2019-06-13 10:26:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Chinese Xi administration may choose to leverage its state dominance of rare-earth elements to better balance the current Sino-U.S. trade war. In recent times, President Xi visits a Jiangxi hardware factory that spins rare earth elements into permanent magnets in iPhones, electric cars, wind turbines, and military missiles. China monopolizes 80% of the strenuous extraction of 17 vital rare-earth elements for ubiquitous applications from consumer electronic technology to military defense. Although the raw ores are as common as copper and lead, rare-earth ores oxidize quickly and their extraction can cause severe pollution. With its low labor costs and lax environmental regulations, China has become the dominant force in the rare-earth market since the 1980s. With almost half of global rare-earth deposits, China produces 120,000 metric tons of rare-earth per annum, or about 80% of the global supply. Australia is the second largest supplier of only 20,000 metric tons of rare-earth per year.

The Chinese Xi administration has a strategic incentive to reduce the quota of rare-earth elements for better environmental protection. The next quota reset is due in June 2019, and this reset can indicate whether China intends to leverage its rare-earth quasi-monopoly to counteract the Trump tariff tactic.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat

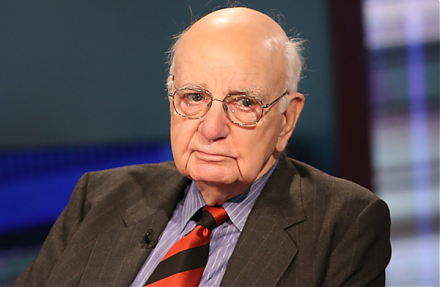

2018-10-23 12:36:00 Tuesday ET

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

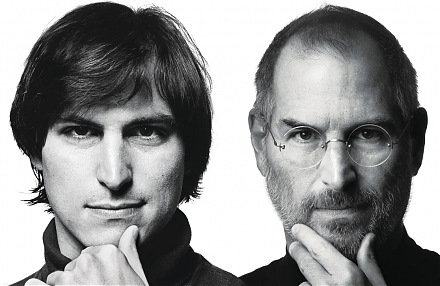

2020-03-19 13:39:00 Thursday ET

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2018-01-25 08:32:00 Thursday ET

After its flagship iPhone X launch, Apple reports its highest quarterly sales revenue over $80 billion in the tech titan's 41-year history. Apple expect

2018-10-05 10:38:00 Friday ET

A 7-year $1.3 billion hedge fund manager Chelsea Brennan shares her investment advice. Her advice encompasses several steps toward better financial literacy