2018-08-13 12:39:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

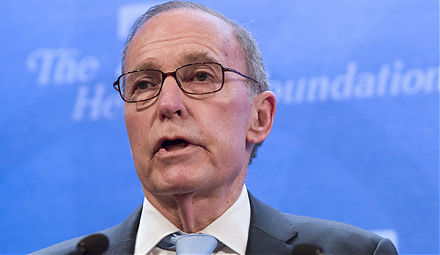

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Greenback appreciation reflects the fact that international capital continues to flow into the U.S. economy as the Federal Reserve accelerates its interest rate hike. Meanwhile, this dollar appreciation helps dampen commodity prices within healthy and reasonable bounds.

However, President Trump suggests in an earlier tweet that the strong dollar may put America at a competitive disadvantage. In fact, greenback strength can render U.S. export prices less competitive and so may exacerbate future trade deficits in the current account. In addition to these recent exchange rate gyrations, the Trump administration gradually reveals the precautionary motive behind the current trade war against China. This major trade dispute and its attendant measures shine light on the U.S. grand strategy that seeks to thwart China's economic rise as a global superpower.

It is plausible for the Trump administration to view China as an aggressive currency manipulator. As the Chinese renminbi continues to depreciate at a gradual pace, Chinese low-cost imports become more affordable to most American households. For these strategic reasons, the Trump administration needs to re-engage Chinese diplomats and economists in the next round of bilateral trade negotiations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-13 10:44:00 Saturday ET

Dow Jones tumbles 3% or 831 points while NASDAQ tanks 4%, and this negative investor sentiment rips through most European and Asian stock markets in early-O

2023-12-03 11:33:00 Sunday ET

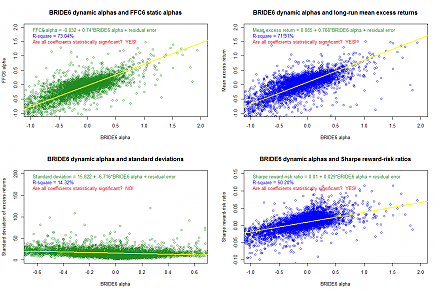

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati

2020-08-26 10:33:00 Wednesday ET

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo

2023-10-07 10:24:00 Saturday ET

Thomas Philippon draws attention to greater antitrust scrutiny in light of the rise of market power and its economic ripple effects. Thomas Philippon (20

2023-01-03 09:34:00 Tuesday ET

USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved

2018-08-13 12:39:00 Monday ET

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Gree