2019-10-23 15:39:00 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

American CEOs of about 200 corporations issue a joint statement in support of stakeholder value maximization. The Business Roundtable offers this statement of corporate purpose in 300 words. The first 250 words focus on stakeholder value maximization before the statement mentions shareholder wealth maximization. In accordance with this joint statement, the main purpose of a corporation should be investing in both the welfare and productivity of employees, delivering key value to customers, and dealing ethically with suppliers. Also, it is practically important for U.S. corporations to promote better diversity and inclusion in the workplace. These corporations should further support social communities in America. Moreover, the corporations should help protect the environment amid substantial economic policy uncertainty, climate change, and environmental degradation.

This landmark U.S. CEO statement represents an important change in business purpose away from the prior thesis of Nobel Laureate Milton Friedman in support of solo shareholder wealth maximization. This latter emphasis reveals drawbacks and impediments to long-term sustainable business development and corporate social responsibility. In a nutshell, it is essential for U.S. corporations to serve in the best interests of employees, customers, suppliers, regulators, and other major stakeholders before these corporations disgorge cash returns to shareholders.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2019-07-03 11:35:00 Wednesday ET

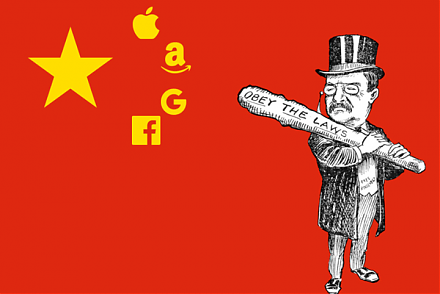

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2022-10-05 08:24:00 Wednesday ET

Precautionary-motive and agency reasons for corporate cash management Bates, Kahle, and Stulz (JF 2009) empirically find that public firms have doubled t

2018-07-13 09:41:00 Friday ET

Yale economist Stephen Roach warns that America has much to lose from the current trade war with China for a few reasons. First, America is highly dependent

2018-06-07 10:36:00 Thursday ET

AT&T wins court approval to take over Time Warner with a trademark $85 billion bid despite the Trump administration prior dissent due to antitrust conce

2020-03-05 08:28:00 Thursday ET

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s