2019-10-15 09:13:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no-deal Brexit in late-October 2019. In addition to losing this vote, Johnson also loses the Conservative one-person majority as Conservative MP Phillip Lee crosses the floor to join the Liberal Democrats. In light of this parliamentary change, Johnson seeks a general election in mid-October 2019 and further threatens to eject all of the 21 Conservative MPs who oppose a hard Brexit.

In response, the opposition parties support setting in stone anti-no-deal Brexit law. The British parliament blocks Brexit with no deal with the European Union, and the House of Lords must give assent to legislate this outcome. Moreover, the British parliament prevents Johnson from instituting a snap general election.

Johnson experiences 3 parliamentary rebukes in 2 consecutive days at the early stage of his new premiership. In reality, there are good economic reasons for anti-Brexit investor anxiety and even a second referendum. Stock market analysts and currency strategists fear that Brexit would lead to substantial trade retrenchment, substantial British pound volatility, and financial capital exodus. After all, European Union remains the biggest trade bloc for Britain.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-05-13 07:28:00 Saturday ET

America's Top 5 tech firms, Apple, Alphabet, Microsoft, Amazon, and Facebook have become the most valuable publicly listed companies in the world. These

2019-09-05 09:26:00 Thursday ET

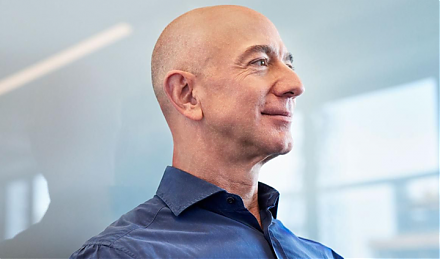

Yale macro economist Stephen Roach draws 3 major conclusions with respect to the Chinese long-run view of the current tech trade conflict with America. Firs

2023-02-28 10:27:00 Tuesday ET

Basic income reforms can contribute to better health care, public infrastructure, education, technology, and residential protection. Philippe Van Parijs

2018-09-21 09:41:00 Friday ET

Former World Bank and IMF chief advisor Anne Krueger explains why the Trump administration's current tariff tactics undermine the multilateral global tr

2018-06-29 11:41:00 Friday ET

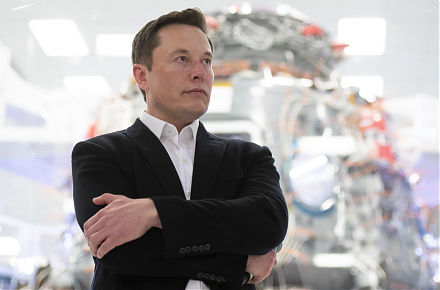

Amazon acquires an Internet pharmacy PillPack in order to better compete with Walgreens Boots Alliance, CVS Health, Rite Aid, and many other drug distributo

2023-05-14 12:31:00 Sunday ET

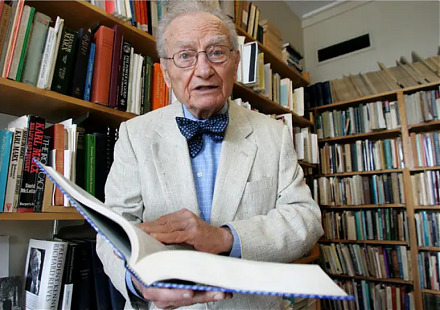

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m