2017-03-27 06:33:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

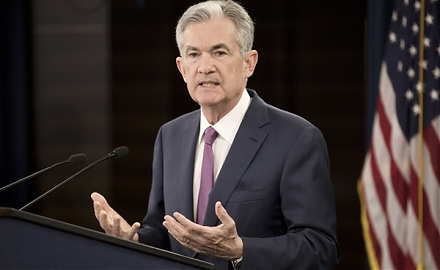

The highly probable shrinkage of Fed's $4.5 billion balance sheet will phase out over the next few months before the next leadership transition.

This shrinkage accords with the Federal Reserve's likely interest rate hike later in 2017.

Targeting inflation at a little over 2% per annum, the Federal Reserve reacts to high stock market momentum with a more hawkish monetary policy stance.

Favorable macroeconomic data such as better industrial production growth and manufacturing job creation support the next interest rate increase.

In response, the U.S. greenback tends to appreciate while American economic growth rebounds to attract capital flows back from emerging economies at the medium stage of the global financial cycle.

With free international capital flows and flexible exchange rates, the current Fed interest rate hike is likely to lead non-U.S. monetary contraction worldwide over the next few years (aka the Mundellian international-finance trilemma).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-21 14:40:00 Sunday ET

President Trump floats generous 10% tax cuts for the U.S. middle class ahead of the November 2018 mid-term elections. Republican senators, congressmen, and

2019-01-08 17:46:00 Tuesday ET

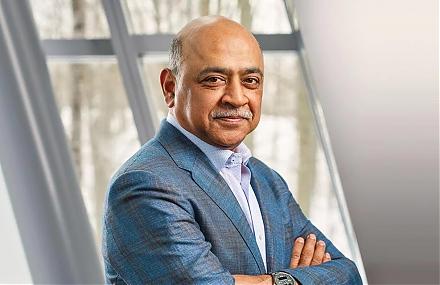

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2024-02-05 11:26:00 Monday ET

China poses new economic, technological, and military threats to the U.S. and many western allies. In the U.S. government assessment, China poses new eco

2023-11-30 08:29:00 Thursday ET

In addition to the OECD bank-credit-card model and Chinese online payment platforms, the open-payments gateways of UPI in India and Pix in Brazil have adapt