2018-08-03 07:33:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

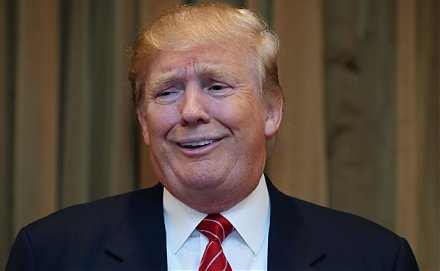

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical products, steel-and-aluminum goods, and other consumer goods from pet food and furniture to car tires, bicycles, baseball gloves, and beauty products. Commerce Secretary Willbur Ross points out that these non-cataclysmic tariffs amount to less than 1% of China's real GDP economic growth. In response, China prepares to retaliate by introducing 5%-25% tariffs on about $60 billion U.S. exports.

China's chief diplomat suggests that any U.S. unilateral threat or blackmail will only intensify Sino-U.S. trade conflicts with severe damage to the economic interests of all parties. Among other trade tools, the Trump administration now applies tariffs and duties to push China to abandon unfair practices in order to reach a new trade deal. The Trump team aims to balance its desire to force the Xi administration back to the negotiating table with joint efforts to avoid escalation in the current Sino-U.S. trade war. U.S. trade reps urge China to address the longstanding U.S. Trade Act Section 301 concerns about Chinese unfair practices such as patent, copyright, and trademark infringement and other intellectual property theft.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2023-12-04 12:30:00 Monday ET

Bank leverage and capital bias adjustment through the macroeconomic cycle Abstract We assess the quantitative effects of the recent proposal

2023-03-21 11:28:00 Tuesday ET

Barry Eichengreen compares the Great Depression of the 1930s and the Great Recession as historical episodes of economic woes. Barry Eichengreen (2016)

2019-03-27 11:28:00 Wednesday ET

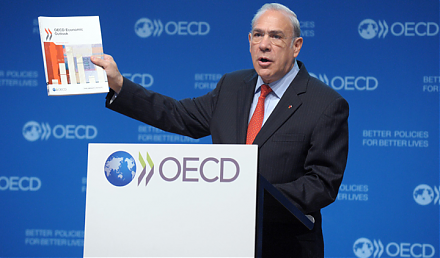

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2022-03-25 09:34:00 Friday ET

Corporate cash management The empirical corporate finance literature suggests four primary motives for firms to hold cash. These motives include the tra

2019-05-09 10:28:00 Thursday ET

President Trump ramps up 25% tariffs on $200 billion Chinese imports soon after China backtracks on the Sino-American trade agreement. U.S. trade envoy Robe