Hovnanian Enterprises Inc was incorporated in New Jersey in 1967 and reincorporated in Delaware in 1983. The company designs, constructs, markets and sells single-family detached homes, attached townhomes and condominiums, mid-rise and high-rise condominiums, urban infill and active adult homes in planned residential developments. The company consists of two distinct operations: homebuilding and financial services. Its homebuilding operations consist of six segments: Northeast, Mid-Atlantic, Midwest, Southeast, Southwest and West. Its financial services operations provide mortgage loans and title services to the customers of its homebuilding operations. It offers products array to provide housing to a range of customers. Its customers consist of first-time buyers, first-time and second-time move-up buyers, luxury buyers, active adult buyers and empty nesters. Its diverse product array includes single-family detached homes, attached townhomes and condominiums, mid-rise and high-rise condominiums, urban infill and active adult homes. The company's residential communities are generally located in suburban areas easily accessible through public and personal transportation. Its communities are designed as neighborhoods that fit existing land characteristics. Recreational amenities such as swimming pools, tennis courts, clubhouses and tot lots are frequently included. It designs and supervises the development and building of its communities. Its homes are constructed according to standardized prototypes, which are designed and engineered to provide innovative product design while attempting to minimize costs of construction. The company's financial services segment provides its customers with competitive financing and coordinates and expedites the loan origination transaction through the steps of loan application, loan approval, and closing and title services. The company is subject to various local, state and federal statutes, ordinances, rules and regulations concerning zoning, building design, construction and similar matters, including local regulations which impose restrictive zoning and density requirements in order to limit the number of homes that can eventually be built within the boundaries of a particular locality. The company is also subject to a variety of local, state and federal statutes, ordinances, rules and regulations concerning protection of health and the environment....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 1 November 2025

2017-02-07 07:47:00 Tuesday ET

With prescient clairvoyance, Bill Gates predicted the recent sustainable rise of Netflix and Facebook during a Playboy interview back in 1994. He said th

2017-02-25 06:44:00 Saturday ET

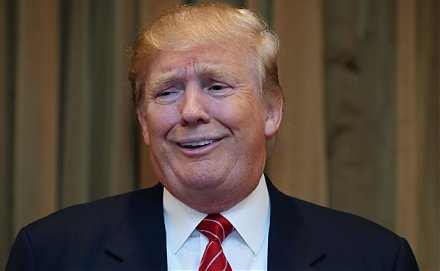

As the White House economic director, Gary Cohn suggests that the Trump administration will tackle tax cuts after the administration *repeals and replaces*

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2018-01-12 07:37:00 Friday ET

The Economist delves into the modern perils of tech titans such as Apple, Amazon, Facebook, and Google. These key tech titans often receive plaudits for mak