2018-11-25 12:37:00 Sun ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between both sides to resolve the current Sino-American trade war. Thus far $360 billion Chinese imports have been subject to 10%-25% U.S. tariffs, and the Trump administration floats additional duties and concessions in recent times. In light of the U.S. midterm elections, President Trump expects to strike a positive trade deal with China. The Trump administration is thus unlikely to impose new tariffs on Chinese imports. As both Chinese and American delegates and diplomats resume their trade talks, the Trump team now sidelines most diehard protectionists.

President Trump and Chinese President Xi can next meet to agree on a new trade framework at the G20 summit in late-November 2018. China can purchase more American goods to help lower bilateral U.S. trade deficits. Nevertheless, the Trump administration may find it difficult to prevent the perennial Sino-U.S. technology transfer and other intellectual property theft in the mainland. This trade dilemma reflects the reality of unfair trade practices in several high-tech industries such as semiconductors, microchips, smart phones, visual animations, speech recognition devices, and artificial intelligence apps etc.

In fact, Sino-American bilateral trade deficits have ballooned about 10% from $275 billion to $305 billion in the interim period from September 2017 to November 2018. Part of this deficit increase reflects an 8.1% surge in U.S. imports from China while U.S. exports to China remain flat. U.S, real output growth, employment, and capital investment fire on all cylinders, thus the American economy attracts more Chinese imports in the current phase of robust economic growth. Greenback appreciation also contributes to this bilateral trade deficit increase, whereas, a weaker Chinese currency helps offset some costs of American tariffs on Chinese imports. The U.S. cannot readily replace Chinese imports with close substitutes because only China can produce these goods in a cost-effective way.

On balance, the Trump administration should seek to deter unfair trade practices such as Sino-American technology transfer and patent and trademark infringement. Whether the Trump team can reduce bilateral trade deficits with China becomes a secondary issue. Insofar as the Trump administration can attain 3%-4% real GDP economic growth, the additional tax revenue intake can self-finance fiscal budget and trade deficits.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-08-07 09:39:00 Monday ET

Global financial markets suffer as President Trump promises *fire and fury* in response to the recent report that North Korea has successfully miniaturized

2018-08-23 11:34:00 Thursday ET

Harvard financial economist Alberto Cavallo empirically shows the recent *Amazon effect* that online retailers such as Amazon, Alibaba, and eBay etc use fas

2017-04-25 06:35:00 Tuesday ET

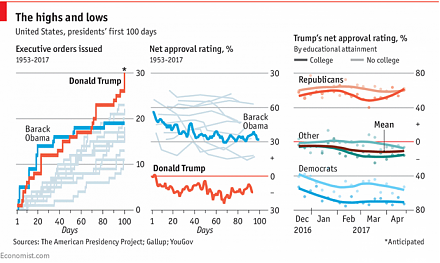

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2020-02-19 14:35:00 Wednesday ET

The U.S. bank oligarchy has become bigger, more profitable, and more resistant to public regulation after the global financial crisis. Simon Johnson and

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has