2019-04-21 10:07:54 Sun ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of both price stability and maximum sustainable employment, most central banks seek to solve the dynamic consistency problem on the basis of a key desire to insulate monetary policy decisions from political influence.

A landmark empirical study of cross-country comparisons by Alberto Alesina and Lawrence Summers confirms that countries with better central bank independence experience lower inflation without suffering any real economic output or labor force penalty. An independent central bank can enhance fiscal discipline by reducing the relative likelihood of fiscal dominance and monetization of perennial budget deficits.

Historical experience and economic theory teach us an informative lesson. When monetary policy is subject to political control, people expect dovish expansionary interest rate adjustments and so anticipate higher wages and prices in response. The undesirable economic outcome is stagflation (or the worst-case scenario of both high inflation and high unemployment). It can cost prohibitive welfare losses for the central bank to bring down inflation with subsequent interest rate hikes. Key credible apolitical monetary policy decisions would thus promote price stability with minimal real impact on economic growth, employment, and capital investment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-01-11 11:38:00 Wednesday ET

Thomas Piketty's recent new book *Capital in the Twenty-First Century* frames income and wealth inequality now as a global economic phenomenon. When

2017-10-15 07:38:00 Sunday ET

Ivanka Trump and Treasury Secretary Steven Mnuchin both press the case for GOP tax legislation as economic relief for the middle-class without substantial t

2019-07-01 12:35:00 Monday ET

Apple releases the new iOS 13 smartphone features. These features include Dark Mode, Audio Share, Memoji, better privacy protection, smart photo collection,

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why

2019-08-09 18:35:00 Friday ET

Nobel Laureate Joseph Stiglitz maintains that globalization only works for a few elite groups; whereas, the government should now reassert itself in terms o

2017-08-01 09:40:00 Tuesday ET

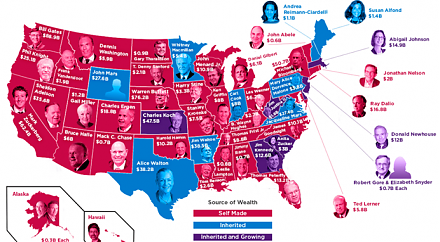

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N