2019-08-06 07:28:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

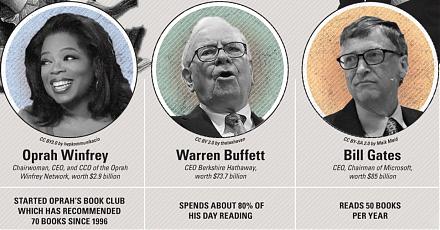

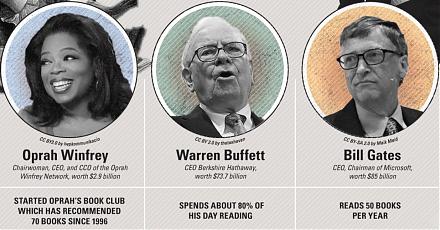

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder Jeff Bezos. In light of this ingenious strategy, Bezos evaluates prospective investment projects in terms of whether these equity stakes change and enrich the economic lives of others. O'Neal indicates that he has almost quadrupled his net worth once he implements this strategy with his personal equity investments in Apple, Google, Las Vegas nightclubs, and fast food franchises (such as Krispy Kreme, Five Guys, Auntie Anne, and Papa John). In terms of his personal preferences, O'Neal points out that Google equity stakes have been his best investment by far. Further, O'Neal most enjoys his equity investment in the Krispy Kreme doughnut chain because he is a big fan of fresh doughnuts.

This reasonable mix of fast food, entertainment, and technology allows O'Neal to diversify his equity stakes across prosperous industries. The information exchange between Bezos and O'Neal illuminates the fundamental value of equity investment. Stock ownership can be an efficient investment vehicle for angel investors such as Bezos and O'Neal to be the positive change that they would like to see in the world.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2023-06-19 10:31:00 Monday ET

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network plat

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2021-02-02 14:24:00 Tuesday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement

2017-11-25 06:34:00 Saturday ET

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement o