2017-05-19 09:39:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon. These tech giants account for more than 15% of market capitalization of the American stock market (NYSE, NASDAQ, and AMEX). Facebook's recent acquisitions of WhatsApp, Instagram, and Oculus have expanded the social media network to encapsulate more than 2 billion active users worldwide. At present, Google still beats Facebook in terms of average revenue per user (ARPU) (about $45 vis-à-vis $20) and dominates the global Internet search and advertisement market.

Microsoft heralds its latest Windows 10 operating system updates and Office 365 suites for better user experience and word-of-mouth proliferation. Moreover, Amazon introduces Retail 2.0 or the Internet of Everything (IoE) in lieu of typical e-commerce with its recent acquisition of Whole Foods to better compete with Wal-Mart, Best Buy, Macy's, Neiman Marcus, JC Penny, and so on.

Apple brings about its iPhone X with AMOLED curvy touch screen and wireless charging functions to celebrate the 10th anniversary of its revolutionary smart phone launch. Many upstream international iPhone suppliers experience hefty stock market gains in recent times. We expect FAMGA to continue to dominate in social media, IoE, software, Internet search and advertisement, and mobile technology with their *competitive moats* from rare and inimitable patents and new proprietary technologies to increasingly inclusive and powerful platforms, networks, and algorithms.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-02-15 14:41:00 Tuesday ET

Modern themes and insights in behavioral finance Lee, C.M., Shleifer, A., and Thaler, R.H. (1990). Anomalies: closed-end mutual funds. Journal

2019-12-01 10:31:00 Sunday ET

Goop Founder and CEO Gwyneth Paltrow serves as a great inspiration for female entrepreneurs. Paltrow designs Goop as an online newsletter, and this newslett

2016-11-08 00:00:00 Tuesday ET

Donald Trump defies the odds to become the new U.S. president. He wants to make America great again. He seeks to repeal Obamacare. He has zero tole

2019-06-15 10:28:00 Saturday ET

The Sino-American trade war may slash global GDP by $600 billion. If the Trump administration imposes tariffs on all the Chinese imports and China retaliate

2018-03-13 07:34:00 Tuesday ET

From crony capitalism to state capitalism, what economic policy lessons can we learn from President Putin's current reign in Russia? In the 15 years of

2018-01-21 07:25:00 Sunday ET

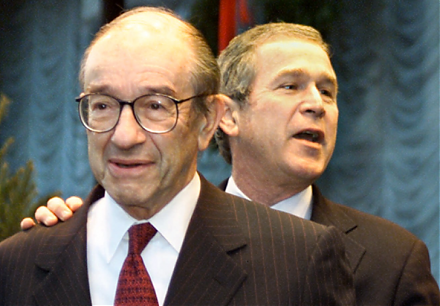

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as