eBay use fast multi-channel pricing algorithms to set the retail prices of consumer goods. For central bankers and monetary policymakers who often need to monitor transitional inflation dynamism over time, retail prices are subject to more frequent adjustments with less insulation from common nationwide shocks. Intense product market competition poses a new economic risk that some retailers may institute an innocuous deterioration in product quality instead of upward price revision.

Online retailers can use smart retail-pricing algorithms to take into account energy costs, exchange rate fluctuations, and other fundamental factors that may affect both production and delivery prices. Product market power concentration further empowers the top 10% superstar companies to capture almost 80% of net profits in Corporate America. These superstar companies retain their competitive moats over the course of more than one single real business cycle (about 7-to-9 years). This anti-competitive clout issue calls for tougher antitrust scrutiny for tech titans (Apple, Amazon, Alibaba, Facebook, Google, and Twitter), big biotech bellwethers (Johnson & Johnson, Pfizer, Merck, Abbot, Amgen, and Bristol-Myers Squibb), and telecoms (Verizon, AT&T, Sprint, and T-Mobile).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-23 12:25:00 Monday ET

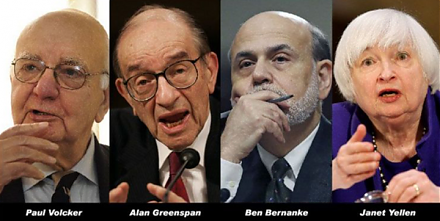

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

2018-06-11 07:44:00 Monday ET

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d

2019-11-03 12:30:00 Sunday ET

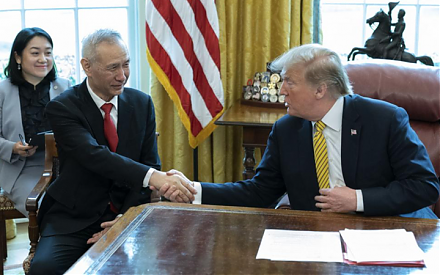

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice