American Express Company is a diversified financial services company, offering charge and credit payment card products, and travel-related services world wide. American Express and its main subsidiary, American Express Travel Related Services Company, Inc., are bank holding companies. The company offers business travel-related services through its non-consolidated joint venture, American Express Global Business Travel. The company's range of products and services include charge card, credit card and other payment and financing products, Merchant acquisition and processing, servicing and settlement, and point-of-sale marketing and information products and services for merchants, Network services, other fee services, including fraud prevention services and the design and operation of customer loyalty programs, Expense management products and services and Travel-related services....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 12 July 2025

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2019-04-21 10:07:54 Sunday ET

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of

2019-09-09 20:38:00 Monday ET

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Ch

2017-06-27 05:40:00 Tuesday ET

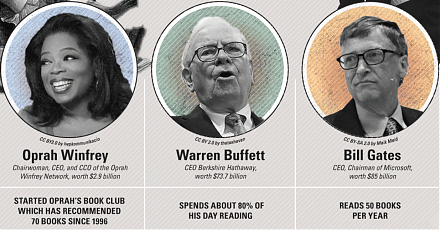

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2019-11-26 11:30:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube November 2019 In this podcast, we discuss several topical issues as of November 2019: (1) The Trump adm

2018-10-13 10:44:00 Saturday ET

Dow Jones tumbles 3% or 831 points while NASDAQ tanks 4%, and this negative investor sentiment rips through most European and Asian stock markets in early-O