2018-05-03 07:34:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Sprint and T-Mobile propose a major merger in order to better compete with AT&T and Verizon. This mega merger is worth $26.5 billion and involves an all-stock deal that exchanges 9.75 Sprint shares for each T-Mobile share. The bipartite company retains the T-Mobile name, keeps its CEO John Legere, and encompasses about 120 million subscribers. This merger carries about $146 billion enterprise valuation with debt in comparison to $313 billion Verizon enterprise value and $334 billion AT&T enterprise valuation. The latter telecom titans invest in substantial fiber-optic, wireless telecom, telephone, can cable television operations.

Joining forces would allow the company to build out a 5G wireless network in direct competition with AT&T and Verizon. This new merger clears the cloudy practices that may harm consumer benefits in the prior M&A attempt back in 2014. T-Mobile and Sprint suggest that times have changed a great deal since 2014 since several companies such as Comcast now enter the mobile business. Moreover, the White House advocates that 5G wireless communication technology is crucial for national economic security reasons. Many stock analysts now consider this mega merger to take place with a 50%+ chance of regulatory approval.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr

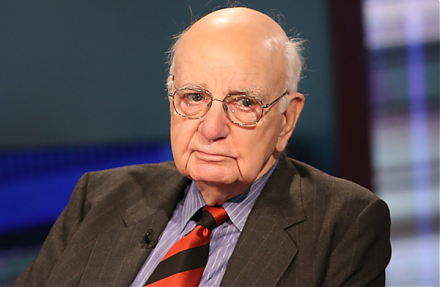

2018-10-23 12:36:00 Tuesday ET

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr

2018-01-08 10:37:00 Monday ET

Spotify considers directly selling its shares to the retail public with no underwriter involvement. The music-streaming company plans a direct list on NYSE

2017-12-09 08:37:00 Saturday ET

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because i