iShares MSCI ACWI ETF (the Fund), formerly iShares MSCI ACWI Index Fund, is an exchange-traded fund (ETF). The Fund seeks investment results that correspond generally to the price and yield performance of the MSCI All Country World Index (the Index). The Index is a free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging markets countries. Components primarily include consumer discretionary, consumer staples, energy, financial, industrials and information technology companies. The Fund generally invests at least 90% of its assets in securities of the Index and in depositary receipts representing securities of the Index. BlackRock Fund Advisors is the Fund’s investment adviser. » Full Overview of ACWI.A ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-07-21 10:30:00 Friday ET

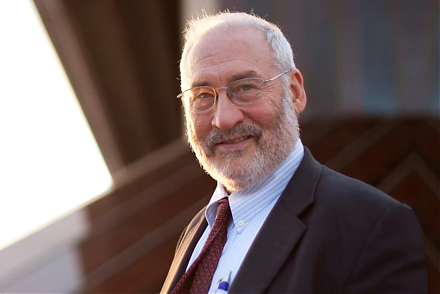

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2023-02-28 11:30:00 Tuesday ET

The Biden Inflation Reduction Act is central to modern world capitalism. As of 2022-2023, global inflation has gradually declined from the peak of 9.8% d

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod

2019-11-21 11:34:00 Thursday ET

Berkeley macro economist Brad DeLong sees no good reasons for an imminent economic recession with mass unemployment and even depression. The current U.S. ec

2022-11-05 11:32:00 Saturday ET

CEO overconfidence and corporate performance Malmendier and Tate (JFE 2008, JF 2005) argue that overconfident CEOs are more likely to initiate mergers an

2019-06-21 13:33:00 Friday ET

Amazon and Google face more intense antitrust scrutiny. In recent times, Justice Department and Federal Trade Commission have reached an internal agreement