2018-12-19 17:41:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a major Chinese Internet company since the Alibaba e-commerce debut IPO back in 2014. Raising more than $1 billion via this massive IPO, Tencent now serves 880 million active freemium users per month, but its premium subscribers represent no more than 5% of the total user base. CNBC economic news host Jim Cramer suggests that Tencent Music shares are great opportunities for U.S. stock market investors in the midst of uncertain Sino-U.S. trade tension.

Spotify owns 9% equity stakes in Tencent Music Entertainment, which has been profitable since 2016 with a pristine balance sheet and 83% organic sales revenue growth. Tencent is a major part of the Chinese micropayment ecosystem because the tech titan allows users to deliver virtual gifts such as stickers and red packets. As of December 2018, 9 million active users spend money on virtual gifts through Tencent, these purchases account for 70%+ of corporate revenue. With its instant-messenger apps Tencent QQ (social networks), WeChat (instant messages), and Weibo (microblogs), the Chinese Internet tech titan aims to enrich the digital lives of freemium active users via virtual gifts, online music streams, and instant messages.

Clarification

CNBC provides an explanatory video clip on Facebook that each Chinese consumer can accomplish almost everything (from instant messages and online games to social networks and stock market news) on a single mobile app, WeChat, via the Internet tech titan Tencent. With its instant-messenger apps Tencent QQ (social networks), WeChat (instant messages), and Weibo (microblogs), the Chinese Internet tech titan aims to enrich the digital lives of freemium active users via virtual gifts, online music streams, and instant messages.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-08 17:46:00 Tuesday ET

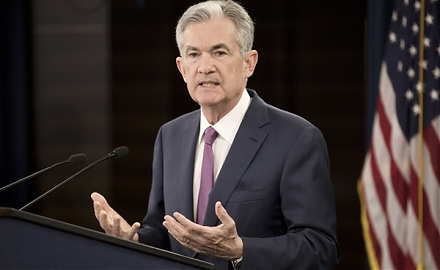

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2019-05-19 19:31:00 Sunday ET

MIT professor and co-author Daron Acemoglu suggests that economic prosperity comes from high-wage job creation. Progressive tax redistribution cannot achiev

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2018-04-23 07:43:00 Monday ET

Harvard professor and former IMF chief economist Kenneth Rogoff advocates that artificial intelligence helps augment human productivity growth in the next d

2018-09-07 07:33:00 Friday ET

The Economist re-evaluates the realistic scenario that the world has learned few lessons of the global financial crisis from 2008 to 2009 over the past deca

2020-05-14 12:35:00 Thursday ET

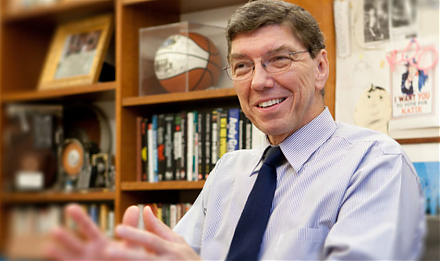

Disruptive innovators can better compete against luck by figuring out why customers hire products and services to accomplish jobs. Clayton Christensen, T