2017-12-19 09:39:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-10-03 18:39:00 Tuesday ET

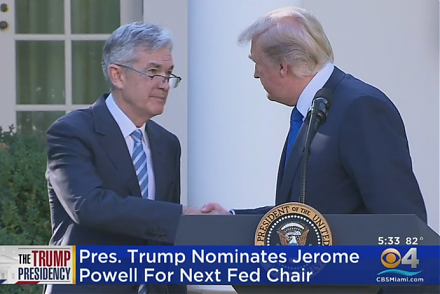

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.

2025-01-22 08:35:08 Wednesday ET

President Donald Trump blames China for the long prevalent U.S. trade deficits and several other social and economic deficiencies. In recent years, Pres

2020-02-19 14:35:00 Wednesday ET

The U.S. bank oligarchy has become bigger, more profitable, and more resistant to public regulation after the global financial crisis. Simon Johnson and