2018-03-23 08:26:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the daily habits and routines of self-made millionaires, and he chronicles these results in his books **Rich Habits** and **Change You Habits, Change Your Life**. Rich people share common habits, and others can learn from these habits that help enrich their lives. First, self-made millionaires maintain long-term vision with short-term focus. They often set bold and lofty life goals, value propositions, and mission statements. At the same time, the rich focus on both the important and urgent matters that can often lead to positive results.

For instance, these millionaires attend to money matters like value investors who focus on small profitable cash cows with low relative market valuation that invest conservatively in both capital investment and balance sheet expansion.

Second, self-made millionaires cherish the importance of self-improvement. They read books, articles, blogs, and newsletters about personal finance, management, and other self-help issues. This practice allows these self-made millionaires to turn unproductive routines into better ones.

Third, self-made millionaires enhance their social integration. These millionaires like to network with successful people in personal finance, sport, family, or other social events, and their active social engagement extends beyond their inner circle. In Corley’s 5-year study, what self-made millionaires choose not to accomplish is as important as what they choose to accomplish over several years.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-29 12:39:00 Saturday ET

The Securities and Exchange Commission (S.E.C.) sues Elon Musk for his August 2018 tweet that he has secured external finance to convert Tesla into a privat

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2018-05-11 09:37:00 Friday ET

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2

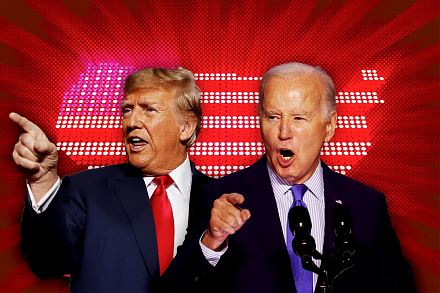

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi