2018-05-05 07:33:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

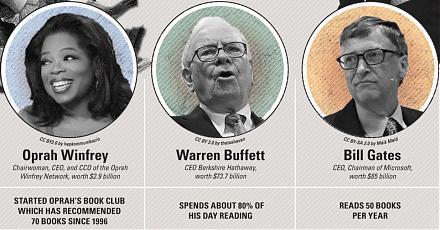

Warren Buffett shares his fresh economic insights and value investment strategies at the Berkshire Hathaway shareholder forum in May 2018 despite the new GAAP accounting rule that has led to a $1.14 billion net loss for the Buffett-Munger stock portfolio. Berkshire reports a $1.14 billion loss in 2018Q1 or its first net loss since 2009 due to an esoteric GAAP accounting rule that Buffett considers a nightmare. The firm also reports an operating profit of 48.7% year-over-year. The new GAAP rule suggests that the change in investment gains and losses must be shown in all net income figures. This requirement produces some wild and capricious gyrations in the GAAP bottom-line.

Berkshire owns $170 billion tradable stocks, and the market values of these stock positions can easily fluctuate by $10 billion or more within each quarter. Including gyrations of such magnitude in net income swamps the more important numbers that better describe Berkshire Hathaway's true operating performance. Buffett thus pierces the key GAAP veil for Berkshire investors to better assess the fundamental intrinsic value of each stock position. Buffett continues his active interest in small-to-mid-cap profitable value stocks that inject capital conservatively in both capital equipment and balance sheet expansion.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2018-06-01 07:30:00 Friday ET

The U.S. federal government debt has risen from less than 40% of total GDP about a decade ago to 78% as of May 2018. The Congressional Budget Office predict

2023-02-03 08:27:00 Friday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2023. Our proprietary alpha investment model outperforms the ma

2020-06-03 09:31:00 Wednesday ET

Lean enterprises often try to incubate disruptive innovations with iterative continuous improvements and inventions over time. Trevor Owens and Obie Fern

2019-11-11 09:36:00 Monday ET

Apple upstream semiconductor chipmaker TSMC boosts capital expenditures to $15 billion with almost 10% revenue growth by December 2019. Due to high global d

2019-03-01 13:36:00 Friday ET

Global economic uncertainty now lurks in a thick layer of mystery. This uncertainty arises from Sino-U.S. trade tension, Brexit fallout, monetary policy nor