2019-09-23 12:25:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

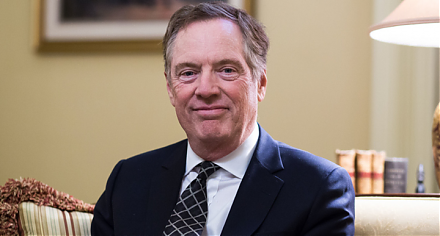

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unite together to express their core concern that Fed Chair Jerome Powell institutes the recent dovish interest rate decrease in response to a vocal president. In their joint conviction, the Federal Reserve and its chair must be able to make monetary policy decisions in the best interests of the U.S. economy. Further, these monetary policy decisions must be independent and free of short-term political pressure without the threat of either removal or demotion of Federal Reserve leaders for non-economic reasons. Volcker, Greenspan, Bernanke, and Yellen emphasize the congressional checks and balances with respect to the Federal Reserve monetary policy purview.

In recent times, Fed Chair Jerome Powell and FOMC members approve a quarter-point interest rate decrease to help sustain the current U.S. economic expansion. This monetary policy decision arises in the broader context of relentless criticisms among the Trump hawkish hardliners. The hardliners and President Trump himself view the prior U.S. interest rate hikes as headwinds that may inadvertently offset the economic benefits of Trump tax incentives and other fiscal stimulus packages for better infrastructure, investment, and technology.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2019-08-30 11:35:00 Friday ET

The conventional wisdom suggests that chameleons change their skin coloration to camouflage their presence for survival through Darwinian biological evoluti

2017-03-03 05:39:00 Friday ET

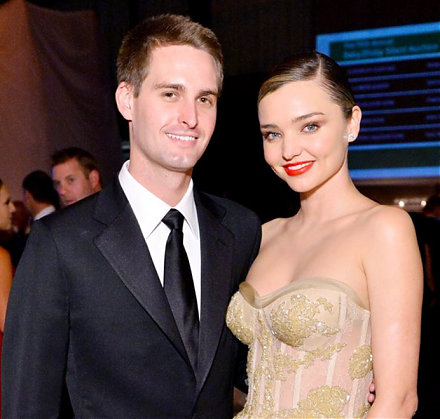

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major

2017-09-25 09:42:00 Monday ET

President Trump has allowed most JFK files to be released to the general public. This batch of documents reveals many details of the assassination of Presid