2019-09-09 20:38:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Chair Jerome Powell yields to the persistent demands of a vocal president, the FOMC approves an interim interest rate cut by quarter point to 2%-2.25%. This rate cut represents a clear departure from the current business cycle of interest rate hikes in recent years. Barro advocates the Taylor monetary policy rule that the nominal interest rate should rise in response to higher inflation and economic output both relative to their targets. In accordance with the key Taylor monetary policy rule, the nominal interest rate normally tends toward a gradual long-term equilibrium path.

In this light, Barro regards the recent interest rate reduction as a special deviation from the prior path of U.S. monetary policy normalization. Federal Reserve Chair Jerome Powell seems to justify the recent interest rate cut in terms of the fact that U.S. inflation remains low and tame as the economy operates near full employment despite continual trade escalation between the U.S. and China. Barro indicates the clear and present danger that the recent rate reduction represents a dovish Powell response to many stock market analysts and the Trump administration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-06 11:35:00 Tuesday ET

The Trump team blocks Broadcom's bid for Qualcomm due to national economic security concerns and 5G telecom network issues. Broadcom makes microchips fo

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2019-05-13 12:38:00 Monday ET

Brent crude oil prices spike to $70-$75 per barrel after the Trump administration stops waiving economic sanctions on Iranian oil exports. U.S. State Secret

2019-06-09 11:29:00 Sunday ET

St Louis Federal Reserve President James Bullard indicates that his ideal baseline scenario remains a mutually beneficial China-U.S. trade deal. Bullard ind

2018-12-07 11:35:00 Friday ET

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo

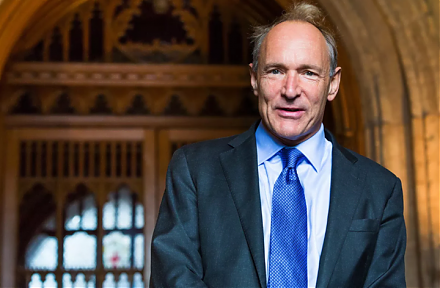

2018-11-09 11:35:00 Friday ET

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern