2017-11-25 06:34:00 Sat ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement on a thorny set of revisions to Basel 3. Many bankers and pundits refer to these revisions as Basel 4. While many banks prefer to standardize their equity capital calculations under Basel 3, several multinational banks apply their own internal risk models to gauge appropriate common equity capital ratios. Now the primary concern relates to the unfortunate outcome that the minimum regulatory capital results would become lower for a given large bank if one chose to apply another bank's internal risk models. This discrepancy might arise from the fact that each bank exhibits different exposure to specific risk types such as commercial real estate default risk and operational risk. Due to this concern, Basel 4 revisions can fill the gap between fact and fiction to help circumvent regulatory arbitrage.

Large banks would need to incorporate loan-to-value ratios into the internal risk models of residential mortgage default risk. On balance, the overall capital floor is 72.5%, which reaches a healthy middle ground between the U.S. preference for 75% and the European tendency toward 70%. Proponents of U.S. financial deregulation suggest that substantially lifting the average capital ratio from 7% to 12%-15% would likely increase the prohibitively high cost of capital for banks, insurance companies, credit unions, and other financial institutions.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

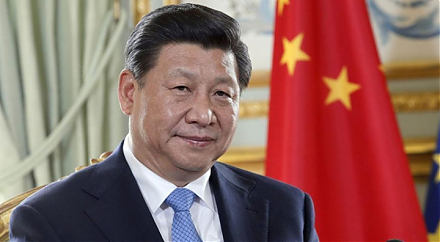

2018-03-03 11:37:00 Saturday ET

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2019-04-01 08:28:00 Monday ET

OraSure and its subsidiary DNA Genotek specialize in the lean production of home DNA spit tubes. OraSure extracts core genetic information from microbiome s

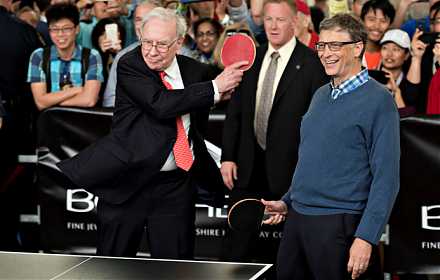

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2018-04-26 07:37:00 Thursday ET

Credit supply growth drives business cycle fluctuations and often sows the seeds of their own subsequent destruction. The global financial crisis from 2008

2018-08-11 14:35:00 Saturday ET

The Trump administration imposes 20%-50% tariffs on Turkish imports due to a recent spat over the detention of an American pastor, Andrew Brunson, in Turkey

2020-09-24 10:26:00 Thursday ET

Edge strategies help business leaders improve core products and services in a more cost-effective and less risky way. Alan Lewis and Dan McKone (2016)