2019-10-09 16:46:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form of gradual interest rate cuts, Chinese expansionary monetary policy decisions help stimulate domestic demand for consumption goods, services, and capital investments.

However, this monetary expansion may inevitably weaken the Chinese renminbi against the U.S. dollar and other core OECD currencies. This competitive currency devaluation renders Chinese exports more affordable. Meanwhile, this currency devaluation reduces global demand for more expensive Chinese imports. In the broader context of international trade, nevertheless, the recent empirical evidence shows that each 10% currency depreciation improves the trade balance by only 0.3% of real GDP economic output ceteris paribus. This evidence remains robust after the econometrician takes into account multi-year exchange rate fluctuations in response to interest rate cuts and other expansionary monetary policy decisions.

In light of these robust results, monetary expansion alone is unlikely to cause the large and persistent currency devaluation that the central bank needs to stimulate economic growth, employment, and capital accumulation. This economic insight further applies to the recent dovish interest rate cuts that the U.S. Federal Reserve institutes in response to a vocal president.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-25 10:36:00 Thursday ET

Trump tariffs begin to bite U.S. corporate profits from Ford and Harley-Davidson to Caterpillar and Walmart etc. U.S. corporate profit growth remains high a

2025-04-30 08:27:00 Wednesday ET

The multiple layers of the world cloud Internet help expand what can be made digitally viable from electric vehicles (EV) and virtual reality (VR) headsets

2019-12-13 09:32:00 Friday ET

Saudi Aramco aims to initiate its fresh IPO in December 2019. Several investment banks indicate to the Saudi government that most investors may value the mi

2020-11-22 11:30:00 Sunday ET

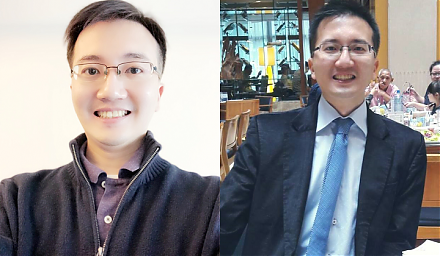

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2022-02-05 09:26:00 Saturday ET

Modern themes and insights in behavioral finance Shiller, R.J. (2003). From efficient markets theory to behavioral finance. Journal of Economi

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I