Better Home & Finance Holding Company is a digitally native homeownership company, serving customers principally in US states and the United Kingdom through its suite of products including residential mortgage, insurance and real estate services. Better Home & Finance Holding Company. Formerly known as Aurora Acquisition Corp., is based in NEW YORK....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-11-22 11:30:00 Sunday ET

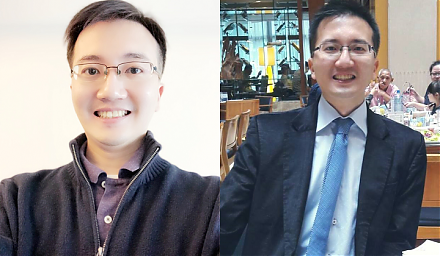

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2018-01-05 07:37:00 Friday ET

Warren Buffett cleverly points out that American children will not only be better off than their parents, but the former will also enjoy higher living stand

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2018-09-19 12:38:00 Wednesday ET

The Trump administration imposes 10% tariffs on $200 billion Chinese imports and expects to raise these tariffs to 25% additional duties toward the end of t

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo

2022-10-15 09:34:00 Saturday ET

Internal capital markets and financial constraints Duchin (JF 2010) empirically finds that multidivisional firms with robust internal capital markets ret