2018-02-07 06:38:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The new Fed chairman Jerome Powell faces a new challenge in the form of both core CPI and CPI inflation rate hikes toward 1.8%-2.1% year-over-year with strong wage growth. The recent greenback depreciation aggravates inflationary concerns as non-farm payroll unemployment declines toward 4% or even 3.9%. This dollar depreciation raises U.S. import prices and therefore can drive greater inflationary momentum. More substantive evidence can shine new light on whether the current Trump stock market rally indicates irrational exuberance for most stock and bond investors.

The Federal Reserve can raise the interest rate to better balance the dual mandate of both price stability and maximum employment. Powell needs to weigh the pros and cons of another interest rate hike that constrains money supply growth near full employment. Price stability helps reduce economic policy uncertainty that may inadvertently dampen both consumption and capital investment decisions. On the other hand, Powell should pick the low-hanging fruits of full employment before America experiences the next gradual deterioration in labor market conditions. During the Trump administration, it takes 3%-3.5% real GDP economic growth for macro momentum to trickle down to the typical U.S. household, firm, and financial intermediary. Supply-side Trumpism needs to prove its feasible case in due course.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-07 07:32:00 Monday ET

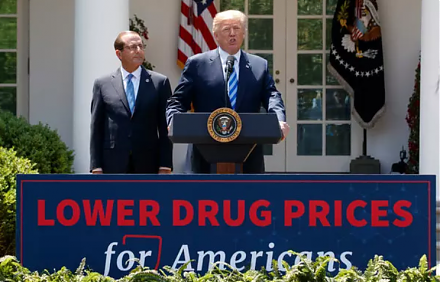

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2017-06-09 06:37:00 Friday ET

To complement President Trump's pro-business economic policies such as low taxation, new infrastructure, greater job creation, and technological in

2019-11-01 12:31:00 Friday ET

Kourtney Kardashian shares the best money advice from her father. This advice reminds her that money just cannot buy happiness. As the eldest of the Kardash

2019-05-01 09:27:00 Wednesday ET

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker

2018-01-23 06:38:00 Tuesday ET

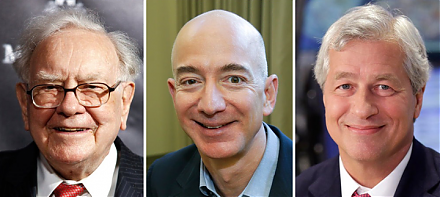

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su