iShares MSCI ACWI ETF (the Fund), formerly iShares MSCI ACWI Index Fund, is an exchange-traded fund (ETF). The Fund seeks investment results that correspond generally to the price and yield performance of the MSCI All Country World Index (the Index). The Index is a free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging markets countries. Components primarily include consumer discretionary, consumer staples, energy, financial, industrials and information technology companies. The Fund generally invests at least 90% of its assets in securities of the Index and in depositary receipts representing securities of the Index. BlackRock Fund Advisors is the Fund’s investment adviser. » Full Overview of ACWI.A ...

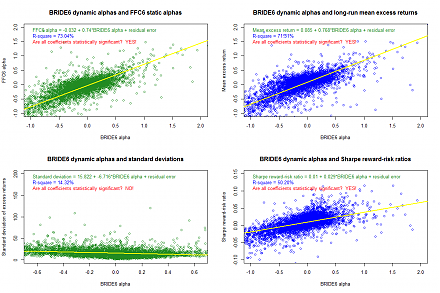

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2025-09-24 09:49:53 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2025-01-31 09:26:00 Friday ET

The current homeland industrial policy stance worldwide seeks to embed the new notion of global resilience into economic statecraft. In the broader cont

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare