2020-01-08 08:25:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general election outcome, British stock and bond markets surge with much investor optimism. As this election result resolves economic policy uncertainty, the British pound reaps reasonable gains against the greenback, euro, and most other currencies. The Conservative Party 365-seat majority can help push for the early resolution of both fair trade and fine Brexit negotiations with the European Union. Many stock market analysts and economic media commentators now expect Brexit to take place in early-2020. As a result, a second referendum on Brexit is less likely as Labour Party garners only 203 seats in the U.K. parliament.

London School of Economics political scientist Sara Hobolt critiques that the first-past-the-post system may not translate U.K. voter beliefs into parliamentary seats. At the heart of the Brexit debate, many British voters consider domestic healthcare and infrastructure subsidies to outweigh in relative importance trade, immigration, and membership in the European Union. In democratic countries with proportional representation, this result has become a major party realignment. This realignment reflects the pervasive British voter sentiment that U.K. politicians should get Brexit done in due course.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-05-07 08:26:00 Thursday ET

Disruptive innovators often apply their 5 major pragmatic skills in new blue-ocean niche discovery and market share dominance. Jeff Dyer, Hal Gregersen,

2017-04-07 15:34:00 Friday ET

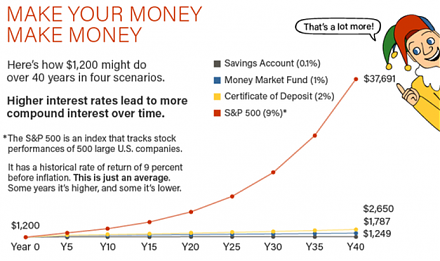

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive

2018-09-21 09:41:00 Friday ET

Former World Bank and IMF chief advisor Anne Krueger explains why the Trump administration's current tariff tactics undermine the multilateral global tr

2018-10-15 09:33:00 Monday ET

Several pharmaceutical companies now switch their primary focus from generic prescription drugs to medical specialties such as cardiovascular medications an

2017-12-19 09:39:00 Tuesday ET

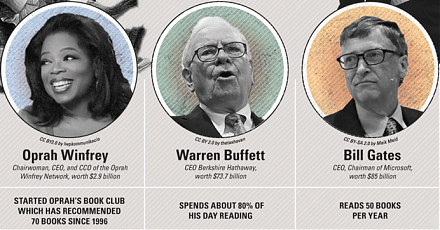

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2019-11-03 12:30:00 Sunday ET

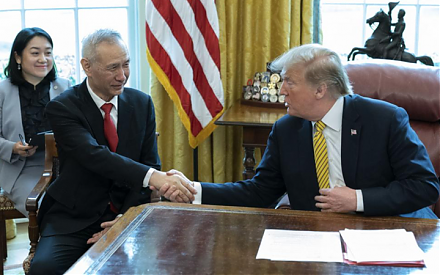

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice