Search results : agency theory

2022-10-15 09:34:00 Saturday ET

2022-10-05 08:24:00 Wednesday ET

2022-09-25 09:34:00 Sunday ET

2022-05-05 09:34:00 Thursday ET

2022-04-25 10:34:00 Monday ET

2022-03-25 09:34:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c

2019-06-25 10:34:00 Tuesday ET

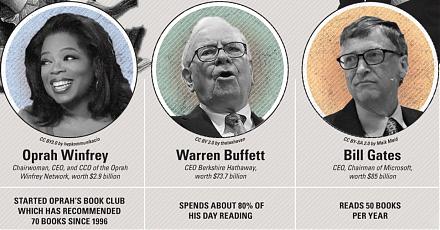

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a

2018-07-05 13:40:00 Thursday ET

U.S. trading partners such as the European Union, Canada, China, Japan, Mexico, and Russia voice their concern at the World Trade Organization (WTO) in ligh

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2019-01-21 10:37:00 Monday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube January 2019 In this podcast, we discuss several topical issues

2017-09-25 09:42:00 Monday ET

President Trump has allowed most JFK files to be released to the general public. This batch of documents reveals many details of the assassination of Presid