Home > Library > AYA analytic report on macro-financial policy developments July 2026

Author Daphne Basel

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2026, we delve into the structural root causes of high productivity growth in America despite several recent extraordinary events. These rare events include the dotcom stock market crash, Global Financial Crisis, Covid pandemic crisis, and the subsequent surge in both inflation and unemployment. In this broader context, we explain and discuss why American economic growth has been so impressive both by historical standards and in comparison to the rest of the world. We draw some vital lessons from American productivity growth in global trade, finance, and technology.

Description:

As of Summer-Fall 2026, we delve into the structural root causes of high productivity growth in America despite several recent extraordinary events. These rare events include the dotcom stock market crash, Global Financial Crisis, Covid pandemic crisis, and the subsequent surge in both inflation and unemployment. In this broader context, we explain and discuss why American economic growth has been so impressive both by historical standards and in comparison to the rest of the world. We draw some vital lessons from American productivity growth in global trade, finance, and technology.

We delve into the mainstream root causes of higher productivity growth in America despite several recent extraordinary events. These rare events include the dotcom stock market crash of 2001-2002, Global Financial Crisis of 2008-2009, Covid-19 pandemic crisis of 2020-2022, and the subsequent surge in inflation and domestic unemployment. In this wider macro context, we explain and discuss why American productivity growth has been so impressive in comparison to the rest of the world. We can draw some vital lessons from American productivity growth in global trade, finance, and technology.

With impressively higher productivity growth, America continues to lead the rest of the world. America’s recent rise as the world’s biggest shale oil producer continues to fuel its own economic growth in the next couple of decades. America’s deep and liquid capital markets for stocks, bonds, ETFs, and so on continue to deliver higher returns, cash dividends, and share repurchases for global investors. The American dollar continues to serve as the dominant global reserve currency for trade, finance, and technology. Only toxic politics can derail American economic growth, low and stable inflation, maximum sustainable employment, and macro-financial stability.

Since the early-1990s, America has grown substantially faster than most other rich countries. Also, the American economy has rebounded more significantly from its recent recessions along the way. In practice, U.S. economic growth has been best-in-class, and American strengths give grounds for greater optimism about the next likely economic power, productivity growth, macro-financial stability, and maximum sustainable employment. However, the U.S. fraction of global GDP has decreased incrementally from 21% in 1990 to 16% today in real purchasing-power parity (PPP) terms. Even the economic growth spurts of the world’s 2 most populous countries, China and India, lag behind American exceptionalism. China’s real GDP per capita remains less than one third of U.S. real GDP per capita. India’s real GDP per capita is still smaller today. In recent years, higher American productivity growth has been impressive by both historical standards and in comparison to the rest of the world. American exceptionalism often turns out to be the heuristic rule of thumb for wider economic growth, full employment, low and stable inflation, real productivity growth, technological advancement, and macro-financial stability.

On a per-person basis, American economic output is now more than 40% higher than economic output in Western Europe and Canada, and about 60% higher than economic output in Japan. Today, these economic output gaps are approximately twice as large as they were back in 1990. Average wages in the poorest American state, Mississippi, remain higher than average wages in Australia, Britain, Canada, France, and Germany. A recent IMF survey shows that America is the only country whose economic output and employment are above pre-pandemic expectations in the G20 club. This impressive productivity growth combines with the global reserve currency status of the U.S. dollar to entrench global economic heft for America and wealth creation for Americans.

We explain and discuss why American productivity growth has been so impressive for so long. Also, we explain and discuss why this growth is likely to continue in the next couple of decades. Some of the fundamental forces relate to the good fortune due to geography. As a quasi-continental economy with a big and broad consumer market, American companies benefit substantially from this sheer economic scale. A good product idea that some Silicon Valley tech startup hatches in California can often spread to the other 49 states in short order. Also, America integrates its labor market into the global economic ecosystem. This integration allows Americans to move to better jobs with higher wages. At the same time, this integration empowers Americans to gravitate toward more productive strategic sectors of high technology. These strategic sectors include semiconductor microchip production, higher-speed broadband cloud services, telecoms, electric vehicles (EV), autonomous robotaxis (AR), generative artificial intelligence (Gen AI) large language models (LLM), and biopharmaceutical medications, treatments, and therapies. In light of green energy transformation, the American-led improvements in techniques for extracting hydro-carbons from shale rocks have turned America into the world’s largest producer of oil and natural gas over the past couple of decades.

With its deep, broad, and liquid financial markets, America has made it both easier and faster for startups to raise new equity. In stark contrast to the alternative debt capital instruments such as bank loans and corporate bonds, this key equity capital availability serves as a better way for numerous American companies to get off the ground. In practice, this novel and non-obvious profusion of young companies has helped build out the broader vital, vibrant, and dynamic startup ecosystem for high technology in America. In addition, the dominant global reserve currency status of the American dollar helps further make global trade, finance, and technology more frictionless for American business. From Harvard, Yale, MIT, NYU, Columbia, and Chicago to Stanford and UC Berkeley, America has many of the world’s best think tanks, universities, and research institutes. These academic institutions attract the world’s best students, doctors, scientists, engineers, statisticians, economists, and other fresh talents worldwide.

In America, business rules and regulations are relatively lax, lenient, tolerant, and inclusive. This broader deregulatory business context has given high-tech startups ample room to grow their core business operations in the midst of significantly less economic policy uncertainty. In the recent couple of decades, the U.S. government has made bold, robust, and resolute interventions in response to some rare crises, disasters, and other extraordinary events. These rare crises span the dotcom stock market crash, Global Financial Crisis, Eurozone sovereign debt debacle, Covid-19 pandemic crisis, and subsequent inflationary outbreak worldwide. At any rate, it is impossible for us to explain America’s smarter, faster, and better economic growth engine without acknowledging the U.S. government’s open and inclusive attitude toward stepping on the financial accelerator pedal when the real economy sputters. The resultant positive government interventions often arise in the common form of better fiscal-monetary policy coordination. In modern economic history, there is an element of relentless dynamism in American business. This unique characteristic of the American economy continues to be the ultimate fundamental force in support of higher-quality economic growth over the next couple of decades.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-06-17 11:25:00 Monday ET

To secure better economic arrangements with European Union, Jeremy Corbyn encourages Labour legislators to back a second referendum on Brexit. In recent tim

2019-07-11 10:48:00 Thursday ET

France and Germany are the biggest beneficiaries of Sino-U.S. trade escalation, whereas, Japan, South Korea, and Taiwan suffer from the current trade stando

2019-06-07 04:02:05 Friday ET

The world seeks to reduce medicine prices and other health care costs to better regulate big pharma. Nowadays the Trump administration requires pharmaceutic

2020-06-10 10:35:00 Wednesday ET

Most lean enterprises should facilitate the dual transformation of both core assets with fresh cash flows and new growth options. Scott Anthony, Clark Gi

2019-05-05 10:34:00 Sunday ET

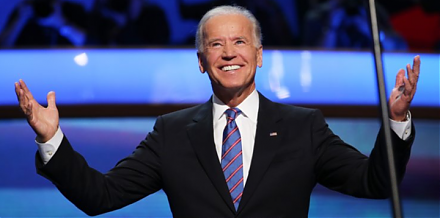

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou

2019-10-25 07:49:00 Friday ET

U.S. fiscal budget deficit hits $1 trillion or the highest level in 7 years. The current U.S. Treasury fiscal budget deficit rises from $779 billion to $1.0