2017-03-03 05:39:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

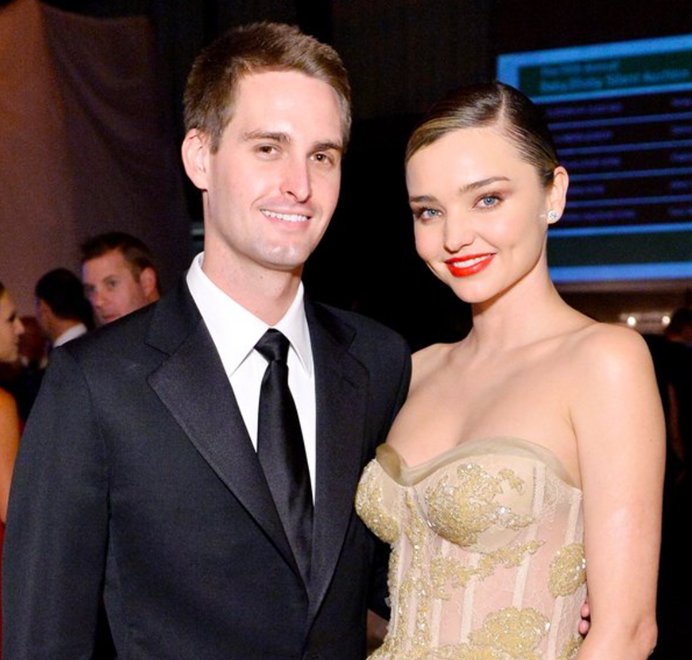

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

Having raised more than $3 billion from its IPO, Snap easily beats the bid price that Facebook offered back in 2013.

In this modern era of digital technology, many financial economists and market observers suggest that unicorns, or tech startups with $1 billion net worth, often seek to be packaged as profitable M&A targets for large public corporations.

Snap demystifies this unicorn puzzle by going public with its stellar stock market performance and millennial popularity.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr

2018-10-19 13:37:00 Friday ET

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations o

2017-01-27 17:19:00 Friday ET

Tony Robbins explains in his latest book on personal finance that *patience* is the top secret to successful stock investment. The stock market embeds an

2017-02-01 14:41:00 Wednesday ET

President Trump refreshes his public image through his presidential address to Congress with numerous ambitious economic policies in order to make America g

2018-11-29 11:33:00 Thursday ET

A congressional division between Democrats and Republicans can cause ripple effects on Trump economic reforms. As Democrats have successfully flipped the Ho

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins