2019-01-02 06:28:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

New York Fed CEO John Williams listens to sharp share price declines as part of the data-dependent interest rate policy. The Federal Reserve can respond to stock market plunges, but key FOMC members still view the U.S. economy as sufficiently strong to grow with higher interest rates. Williams emphasizes softening the central bank language that the next 2 interest rate increases are only economic projections. The upward interest rate trajectory is not a matter of right-or-wrong with Wall Street, and the central bank cannot be on autopilot at this stage of the real business cycle. Williams expects U.S. real GDP to slow to 2%-2.5% in 2019 from 3%-3.5% in 2018, whereas, inflation should be around 2% in 2019. Trump tariffs continue to pose a major tone of economic policy uncertainty.

Treasury Secretary Steven Mnuchin tries to assuage bank CEOs and stock market investors that the Trump administration has no power to oust Fed Chair Jay Powell for his recent interest rate hike. Mnuchin seeks consultation with the Securities and Exchange Commission and Federal Reserve on the partial government shutdown and stock market turmoil. This stock market plunge protection team hence receives reassurance from banks that there is ample liquidity for lending to both consumers and firms.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-19 17:41:00 Wednesday ET

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a m

2019-12-01 10:31:00 Sunday ET

Goop Founder and CEO Gwyneth Paltrow serves as a great inspiration for female entrepreneurs. Paltrow designs Goop as an online newsletter, and this newslett

2018-10-30 10:41:00 Tuesday ET

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It

2019-09-03 14:29:00 Tuesday ET

Due to U.S. tariffs and other cloudy causes of economic policy uncertainty, Apple, Nintendo, and Samsung start to consider making tech products in Vietnam i

2020-09-24 10:26:00 Thursday ET

Edge strategies help business leaders improve core products and services in a more cost-effective and less risky way. Alan Lewis and Dan McKone (2016)

2019-01-04 11:41:00 Friday ET

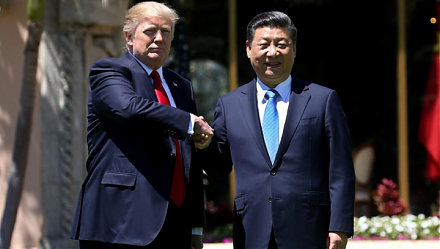

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin