2025-06-20 08:27:00 Fri ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt technology employment inflation global macro outlook interest rate fiscal stimulus economic growth central bank fomc capital gdp output commitment discretion

We describe, discuss, and delve into the mainstream reasons, concerns, and considerations for President Trump to pose recent threats to the Federal Reserve System’s monetary policy independence again. The Trump administration seems to set in motion a new challenge to the landmark 1935 Humphrey’s Executor judgment from the Supreme Court. This landmark Supreme Court judgment has prevented all American presidents from removing government officers of independent agencies without any cause. In 1933, President Roosevelt fired Bill Humphrey from the Federal Trade Commission (FTC) without any cause, although the FTC Act permitted such dismissal only for inefficiency, neglect of duty, or malfeasance in office. In 1935, the Supreme Court ruled this presidential dismissal invalid, and hence distinguished FTC commissioners as quasi-legislative or quasi-judicial officers, not executive officers, that might be subject to presidential removal only with sound, fair, and just legitimate procedures in accordance with the key statutes set by Congress. In addition, the Supreme Court upheld the Independent Counsel Act of 1978 to affirm that Congress could create key independent agencies with restrictive removal protections for these officers. In America, the independent agencies include the American Federal Reserve System (FRS), Federal Trade Commission (FTC), Environmental Protection Agency (EPA), Fannie Mae, Freddie Mac, National Labor Relations Board (NLRB), as well as Public Company Accounting Oversight Board (PCAOB), among others.

The Federal Reserve System retains instrument independence, but not goal independence, in the wider context of the statutory dual mandate for monetary policy. In effect, the Federal Reserve System has the freedom to apply its monetary policy tools and instruments without political interference in accordance with the narrow dual mandate of both price stability and maximum employment in America. This dual mandate combines with only several monetary policy tools, instruments, and market operations to suggest that the Federal Reserve System keeps narrow independence under sound, robust, and efficient statutory conditions.

For the Federal Reserve System as an independent government agency, this independence remains vital to produce better economic outcomes, specifically low and stable inflation and broader economic growth. In a counterfactual scenario where the American politicians could instruct the Fed Chair to steer monetary policy decisions with further interest rate cuts, such political interference would risk plunging the American economy back into severe stagflation in the 1970s. When we take into account the empirical studies from central banks worldwide, we infer that a presidentially driven shift toward a less independent Federal Reserve System would likely lead to higher inflation, higher long-end Treasury bond interest rates, lower stock market prices and returns, and a substantially weaker American dollar. These 2 latter ripple effects on asset prices and exchange rates would turn out to be more severe in the broader global context when the central bank officers were subject to presidential removal, dismissal, or relegation without any cause, such as inefficiency, neglect of duty, or malfeasance.

In American financial history, the president has never been able to remove Fed Chair without cause. If the Supreme Court overturned the landmark 1935 Humphrey’s Executor for-cause removal protection, this surprise judgment would inexorably usher in a new open season on appointees across all of the relevant independent government agencies in America. Even if the Supreme court overturned this for-cause removal protection, the Fed Chair and several other senior officers could still receive exemptions in light of the Federal Reserve System’s rare unique position among the American independent government agencies.

In the best likelihood of success, President Trump may not be able to fire Fed Chair Jerome Powell and other monetary policy decision-makers within the Federal Reserve System; but, President Trump could simply appoint a new political ally as Fed Chair upon the end of Chair Powell’s second term in May 2026. Given the rigorous Senate confirmation process for Fed Chair and other senior officers within the Federal Reserve System, as well as the committee structure of the Federal Open Market Committee (FOMC), the Fed Chair often tends to be extremely influential over monetary policy decisions, interest rate adjustments, and several other macro-financial affairs. In addition to the Fed Chair, the FOMC comprises 12 monetary policy advisors, officers, and decision-makers with the 7 members of the Board of Governors, the president of the Federal Reserve Bank of New York, and 4 of the other 11 Reserve Bank presidents who serve and rotate as extra committee members with annual terms on a regular basis. The FOMC makes all of the monetary policy decisions and interest rate adjustments by majority vote. Unlike the Supreme Court, the Fed Chair almost never votes in the minority. The broader FOMC would probably not hesitate to express dissent if a new Fed Chair tried to pursue monetary policy decisions, especially interest rate adjustments, not in accordance with the Federal Reserve System’s dual mandate.

In light of the extant American domestic institutional arrangements for the FOMC specifically, and the Federal Reserve System more generally, President Trump’s recent remarks, public talks, and demands for interest rate cuts are not rare, unusual, or atypical in American history. We identify numerous recent presidential attempts to publicly talk down interest rates in the past few decades. However, these presidential demands for interest rate cuts have had only minimal impact on monetary policy outcomes. For the foreseeable future, we can expect this empirical result to persist in the FOMC, Federal Reserve System, and even almost all of the independent government agencies in America. Even if there might be some serious risks to Fed Chair independence today, we believe Trump talk is not one of these risks.

In recent years, the Federal Reserve System seems to have become a bit too independent in some ways by wading into several fresh policy areas outside the statutory dual mandate. Good examples span the Federal Reserve System’s recent attempts to dip its toes into the purchases of large amounts of mortgage securities for more affordable residential properties, climate change risk management, and even economic inequality. At least some of these key policy goals fall outside the broader statutory remit for monetary policy, specifically the dual mandate of both price stability and maximum sustainable employment. For this reason, the recent mainstream monetary policy framework reviews for central banks worldwide warrant some strategic reset for the FOMC, Fed Chair, and Federal Reserve System to better realign U.S. monetary policy decisions, interest rate adjustments, and several other macro-financial policy affairs with the statutory dual mandate. At any pace, it is vital for the Federal Reserve System not to attempt to spin the jury by crossing the line into new democratic advocacy on political issues such as better climate change risk management for rare disasters, affordable residential real estate, and even economic inequality.

We further describe, discuss, and delve into the broader macro-financial asset implications of lesser Federal Reserve System independence. A less independent Fed Chair, FOMC, or Federal Reserve System could cause more frequent foreign exchange currency intervention, less liquidity and capital support for big banks and other financial institutions in rare times of severe macro-financial stress (such as the key Global Financial Crisis of 2008-2009 and the recent rampant Covid pandemic crisis of 2020-2022), and a gradual decline in the greenback as the rare, unique, and dominant global reserve currency. Also, a less independent Federal Reserve System could reduce the modern appeal of both U.S. Treasury bonds and several other dollar assets for foreign investors. The vast majority of these foreign investors include central banks, sovereign wealth funds, foreign reserve managers, and numerous active and passive index funds. In the best-case scenario, Treasury bond yields would need to increase substantially to motivate these foreign investors to continue buying these safe dollar assets. In recent times, the 3 major credit rating agencies downgrade Treasury bonds from the top-notch investment grade. As a consequence, we witness significant fluctuations in American Treasury bond prices, returns, yields, and many other asset risk premiums. Less Fed Chair independence could exacerbate these volatile fluctuations in the global markets for Treasury bonds and other dollar assets. By contrast, gold would shine brighter as a better alternative stable store of value to Treasury bonds and other dollar assets if President Trump seeks to further weaken Fed Chair independence in due course.

The current Federal Reserve System keeps its instrument independence in the fundamental sense that the FOMC can adjust interest rates with Treasury bond market operations without political interference in America. This narrow instrument independence derives from several statutory protections for the non-political appointments of Federal Reserve governors for 14-year terms once every 2 years, such that it would be difficult for any one president to appoint the entire Federal Reserve Board of Governors. Also, the current statutes stipulate that the president could not fire the Fed Chair and other senior officers on the sole basis of monetary policy disagreements. Specifically, the landmark Supreme Court judgment on Humphrey’s Executor ruled that the president could only remove the Fed Chair for some causes such as inefficiency, neglect of duty, and malfeasance. In America, these current and long prevalent statutory procedures, processes, checks and balances, and Supreme Court precedents help insulate the Fed Chair and several other senior officers from presidential removal, dismissal, relegation, and many other political influences.

However, the Federal Reserve System has no policy goal independence. Through American legislation, Congress created and designed the Federal Reserve System to achieve the dual mandate of both price stability and maximum employment. In addition, the regional Federal Reserve Banks should provide an elastic domestic currency to facilitate bank intermediation. In recognition of the vital role of the Federal Reserve System in promoting better economic performance, Congress formalized the relatively narrow dual mandate in numerous statutory amendments to the Federal Reserve Act of 1913. More broadly, the Fed Chair, FOMC, and Federal Reserve System perform well to better ensure price stability, maximum sustainable employment, as well as better economic growth, productivity, macro-financial intermediation, and even technological development in America.

The Fed Chair’s instrument independence is vital because human history shows that central banks produce significantly better economic outcomes in the absence of political pressures. These better economic outcomes span low and stable inflation, full employment, better bank intermediation, labor productivity, and economic growth. Independent central banks promote low and stable inflation without any material trade-offs in terms of substantially more volatile fluctuations in real GDP per capital, total economic output, and employment. For this reason, the recent empirical results show that an operationally independent central bank is close to a free lunch in terms of better macro-economic performance.

President Trump’s recent criticisms of Fed Chair Jerome Powell are not so anomalous when we consider the complete history of the Federal Reserve System. It was relatively common for the American presidents to pressure the Fed Chair into accelerating interest rate cuts in support of both the broader economy and financial markets. For instance, President Truman publicly pressured the Fed Chair to pause further interest rate hikes during the Korean War. Also, President Johnson did so likewise in public and private discussions with the Fed Chair from the Great Society to the Vietnam War. Further, numerous White House tapes of private discussions at the Oval Office revealed that President Nixon successfully pressured the Fed Chair to ease the monetary policy stance with interest rate cuts in support of his presidential re-election bid. While President Reagan was more discreet publicly, his memoirs show that his White House senior advisors put substantial pressure on the Fed Chair Paul Volcker to keep the broader, brighter, and more expansionary monetary policy stance with interest rate cuts. A different norm only began to evolve during the Clinton administration, when President Clinton’s first Director of the National Economic Council and subsequent Treasury Secretary, Robert Rubin, launched the best practice of avoiding public political criticisms in favor of Fed Chair independence. Since the 1990s, this new best practice has served as the new normal steady state of Fed Chair independence for better monetary policy decisions and economic policy results, outcomes, and considerations.

President Trump has remained publicly critical of the Fed Chair Jerome Powell in his second term. In recent times, the White House indicated that the second Trump administration tried to study whether President Trump could remove Powell as Fed Chair. At this stage, it would be difficult for President Trump to override the Supreme Court precedent that the American president has no statutory legal power to interfere with the public policy affairs of all sorts of independent government agencies. This time, however, the Trump administration continued to assess whether the Federal Reserve System’s interest rate adjustments would be subject to new sound, efficient, and regular White House reviews. For some unknown reasons, the second Trump administration seemed to carve out a rare exemption for Fed Chair monetary policy decisions, but not for the other Federal Reserve System macro-financial supervisory reviews, rules, and regulations. Hence, the Trump administration took some concrete steps to act on the presidential Fed Chair criticisms in recent times.

Central banks worldwide have no particular protection for their respective governors. In light of this common norm among many central banks worldwide, the Supreme Court’s precedent, Humphrey’s Executor, seems to be a rare unique feature of American domestic institutional arrangements for independent government agencies such as the Federal Reserve System (FRS) and the Federal Trade Commission (FTC). In most non-U.S. countries, central banks continue to serve as independent monetary policy makers with no, little, or minimal political interference. In these countries, several other domestic institutional arrangements establish central bank independence in some different ways. In many Anglo-Saxon countries such as Australia, Britain, Canada, and New Zealand, central banks establish their monetary policy independence through a Policy Target Agreement (PTA) between the Finance Ministry and each central bank itself. Specifically, this agreement usually stipulates the 2% inflation target or some broader inflation target range of 1% to 3% per year. In America, if President Trump sought to challenge the Supreme Court precedent for Fed Chair independence, this surprise removal would probably cause substantial economic policy uncertainty around price stability and maximum employment in America. Global financial markets would likely expect to see significantly higher inflation in the U.S. and many other parts and regions of the world. These market expectations would lead to higher long-end Treasury bond interest rates too. Global financial markets would look substantially different if the longer-run inflation rate and interest rates were subject to the political whims of the White House. For these reasons, the potential surprise removal of the Supreme Court’s legal protection for Fed Chair independence would be consequential with adverse economic results, outcomes, and scenarios.

President Trump would probably appoint a new political ally as the next Fed Chair when Fed Chair Powell’s second term ends in May 2026. As of early-June 2025, we believe the former Federal Reserve Governor, Kevin Warsh, serves as one of the frontrunners in favor of fewer macro-financial supervisory reviews, rules, and regulations in America. At any pace, the new Fed Chair would not be an autocrat. Specifically, the FOMC sets monetary policy as a series of committee decisions for interest rates, open market operations, and financial regulations. The rigorous Senate confirmation process screens all of the 7 Federal Reserve Governors, and 5 of the 12 Reserve Bank Presidents. In addition to the Fed Chair, each of these FOMC members has only one vote for all monetary policy decisions. Nonetheless, the Fed Chair is influential in all monetary policy decisions by tradition, in theory, and in practice. The FOMC committee structure of the Federal Reserve System acts as a vitally important check on the power of any one person in setting the monetary policy stance.

Several checks and balances further help promote better monetary policy independence for Fed Chair, FOMC, and the Federal Reserve System. President Trump’s new nomination for Fed Chair would be subject to the rigorous Senate confirmation process. Although the vast majority of Republican Senators would likely tend to support President Trump’s nomination for Fed Chair, Senators take any Fed Chair confirmations very seriously. Whoever makes it through the gauntlet of Senate confirmation would be someone who serves as the Fed Chair in accordance with the dual mandate for monetary policy, financial market stabilization, and the best interests of Americans. Finally, one of the more powerful checks and balances for the new Fed Chair and Federal Reserve Governors is that American history judges first and foremost their rare unique monetary policy performance in terms of better achieving the dual mandate, especially the broader price stability policy target of 2% long-run inflation per year. In practice, American history would not be kind to these new Fed Chair and Federal Reserve Governors if they fail to achieve the dual mandate.

Some macro-financial economists contend that many central banks worldwide have become too independent in wading into several other public policy affairs outside the statutory remit, specifically the dual mandate of both price stability and maximum sustainable employment. In recent times, these mission-creep criticisms focus on 3 major policy issues. First, the Fed Chair and broader Federal Reserve System now delve into climate change risk management not in accordance with the dual mandate. However, the Federal Reserve System only takes into account climate change risk management in its supervisory capacity for American mega banks. Specifically, these systemically important financial institutions (SIFI) face substantial exposures to potential losses as a result of market risk, credit risk, and operational risk due to climate-driven rare disasters and extreme weather events. In this fundamental sense, the Federal Reserve System has to scale up the new Basel bank capital requirements, liquidity constraints, supplementary leverage ratios (SLR), and even macro-prudential stress tests in support of stable, robust, and resilient financial markets. In this positive light, climate change risk management should not be subject to the recent mission-creep critiques about the wider Federal Reserve System.

Second, the Fed Chair, FOMC, and Federal Reserve System substantially expand and then shrink the central bank balance sheet with large-scale asset purchases of both long-maturity Treasury bonds and mortgage securities, specifically QE1-QE4 open market operations, in recent years. Good examples span the recent macro episodes of the Global Financial Crisis of 2008-2009 and the recent rampant Covid pandemic crisis of 2020-2022. In practice, large-scale asset purchases per se may not be subject to the recent mission-creep criticisms about the broader Federal Reserve System. Specifically, the FOMC regards both Treasury bonds and mortgage securities as fundamentally equivalent in terms of their credit default attributes, tendencies, and characteristics. Under the long prevalent U.S. statutes, the Federal Reserve System has the legal power to purchase these dollar assets in support of stable, robust, and resilient financial markets in America. When the Federal Reserve System buys long-maturity Treasury bonds and mortgage securities, the central bank supports some specific segments of financial markets. We should draw a distinction between core central bank balance sheet operations for more effective monetary policy decisions and large-scale asset purchases for better financial market stabilization. In this positive light, again, large-scale asset purchases and other central bank balance sheet operations should not be subject to the recent mission-creep criticisms about the Federal Reserve System.

Third, the Federal Reserve System continues to expand incrementally its recent supervisory and regulatory responsibilities for American financial markets. The common macro-financial policy tools, methods, and instruments include the new Basel bank core capital requirements, liquidity constraints, supplementary leverage ratios (SLR), macroprudential stress tests, and deposit insurance limits, rules, and regulations. From Silicon Valley Bank and First Republic Bank to Signature Bank, these recent bank failures serve as vital, useful, and practical case studies for effective bank failure resolution and financial risk management. In the meantime, the Federal Reserve System continues to regulate bank holding companies (BHC) and state members of the broader American financial system. These regulatory and supervisory roles, powers, and responsibilities are the statutory duties for the broader Federal Reserve System. For this reason, we should not regard these financial supervisory reviews, roles, rules, and regulations as part of the recent mission-creep criticisms about the Federal Reserve System. In recent times, the second Trump administration seeks to pursue a complete strategic reset of Federal Reserve autonomy in macro-financial supervisory reviews, rules, and regulations. This strategic reset would probably be subject to further political discourse and judicial travel with better congressional oversight in due course.

Like several Anglo-Saxon countries from Australia and Britain to Canada and New Zealand, America continues to operate as an open democratic society. The U.S. government controls inflation, adjusts social welfare programs, and provides pervasive unemployment insurance, labor protection, and education through both federal and state taxes and fiscal expenditures. These public policy goals, affairs, and programs are often intensely political in nature. In this positive light, the American government delegates these public policy goals to Congress as well as the executive branch with regular re-elections as the vital checks and balances. The Federal Reserve System lacks the statutory power to interfere with these non-monetary and non-macro-financial policy affairs. At any pace, the Federal Reserve System should seek to achieve better fiscal-monetary policy coordination in accordance with at least some political goals and congressional demands in the modern American democratic society. In the 1980s and 1990s, the Federal Reserve System had complete control over inflation by adjusting the money supply growth to match contemporaneous growth in the general price level. However, both federal and state taxes and fiscal expenditures started to complicate the causal relation between money supply growth and headline core inflation from the late-1990s to the present. Macro-financial market forces combine with new boom-bust fluctuations in the real business cycle to affect monetary non-neutrality. In due time, these market forces drive the short-term trade-offs between inflation and unemployment, or the short-run trade-offs between inflation and economic output growth, as part of the New Keynesian Phillips Curve (NKPC). However, these short-term market forces, factors, and trade-offs should not persist in the long run.

The Fed Chair, the FOMC, and the broader Federal Reserve System should not blindly bend to presidential whims and impulses, political pressures, and congressional demands, special treatments, and preferences in the U.S. democratic society. At the same time, however, the Federal Reserve System should seek to achieve greater fiscal-monetary policy coordination with the Treasury Department in support of better macro-economic outcomes. These macro policy outcomes include low and stable inflation, full employment, greater labor productivity, steady and consistent economic growth, and technological advancements in some strategic sectors for U.S. national security purposes. Specifically, the Federal Reserve System should seek to cooperate with the Treasury Department on the maturity transformation of American government bonds. In recent decades, the Treasury continues to issue long-maturity bonds to protect itself against interest rate hikes that the FOMC applies to tame inflation for broader price stability in America. When the FOMC and wider Federal Reserve System launch large-scale asset purchases, these asset purchases target both long-maturity Treasury bonds and mortgage securities. By shortening the key maturity structure of Treasury bonds with steeper bond yield curves, the American government as a whole would face fierce fiscal strains when interest rates rise in response to inflationary pressures. On this front, a new accord or a new policy target agreement between the Federal Reserve System and the Treasury Department should help ensure better fiscal-monetary policy coordination on the empirically proven basis of monetary policy rules. These vital, useful, and practical policy rules remake, reshape, and reinforce the new macro-financial world order from World War II to the recent decades.

By the same token, the Fed Chair, the FOMC, and the Federal Reserve System may or may not worry about exchange rates and foreign currency fluctuations from day to day. However, the second Trump administration continues to reiterate a new policy preference for a weaker American dollar, and interest rates play an important role in driving fluctuations in exchange rates. In recent times, the top American trade negotiators, Treasury Secretary Scott Bessent, Trade Representative Jamieson Greer, and Commerce Secretary Howard Lutnick manage to reach a new trade truce framework with China to implement the wider Geneva consensus on the tariff front. Specifically, the rare earths exports from China and subsequent relaxation of American bans and restrictions on foreign investments from semiconductor microchips to high-speed broadband telecoms combine to serve as the vital quid pro quo for bilateral trade negotiations. In this broader context, the Trump administration seeks to smooth out extreme fluctuations in interest rates, exchange rates, and principal payments and interest costs on Treasury bonds with better, faster, smarter, and more comprehensive fiscal-monetary policy coordination between the Treasury and the broader Federal Reserve System.

Today, the Fed Chair, the FOMC, and the broader Federal Reserve System face a relatively difficult situation. President Trump’s tariff policies set the stage for subpar U.S. output growth, higher inflation, and greater unemployment in the next few years. For the foreseeable future, the Fed Chair would have to re-evaluate the trade-offs between inflation and unemployment. If the Fed Chair seeks to raise interest rates to curtail inflation, these interest rate hikes risk a severe recession, a Treasury debt debacle, and a Silicon-Valley-Bank-style financial crisis. If the Fed Chair chooses to reduce interest rates to fight unemployment, these interest rate cuts risk substantially higher inflation. In response, the Fed Chair and the FOMC would need to be careful to tread a tightrope between the hawkish battle against inflation and the dovish support for maximum employment in America. At any pace, the next Fed Chair would learn to be politically savvy in light of the harsh trade-offs between inflation and unemployment.

In recent decades, the Fed Chair, the FOMC, and the wider Federal Reserve System made at least 3 massive mistakes. These 3 massive mistakes included the Global Financial Crisis of 2008-2009, the inflation surge in the Covid pandemic crisis of 2020-2022, and the regional bank failures from Silicon Valley Bank and Signature Bank to First Republic Bank. The wider Federal Reserve System reacted to these rare economic events with the Dodd-Frank Act of 2010, more stringent Basel bank capital requirements, short-term liquidity controls, leverage limits, macro-prudential stress tests, and deposit insurance limits, rules, and regulations. In particular, the FOMC sharply tightened macro-financial conditions with interest rate hikes to rein in inflation in recent years. Some macro-financial economists suggest that the Fed Chair should re-interpret price stability to aim for a stable general price level over the long run; but, several other macro-financial economists blame the Fed Chair and the FOMC for forgetting about their past massive mistakes. On balance, the Fed Chair and the FOMC might want to re-calibrate the long prevalent 2% inflation target to a more flexible target range of 1% to 3% per annum. Some medium-term price-level targets might better inform interest rate decisions in response to the harsh trade-offs between inflation and unemployment. In addition to these new near-term policy targets, some alternative measures might help better target real growth in nominal GDP per capita. These reasons, forces, factors, and considerations further shine new skeptical light on what Fed Chair independence means for better fiscal-monetary policy coordination in practice.

A substantially less independent Fed Chair, FOMC, or Federal Reserve System would likely lead to upward inflation pressures and higher short-maturity Treasury bond interest rates. In addition, substantially less Fed Chair independence would likely further reduce stock market prices, returns, broader asset premiums, and positive currency fluctuations in the greenback. We describe, discuss, and delve into these recent empirical results with respect to Fed Chair independence.

President Trump’s recent comments signaled a resumption of the public pressure campaign from his first term when he called for the Fed Chair to reduce interest rates many times. This act could erode the general public’s perception of American monetary policy independence even though the key U.S. statutes kept intact Fed Chair independence. High-frequency data analysis suggests that President Trump’s recent comments were pretty successful in further reducing Treasury bond interest rates with few or minimal economic costs. Specifically, the 5-minute data show that the short-term Treasury bond interest rates declined significantly in response to President Trump’s recent criticisms of the Fed Chair Jerome Powell. These new criticisms further led to U.S. dollar depreciation and significantly lower stock market valuation, although these adverse ripple effects were not statistically significant.

Broader global empirical results show that political pressures on central bank independence might result in hefty economic costs of higher inflation rates and long-maturity Treasury bond interest rates. A recent empirical analysis of panel data from 118 countries shows that new political pressures on central bank independence would likely result in a 2 percentage-point increase in inflation 6 to 8 quarters after the start date of the new political pressure campaign. Specifically, the peak impact on inflation would take place after almost 2 years. Further, the adverse impact of these political pressures on economic growth and domestic employment seemed to be small, statistically insignificant, and slightly negative.

With respect to Treasury bond interest rates, we find that these new political pressures were pretty successful in further reducing 3-month interest rates in the subsequent months. In the vast majority of countries, however, these new political pressures would likely cause 10-year interest rates to rise by almost 35 to 50 basis points. In effect, these new political pressures on central bank independence would likely steepen the Treasury bond yield curve by almost 2 to 3 percentage points. On the margin, any subsequent increase in inflation would probably offset the shorter-run macro growth benefits of expansionary monetary policy decisions. On balance, the recent empirical results show that these new political pressures on central bank independence globally would lead to upward inflation pressures with relatively few, low, and minimal benefits from higher output growth rates and steeper Treasury bond yield curves.

In global human history, broader economic reforms that substantially improved central bank independence consistently reduced inflation by 2 to 3 percentage points in the subsequent years. In practice, many macro-financial economists referred to the relatively calm economic episode from the 1980s to 2008 as the Great Moderation with low and stable inflation, steady and robust economic growth, and full employment in several G20 countries. In America, the Treasury and Federal Reserve System provided joint fiscal and monetary stimulus programs of more than $4 trillion dollars to substantially boost U.S. money supply growth in support of the recent economic recovery from the Covid-19 pandemic crisis worldwide. In recent years after the post-Covid inflation surge, many central banks worldwide from the Federal Reserve System to the European Central Bank (ECB) launched interest rate hikes to contain inflation as price stability turned out to be the single central macro mandate for many monetary policy makers worldwide. As the Nobel Laureate Milton Friedman wisely observed several decades ago, inflation was always and everywhere a monetary phenomenon.

In American history, Congress has not been completely silent on central bank independence. The Federal Reserve Act of 1913 affords the Fed Chair and other senior leaders some legal protections. First, the president cannot remove any of the 12 regional Federal Reserve Bank presidents as they rotate to serve on the FOMC. This protection serves as a key bulwark of broader Federal Reserve System independence. Second, the president cannot remove with no cause any of the 7 members of the Federal Reserve Board of Governors before their 14-year terms expire in due course. These governors serve their regulatory duties with no, little, and minimal political interference. Any cause for concern would require inefficiency, neglect of duty, or malfeasance in office. Policy differences and disagreements have historically not been sufficient for presidential removal, dismissal, demotion, or relegation. Even though U.S. laws say little about whether the president has the legal authority to demote Federal Reserve Board leaders, specifically the Fed Chair, Vice Chair for monetary policy, and Vice Chair for bank supervision, before their 4-year terms expire, the statutory term length implies that the president lacks this legal authority.

In recent times, Fed Chair Jerome Powell has made clear his intention to serve out his full second term up to May 2026. In American history, it is virtually impossible for the president to remove a current Fed Chair who does not agree to leave before the end of his or her term. William McChesney Martin and Alan Greenspan remained Fed Chairs for decades despite presidential opposition. In the past 40 years, central bankers worldwide have been extremely zealous in protecting their independent sphere of influence over monetary policy affairs and financial regulations. Fed Chair Jerome Powell has proven no different in this regard. In fact, the Supreme Court would likely uphold the 90-year precedent that safeguards independent government agencies in America.

In the past few decades, it was common for the president to develop a positive allyship with the Fed Chair. For instance, William Miller worked on President Jimmy Carter’s presidential election campaign. Ben Bernanke was a close economic adviser to President George Bush. While few people were close to President Ronald Reagan, Greenspan was as close to the conservative movement as anyone. The best example would be Arthur Burns, who had an almost familial relationship with President Richard Nixon. President Trump would probably appoint a new political ally as the next Fed Chair when Fed Chair Powell’s second term ends in May 2026. As of early-June 2025, we believe the former Federal Reserve Governor, Kevin Warsh, now serves as one of the frontrunners in favor of fewer financial supervisory reviews, rules, and regulations in America. At any pace, the Fed Chair needs to understand the macro mandate for the FOMC and the broader Federal Reserve System. This macro mandate now spans partisan interests, and the Senate confirmation process provides some reassurance that the new Fed Chair would serve as a competent central banker with policy independence across interest rate adjustments, open market operations, and macrofinancial reviews, rules, and regulations.

Better central bank independence has historically ensured relatively low inflation in America and many other parts and regions of the world. Low and stable prices preserve the American dollar’s real purchasing power over time. Sound monetary policy contributes to the 3 central features, functions, and properties of the American dollar as the global reserve currency. In particular, these 3 central features, functions, and properties include a stable store of value, a long prevalent unit of account, and a common medium of exchange for financial payments, transactions, and cross-country capital flows worldwide. However, a less independent Fed Chair would risk political foreign exchange intervention in the global currency market for the U.S. dollar.

The White House’s overt currency targets for American dollar depreciation would create new challenges for both institutional investors and macro policymakers worldwide. Such currency targets would probably prevent flexible exchange rates from adjusting sufficiently to address global market conditions. Political foreign exchange intervention would further raise inflation concerns, and these new inflationary pressures would weigh on the dominant global reserve currency status of the American dollar. In practice, the inflationary impulse from a weak U.S. dollar might necessitate more restrictive monetary policy rates and weaker domestic output growth rates.

Today, the American dollar continues to be the dominant global reserve currency of choice in the vast majority of foreign exchange transactions. Moreover, the American dollar remains the largest common denominator of global capital markets. Acute financial market disruption typically sets off a dash for dollars as institutional investors strategically reset their respective currency hedges and multinational corporations seek to raise cash worldwide. The Federal Reserve System plays a vitally important role in this process by supplying American dollars to creditworthy borrowers in need of these dollars via swap lines, short-term inter-bank loans, and other near-term credit lines, programs, and facilities. Historically, this new normal steady state of global market access to American dollar assets has been a key determinant of global reserve currency adoption. However, if substantially lesser Fed Chair independence might lead to questions about this longer-run stable provision of American dollar support, this new chain of thought would probably prompt American dollar investors, traders, and professional arbitrageurs to consider potential vulnerabilities from the widespread use of the greenback. As a result, these key institutional investors and multinational corporations might turn toward some other hard currencies such as the Euro, British Pound, Japanese Yen, Deutsche Mark, and even the Chinese Renminbi (Yuan).

President Trump’s recent pressures on Fed Chair Jerome Powell have raised new questions about Fed Chair independence, legal protections, and broader institutional commitments to the dual mandate. From sovereign wealth funds to global index funds, many investors might shift away from American dollar assets, especially short-maturity and long-maturity Treasury bonds. To the extent that President Trump’s recent pressures on Fed Chair Jay Powell might weaken broader institutional commitments to the dual mandate, near-term inflation concerns and less favorable growth trade-offs would heighten the risk of a passive decrease in foreign appetite for American Treasury bonds. Specifically, the massive sales of Treasury bonds by central banks in China and Japan could trigger asset market disruption. A less independent Federal Reserve System would reduce the modern appeal of both U.S. Treasury bonds and several other dollar assets for foreign investors. The vast majority of these foreign investors include central banks, sovereign wealth funds, foreign reserve managers, and several active and passive index funds. In the best-case scenario, Treasury bond yields would need to rise substantially to motivate these foreign investors to continue buying these safe dollar assets. In recent times, the 3 major credit rating agencies downgrade Treasury bonds from the top-notch investment grade. As a result, we would witness significantly more volatile fluctuations in American Treasury bond prices, returns, yields, and other asset risk premiums. Less Fed Chair independence could exacerbate volatile fluctuations in the global markets for Treasury bonds and other dollar assets. By contrast, gold would shine brighter as a better alternative stable store of value to Treasury bonds and other dollar assets if President Trump seeks to further weaken Fed Chair independence in due course.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

Andy Yeh (online brief biography)

Co-Chair

AYA fintech network platform

Brass Ring International Density Enterprise ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

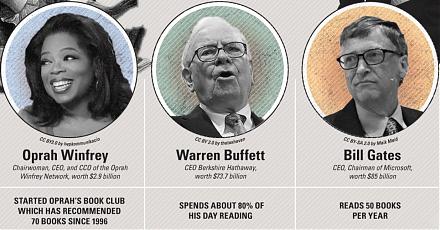

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-10-08 11:34:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-02-05 10:32:00 Tuesday ET

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities

2017-01-11 11:38:00 Wednesday ET

Thomas Piketty's recent new book *Capital in the Twenty-First Century* frames income and wealth inequality now as a global economic phenomenon. When

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's