2019-09-09 20:38:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Chair Jerome Powell yields to the persistent demands of a vocal president, the FOMC approves an interim interest rate cut by quarter point to 2%-2.25%. This rate cut represents a clear departure from the current business cycle of interest rate hikes in recent years. Barro advocates the Taylor monetary policy rule that the nominal interest rate should rise in response to higher inflation and economic output both relative to their targets. In accordance with the key Taylor monetary policy rule, the nominal interest rate normally tends toward a gradual long-term equilibrium path.

In this light, Barro regards the recent interest rate reduction as a special deviation from the prior path of U.S. monetary policy normalization. Federal Reserve Chair Jerome Powell seems to justify the recent interest rate cut in terms of the fact that U.S. inflation remains low and tame as the economy operates near full employment despite continual trade escalation between the U.S. and China. Barro indicates the clear and present danger that the recent rate reduction represents a dovish Powell response to many stock market analysts and the Trump administration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2022-11-25 09:29:00 Friday ET

Uniform field theory of corporate finance While the agency and precautionary-motive stories are complementary, these stories can be nested as special cas

2020-03-12 09:32:00 Thursday ET

Google CEO Eric Schmidt and his co-authors show the innovative corporate culture and mission of the Internet search tech titan. Eric Schmidt, Jonathan Ro

2020-02-05 10:28:00 Wednesday ET

Our proprietary AYA fintech finbuzz essay shines light on the modern collection of business insights with executive annotations and personal reflections. Th

2026-02-14 11:26:00 Saturday ET

Our AYA fun podcasts deep-dive into the current global trends, topics, and issues in macro finance, political economy, public policy, strategic management,

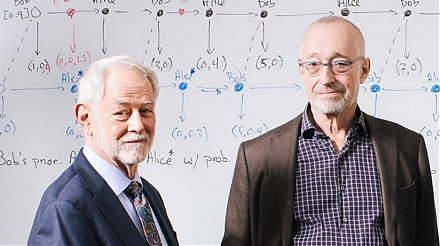

2023-11-21 11:32:00 Tuesday ET

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)