2022-08-30 10:32:00 Tuesday ET

2022-05-30 09:32:00 Monday ET

2022-05-25 09:31:00 Wednesday ET

2022-05-15 10:29:00 Sunday ET

2022-05-05 09:34:00 Thursday ET

2022-04-25 10:34:00 Monday ET

2022-04-15 10:32:00 Friday ET

2022-04-05 17:39:00 Tuesday ET

2022-03-25 09:34:00 Friday ET

2022-03-15 10:32:00 Tuesday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2026-02-02 12:30:00 Monday ET

With U.S. fintech patent approval, accreditation, and protection for 20 years, our proprietary alpha investment model outperforms most stock market indexes

2018-07-09 09:39:00 Monday ET

The Federal Reserve raises the interest rate again in mid-2018 in response to 2% inflation and wage growth. The current neutral interest rate hike neither b

2025-09-14 14:23:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

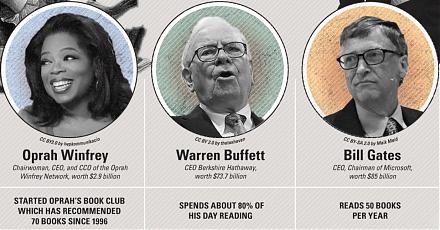

2017-01-27 17:19:00 Friday ET

Tony Robbins explains in his latest book on personal finance that *patience* is the top secret to successful stock investment. The stock market embeds an

2018-05-27 08:33:00 Sunday ET

The Federal Reserve proposes softening the Volcker rule that prevents banks from placing risky bets on securities with deposit finance. As part of the po

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff