Home > Library > Stock market alphas help predict macroeconomic innovations.

Author Andy Yeh Alpha

This research article delves into mutual causation between stock market alphas and macroeconomic innovations. The online appendix provides complete econometric details and algorithms for empirical analysis. This empirical analysis includes the recursive multivariate filtration of Fama-French dynamic conditional alphas, ARMA-GARCH representation of both dynamic conditional alphas and betas, and vector autoregression analysis of mutual causation between alpha spreads and macro surprises.

Description:

We extract dynamic conditional factor premiums from the Fama-French factor model and find that most anomalies disappear after we account for time variation in these premiums. New vector autoregression evidence shows that mutual causation between dynamic conditional alphas and macroeconomic surprises serves as a core qualifying condition for fundamental factor selection. This economic insight is an incremental step toward drawing a distinction between rational risk and behavioral mispricing models. As dynamic conditional alphas often reveal the marginal investor’s fundamental news and expectations about the cross-section of average asset returns, our economic insight helps enrich macroeconomic asset return prediction.

This research article delves into mutual causation between stock market alphas and macroeconomic innovations. The online appendix provides complete econometric details and algorithms for empirical analysis. This empirical analysis includes the recursive multivariate filtration of Fama-French dynamic conditional alphas, ARMA-GARCH representation of both dynamic conditional alphas and betas, and vector autoregression analysis of mutual causation between alpha spreads and macro surprises.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2017-05-25 08:35:00 Thursday ET

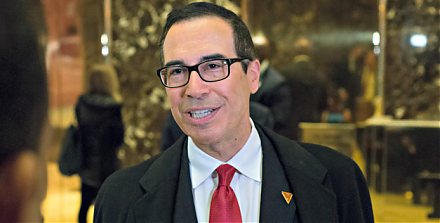

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2020-05-21 11:30:00 Thursday ET

Most blue-ocean strategists shift fundamental focus from current competitors to alternative non-customers with new market space. W. Chan Kim and Renee Ma

2019-07-05 09:32:00 Friday ET

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilitie

2018-10-05 10:38:00 Friday ET

A 7-year $1.3 billion hedge fund manager Chelsea Brennan shares her investment advice. Her advice encompasses several steps toward better financial literacy

2022-08-30 10:32:00 Tuesday ET

The financial services industry needs fewer banks worldwide. As long as banks have existed in human history, their managers have realized how not all dep

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an