2018-03-03 11:37:00 Sat ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade deals and economic ties. Foreign investors now activate their keen interest in Chinese tech titans such as Baidu, Alibaba, and Tencent (BAT). Baidu specializes in Chinese online search; Alibaba focuses on international e-commerce and fintech solutions; and Tencent derives most of its revenue from Chinese instant messengers such as WeChat and Tencent QQ, online games, and other entertainment and lifestyle software solutions. BATs operate as oligopolies with hefty competitive moats that manifest in the form of patents, trademarks, copyrights, and some other intellectual properties. Their high product market concentration serves as a major explanation for worse income and wealth inequality in China.

President Xi's strongman rule can further entrench these Chinese tech titans with product market dominance. This new Sino political economy defeats the western purpose of admitting China into the World Trade Organization (WTO) after the key post-war collapse of the Soviet Union. China resists both regional trade integration and global economic order and thus often fails to comply with WTO trade rules on fair trade and intellectual property protection.

Few mainland residents embrace democracy, economic freedom, and the rule of law in China.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-06-21 10:25:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why emotional intelligence can serve as a more important critical succ

2017-03-03 05:39:00 Friday ET

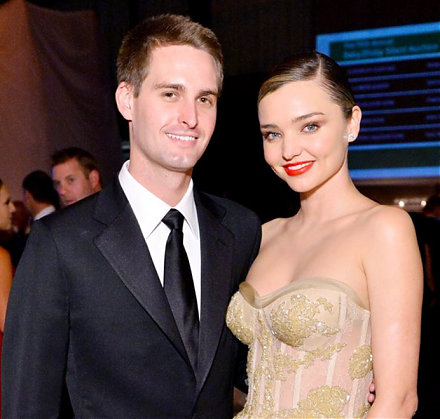

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2023-06-19 10:31:00 Monday ET

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2019-10-25 07:49:00 Friday ET

U.S. fiscal budget deficit hits $1 trillion or the highest level in 7 years. The current U.S. Treasury fiscal budget deficit rises from $779 billion to $1.0

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.