2018-08-27 09:35:00 Mon ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta of plausible explanations for better economic fortunes during the current Trump administration. First, some traditional industries that specialize in the extraction of non-renewable resources such as petroleum, natural gas, and even water grow faster than the overall U.S. economy. In fact, these labor-intensive ore industries tend to concentrate in conservative parts of the American political spectrum.

Second, the U.S. economy improves in the latter stages of an economic boom as firms tend to hire more low-skill workers. This trend may favor Trump-driven cities and towns.

Third, investor confidence among Trump supporters and proponents provides a psychological boost to household consumption and firm-specific investment in the form of mergers and acquisitions and capital expenditures. This positive investor sentiment can drive gradual increases in real macro variates such as employment, capital accumulation, and economic output.

A recent poll by Ipsos shows that 66% of Republicans feel more comfortable to make major purchases than 6 months ago, whereas, only 44% of Democrats feel the same way.

A recent McKinsey report delves into the current status of world economic affairs about a decade after the global financial crisis. Several punchlines arise from this broader context. First, global debt grows as the aggregate debt of governments, non-financial firms, and households has grown by $72 trillion since late-2007. Also, the global debt-to-GDP ratio has grown from 207% to 236%.

Second, government debt more than doubles from $29 trillion to $60 trillion while corporate debt also soars from $37 trillion to $66 trillion due to low interest rates. Household debt declines as a proportion of GDP in America, Britain, and Germany, but this household-debt-to-GDP ratio increases in several other OECD countries such as Australia and Canada. On balance, global household debt grows from $31 trillion to $43 trillion from late-2008 to mid-2018.

Third, many banks experience greater core capital strength as the core equity ratio rises from less than 4% in America and Europe to more than 15% in early-2018. Most banks thus have become less profitable with much lower ROEs and ROAs. In effect, financial contagion becomes less likely as a result of sharp cross-border capital retreat from $13 trillion in late-2007 to $6 trillion in early-2018.

The McKinsey report points out that corporate debt growth gives cause for pause, especially in Chinese real estate. Geopolitical flashpoints now span the nationalist movements that shed skeptical light on free trade agreements and WTO rules.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-05 09:45:00 Sunday ET

President Trump criticizes the potential media merger between AT&T and Time Warner, the latter of which owns the anti-Trump media network CNN. President

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2018-05-15 08:40:00 Tuesday ET

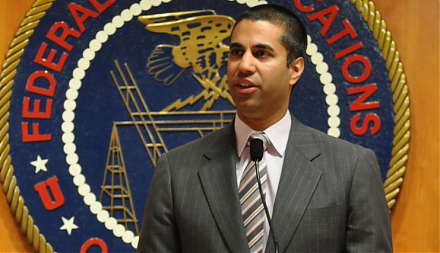

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2017-08-31 09:36:00 Thursday ET

The Trump administration has initiated a new investigation into China's abuse of American intellectual property under Section 301 of the Trade Act of 19

2018-01-15 07:35:00 Monday ET

Treasury Secretary Steven Mnuchin welcomes a weak U.S. dollar amid pervasive fears of an open trade war between America and China. At the World Economic For

2019-12-28 09:36:00 Saturday ET

Global debt surges to $250 trillion in the fiscal year 2019. The International Institute of Finance analytic report shows that both China and the U.S. accou