2017-11-13 07:42:00 Mon ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washing-ton Business School. Buffett said his investment business Berkshire Hathaway was the best career because he enjoys what he does. He said it is important to take a big swing when extraordinary investment opportunities emerge. Alluding to his own experiences as a stock market investor, Buffett noted the need for a typical investor to act quickly when these great investment opportunities arise because "there is no time to be reading a book on the modern portfolio theory of diversification". Buffett further explained that when one finds a company or a business idea within his or her own circle of competence, the price is right, the people are right, then the investor should barrel in.

For Gates, his best business decision was to go into partnership with Microsoft co-founder Paul Allen. Gates explained the importance of working with a person who "shares our vision, earns our trust, and complements us with a different set of skills". Buffett concurred and regarded his long-time reliable business partner Charlie Munger as his best friend with sound expert judgement. For Gates and Buffett, friendship and clairvoyance are the backbone of their business success.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-14 12:41:00 Thursday ET

Federal Reserve raises the interest rate by 25 basis points to the target range of 1.25% to 1.5% as FOMC members revise up their GDP estimate from 2% to 2.5

2018-05-02 06:32:00 Wednesday ET

What are the primary pros and cons of free trade or fair trade in the current Sino-American quagmire? Free trade means allowing goods and services to move a

2018-03-03 11:37:00 Saturday ET

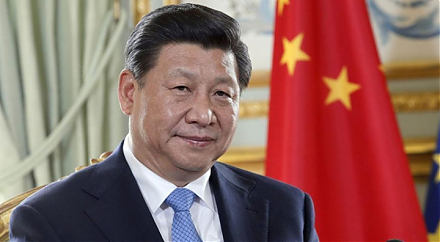

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2018-01-06 07:32:00 Saturday ET

Subsequent to the Trump tax cuts for Christmas in December 2017, the one-year-old Trump presidency now aims to make progress on health care, infrastructure,

2017-07-13 08:35:00 Thursday ET

President Donald Trump has announced that a major Apple iPhone upstream supplier, Foxconn Technology Group (aka Hon Hai Precision Group), will invest $10 bi

2022-04-15 10:32:00 Friday ET

Corporate investment management This review of corporate investment literature focuses on some recent empirical studies of M&A, capital investm