2019-04-29 08:35:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

IMF chief economist Gita Gopinath predicts no global recession with key downside risks at this delicate moment. First, trade tensions remain one of the key downside risks to the global economy, especially in the car and aircraft sectors. Trump trade envoys need to reach mutual agreement with the Chinese Xi administration with respect to U.S. bilateral trade deficit eradication and intellectual property protection and enforcement. Second, slower economic growth poses another major threat to continental economies such as China and Europe. These economies turn out to be the biggest victims of American tariffs that the Trump administration unilaterally decides to impose due to U.S. trade protectionism. Third, a deterioration in stock market investor sentiment may rapidly tighten financial constraints and conditions in the broader context of perennial public debt accumulation in the U.S. and several other OECD countries. This deterioration may inadvertently exacerbate sovereign bank doom-loop default risks.

Federal Reserve has to halt the current interest rate hike to reinvigorate a smooth global financial cycle as the Chinese, European, and Japanese central banks and fiscal authorities coordinate their next macroeconomic stimulus programs. Global monetary policy coordination continues to help maintain stock market momentum and economic growth via dovish monetary expansion and fiscal stimulus worldwide.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2022-11-15 10:30:00 Tuesday ET

Stock market misvaluation and corporate investment payout The behavioral catering theory suggests that stock market misvaluation can have a first-order

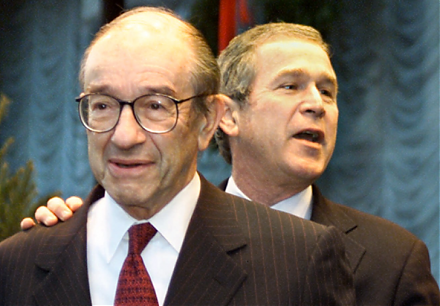

2018-01-21 07:25:00 Sunday ET

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2019-12-22 08:30:00 Sunday ET

European Commission President Ursula von der Leyen now protects the European circular economy and green growth from 2020 to 2050. The new circular economy r

2019-02-09 08:33:00 Saturday ET

Apple provides positive forward guidance on both revenue and profit forecasts for iPhones, iPads, and MacBooks. In the Christmas 2018 festive season, MacBoo