Paycom Software, Inc. is a provider of cloud-based human capital management (HCM) software as a service solution for integrated software for both employee records and talent management processes. The company offers analytics that manages the complete employment life cycle from recruitment to retirement. Its human resource services include retirement services administration, workers' compensation administration, employee benefit solutions, professional employer organization and other administrative services for businesses. Paycom's HCM solution offers a full suite of applications that generally falls within the following categories, namely talent acquisition, time and labor management, payroll, talent management and HR management. Its HCM software streamlines and automates many of the day-to-day record-keeping processes and provides a framework for HR staff to manage benefits administration and payroll, and map out succession planning and documents....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-08-31 09:36:00 Thursday ET

The Trump administration has initiated a new investigation into China's abuse of American intellectual property under Section 301 of the Trade Act of 19

2018-12-23 13:39:00 Sunday ET

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As fre

2019-03-17 14:35:00 Sunday ET

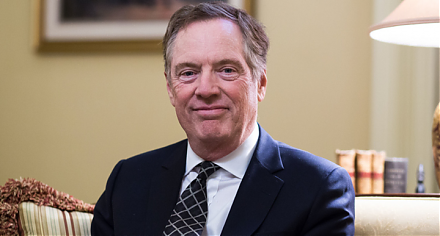

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2018-05-01 11:38:00 Tuesday ET

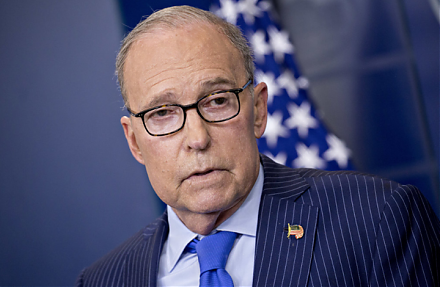

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2018-11-03 11:36:00 Saturday ET

Apple adds fresh features to its new iPad Pro and MacBook Air in addition to its prior suite of iPhone XS, iPhone XS Max, and iPhone XR back in September 20

2018-05-08 13:39:00 Tuesday ET

The Trump administration weighs the pros and cons of a potential mega merger between AT&T and Time Warner. Recent stock prices show favorable trends for