Home > Library > Bank leverage and capital bias adjustment through the macroeconomic cycle

Author Apple Boston

This simulation study delves into the quantitative effects of the recent proposal for more robust bank capital adequacy.

Description:

The U.S. Basel Final Rule stipulates that the default probability should be the "bank's empirically based best estimate of the long-run average of one-year default rates for the exposures in the segment, capturing the average default experience for exposures in the segment over a mix of economic conditions (including downturn conditions) [that are] sufficient to provide a reasonable estimate of the average one-year default rate over the economic cycle for the segment". The core idea pertains to how the risk model developer incorporates the joint non-linear effect of macroeconomic risk covariates into the default probability function to measure the through-the-cycle (TTC) probability of default (PD). The conventional industry practice is to plug the long-term average macroeconomic risk covariates into the non-linear default probability function to compute the TTC1 PD. In comparison, an alternative approach would be to calculate each long-term average TTC0 PD based on the point-in-time (PIT) macroeconomic fluctuations through at least one complete business cycle. To the best of our knowledge, the extant literature does not provide an evaluation of these different approaches for the default probability adjustment through the macroeconomic cycle under the new Basel bank capital regime.

For bank capital management, PIT default probabilities include all available and pertinent information as of a given date to estimate the propensity for the borrower to default on the loan over the one-year period. This information includes not only the bank's expectations about the borrower's long-run credit risk trend but also the macroeconomic and idiosyncratic shifts in the borrower's credit risk profile. As a result, PIT default probabilities respond immediately to all the news that affects the borrower's default risk. For this reason, PIT default probabilities are highly volatile and procyclical in contrast to TTC default probabilities. Relative to PIT default probabilities, TTC default probabilities show less volatility and procyclicality over the business cycle. TTC default probabilities primarily reflect the borrower's long-term persistent default risk trend and thus do not contain the short-term transient changes in default risk that are likely to reverse with the passage of time. As TTC default probabilities are stable over the macroeconomic cycle, the Basel capital accord requires banks to use TTC default probabilities for regulatory capital measurement. This major distinction between PIT and TTC default probabilities affects how the bank incorporates macroeconomic risk covariates into the highly non-linear default probability model. The resultant default probability quantification contributes to the joint determination of bank equity capital.

There are several advantages of greater equity capital for banks. First, the main purpose of stricter equity capital regulation is to ensure that each bank is able to contain significant losses in its asset value while the bank continues to honor deposit withdrawals and other debt obligations (Admati and Hellwig, 2013; Demirguc-Kunt, Detragiache, and Merrouche, 2013; Aginer and Demirguc-Kunt, 2014). In this light, higher equity capitalization reduces bank risk and increases its long-term survival probability. Second, a larger equity capital buffer requires bank owners to retain an active interest in the financial enterprise. This active interest induces bank owners to improve the bank's risk management practices with fewer excessive risk-taking incentives due to both limited-liability and bailout expectations (Allen, Carletti, and Marquez, 2011; Coval and Thakor, 2005; Holmstrom and Tirole, 1997; Myerson, 2014). Third, greater equity capitalization would result in the choice of less risky portfolios through the lens of moral hazard because each bank has to contain large reductions in its asset value while there would be little incentive to transfer risk to another party (Keeley, 1990; Calomiris and Kahn, 1991; Acharya, Mehran, and Thakor, 2014). To the extent that discretionary regulatory forbearance counterproductively induces banks to increase their leverage, this high leverage funds excessively risky assets whose default probabilities significantly correlate with one another. The resultant equilibrium outcome is a suboptimal balance between asset substitution and debt discipline on managerial rent protection. This rationale suggests an important role for greater equity capitalization that helps resolve the moral hazard problem. In addition to the above, another reason for greater equity capital concerns the fact that higher equity capital requirements lead to higher endogenously determined bank survival probabilities at the interim point in time (Mehran and Thakor, 2010). This increase in survival likelihood suggests better cash-flow benefits from monitoring bank management in subsequent periods. Higher future profitability helps enhance bank value in the cross-section. Mehran and Thakor's (2010) empirical analysis of gains and synergies from bank mergers and acquisitions confirms a positive relation between equity capital and bank value, the latter of which can be measured in terms of total bank value and its components such as acquisition value, goodwill, and net present value to the target bank's shareholders.

This literature review suggests that the benefits of greater equity capital requirements for banks should outweigh the costs. Although many proponents of the compelling case for more robust total bank capital adequacy offer qualitative perspectives on this important policy issue (e.g. Admati and Hellwig (2013); Kashyap, Stein, and Hanson (2010); Myerson (2014)), we know little about the quantitative implications of this recent proposal. In other words, the econometrician has yet to test for the effect of changes in major risk parameters on the typical bank's equity capital ratio. This test requires a deeper analysis of the default probability adjustment through the macroeconomic cycle. To the extent that the TTC1 PD computation tends to underestimate the true TTC0 PD adjustment, this latter adjustment emerges as a topical subject for bank capital analysis.

Our current study first derives the mathematical result and then uses Monte Carlo simulation to demonstrate that there is a significant difference between the TTC0 and TTC1 PD estimates. Insofar as the vast majority of individual PDs land in the convex region of the highly non-linear PD function, the mathematical notion of Jensen's inequality suggests that the TTC1 PDs would be much lower than the TTC0 PDs. It is important to note that the TTC0 PD adjustment by brute force can be computationally intensive. For the sheer volume of a typical bank's retail and wholesale portfolios, it can be prohibitively costly to carry out the TTC0 PD adjustment by brute force. For this reason, we propose a convenient approximation, TTC2 and TTC3, via the higher-order Taylor-series expansion. Our empirical analysis suggests that this approximation is closer to the TTC0 PD origin by a full order of magnitude.

Our analytical result suggests that the conventional industry practice introduces a downward bias in the default probability adjustment for bank capital measurement. In contrast to the TTC1 PD adjustment, both the TTC0 PD adjustment by brute force and the TTC2 and TTC3 PD alternative methods result in higher default probabilities. This evidence has important implications in the context of the recent proposal for banks to hold more equity capital (Admati, DeMarzo, Hellwig, and Pfleiderer, 2011; Admati and Hellwig, 2013; Kashyap, Stein, and Hanson, 2010; Myerson, 2014). Specifically, our results bolster the case for revisiting the newly introduced 3%-6% equity capital requirement under the Basel bank capital regime. In contrast to this rather lenient regulatory equity capital requirement, our empirical results suggest that the typical bank's equity capital as a proportion of the total asset base should be as high as 22%-26%. This broad range is consistent with the qualitative implications of the recent proposal for banks to substantially raise their equity capital ratios that would become more commensurate with financial risk exposure that such banks would face in a rare severe macroeconomic recession (e.g. Admati and Hellwig (2013); Kashyap, Stein, and Hanson (2010); Myerson (2014)). Also, our analysis can be extended to help design a macroeconometric stress test for bank capital management. Overall, our research advocates support for more robust total capital adequacy. This endeavor thus serves as a scientific microfoundation for the central thesis that banks can become more stable by holding a greater capital cushion to absorb large losses in times of severe financial stress.

Is the recent bank capital proposal the specific recommendation that banks should hold more capital? Alternatively, does this proposal refer to the theoretical explanation for this recommendation? It would be necessary for us to explain how the theoretical explanation for the specific bank capital proposal maps into the higher moments of the logit default probability adjustment for capital bias correction.

Both points are valid within our Monte Carlo simulation framework. On the one hand, our quantitative results bolster the recent proposal for banks to hold substantially higher core equity capital to safeguard against extreme losses that might arise in rare times of severe financial stress. On the other hand, this proposal has to embed the theoretical higher moments (i.e. variance and skewness) of Taylor series expansion of the highly non-linear logit default probability adjustment for bank capital bias correction. To the extent that macroeconomic fluctuations manifest in the higher moments of the standard default probability function due to the procyclical nature of bank capital, it is important for bank supervisors to enforce the putative capital bias adjustment through the macroeconomic cycle.

Several recent studies connect the credit risk model with macroeconomic variables (Duffie, Saita, and Wang, 2007; Duffie, Eckner, Horel, and Saita, 2009; Koopman, Kraussel, Lucas, and Monteiro, 2009; Koopman, Lucas, and Schwaab, 2011). Bangia, Diebold, Kronimus, Schagen, and Schuermann (2002) and Nickel, Perraudin, and Varotto (2000) empirically find that macroeconomic fluctuations have a significant effect on credit rating transitions. Also, Pesaran, Schuermann, Treutler, and Weiner (2006) link the macroeconomic covariates contemporaneously with global equity returns. Pesaran et al assess the impact of macro shocks on the average loss distribution for each credit portfolio and then demonstrate that these macro shocks have an asymmetric and non-proportional effect on default risk due to the highly non-linear nature of the credit risk model. In this context, the extant literature does not distinguish the manner in which macroeconomic risk factors enter the default probability model. In particular, there is virtually no guidance on how the risk model developer should incorporate the joint non-linear effect of macroeconomic risk factors into the default probability adjustment through the business cycle. In relation to the distinction between TTC and PIT default probabilities, one can condition the default probability model on a set of long-term average macroeconomic risk covariates to design the TTC credit risk metric; alternatively, one can also use the long-term average credit risk metric of the PIT default probabilities over at least a complete macroeconomic cycle. In this paper, we investigate this important issue and assess these alternative approaches to integrating macroeconomic risk factors into the default probability model.

Several other studies examine the TTC properties of external credit rating measures as well as how credit rating agencies achieve rating stability over time (Carey and Hrycay, 2001; Loeffler, 2004, 2005; Altman and Rijken, 2004 and 2006). The major credit rating agencies focus on the permanent credit risk component when they assign exposures to credit risk grades. Altman and Rijken (2006) suggest that credit rating agencies tend to slowly adjust their credit rating assignment while this slow adjustment is the most important source of rating stability. Further, Loeffler (2005) suggests that the slow adjustment can be explained by the desire to avoid subsequent credit rating reversals. Building on Fama and French's (1988) model of the effect of both permanent and transitory components on stock prices, Loeffler (2004) imposes a stress scenario on the transitory component when one forecasts future asset prices. Carey and Hrycay (2001) note that the TTC approach entails estimating default risk over a long time horizon subject to an explicit worst-case scenario. In this view, the conventional practice of plugging long-run average macroeconomic risk factors into the default probability model may be too lenient to be consistent with the spirit of the TTC default probability requirement set out in the Basel capital framework. As a result, we need to revisit the current industry practice and its quantitative implications for bank capital management.

The current U.S. federal agencies propose a target equity capital ratio in the range of 3%-5% for bank holding companies and up to 6% for U.S. systemically important financial institutions that receive the protection of federal deposit insurance. With a unique set of plausible risk parameters, our Monte Carlo analysis suggests that the equity capital ratio for a typical bank should be substantially higher. While most estimates of the value-at-risk capital ratios land in the intermediate range of about 13%-19%, most estimates of the conditional value-at-risk capital ratios land in the range of 15%-23%. When the econometrician conservatively increases asset correlation from 15% to 35% for a severe downturn scenario, ceteris paribus, the equity capital ratio can be as high as 22%-26%. This quantitative evidence supports the recent proposal by Admati and Hellwig (2013), Admati (2014), Kashyap, Stein, and Hanson (2010), and Myerson (2014) to introduce a 20%-30% bank capital requirement. Our evidence lends credence to a scientific basis for the socially optimal introduction of substantially heightened equity capital requirements for banks in particular as well as financial institutions in general. This fresh strand of quantitative research can become part of our financial risk toolkit in due course.

Overall, our analysis poses an important challenge to the central prediction of DeAngelo and Stulz's (2015) baseline model of high bank leverage. Through the lens of financial risk management, the typical bank should substantially raise its equity capital cushion to counteract severe losses in times of extreme financial stress. From this normative perspective, high bank leverage cannot be socially optimal because the typical bank runs the risk of not being able to absorb large financial losses in a rare macroeconomic downturn such as the recent Global Financial Crisis. In contrast to DeAngelo and Stulz's (2015) emphasis on the important role that most banks play in producing aggregate liquid claims, our current study points out that the typical bank's high leverage ratio suggests an insufficient equity capital buffer for extreme loss absorption in a rare but plausible economic recession. Our empirical analysis corroborates the recent proposal for most banks to substantially raise their equity capital positions due to precautionary concerns (Admati, DeMarzo, Hellwig, and Pfleiderer, 2011; Admati and Hellwig, 2013; Kashyap, Stein, and Hanson, 2010; Myerson, 2014).

2019-03-01 13:36:00 Friday ET

Global economic uncertainty now lurks in a thick layer of mystery. This uncertainty arises from Sino-U.S. trade tension, Brexit fallout, monetary policy nor

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in

2018-01-01 06:30:00 Monday ET

As former chairman of the British Financial Services Authority and former director of the London School of Economics, Howard Davies shares his ingenious ins

2017-11-27 07:39:00 Monday ET

Is it anti-competitive and illegal for passive indexers and mutual funds to place large stock bets in specific industries with high market concentration? Ha

2017-04-07 15:34:00 Friday ET

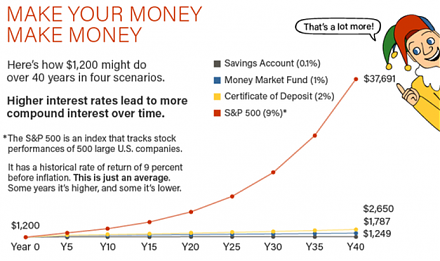

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive