2018-07-19 18:38:00 Thu ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Goldman Sachs chief economist Jan Hatzius proposes designing a new Financial Conditions Index (FCI) to be a weighted-average of interest rates, exchange rates, stock prices, and credit spreads. Each weight corresponds to the direct marginal contribution of each macro variate to real GDP economic growth. Hatzius amends a New Keynesian macroeconomic model to embed an FCI in a Taylor monetary policy rule that induces the central bank to ease the FCI when either inflation or employment falls below mandate-consistent thresholds. This macroeconometric analysis suggests an FCI-driven policy rule for maintaining the neutral interest rate that better contains inflation near full employment.

The Trump administration's chief economic advisor Larry Kudlow engages in a hot and healthy debate with several economists who warn of an economic recession that might arise from the Sino-American trade war with higher U.S. budget deficits and tax cuts. Kudlow advocates the optimistic outlook for the U.S. economy in light of both robust employment and 3.5%-4% real GDP growth in mid-2018. Moreover, Kudlow even emphasizes that the current U.S. economic boom may continue until 2022-2024.

In contrast, some other eminent economists such as Mark Zandi (Moody's chief economist) and Ken Griffin (Citadel CEO) are less optimistic about the current U.S. economic boom. Zandi shares his fresh insight that the Federal Reserve continues its interest rate hike to dampen inflationary pressure until a recession occurs early in the next decade. Griffin considers a murkier outlook that the Trump tax cuts may have pulled forward both consumer and business demand.

The current economic boom is the second-longest in U.S. history and thus may or may not sustain in the next decade. Treasury Secretary Steve Mnuchin reiterates America’s long-term credible commitment to maintaining a strong greenback with minimal risk of a currency war. In accordance with Mnuchin's recent remarks after the G20 summit of finance ministers, Mnuchin needs to dismiss the arcane idea of U.S. dollar intervention.

On balance, the U.S. Treasury and Federal Reserve can consider the new FCI in order to make better and wiser economic policy decisions.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-27 11:28:00 Wednesday ET

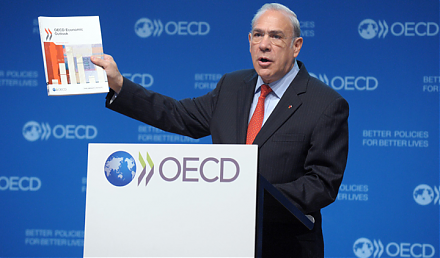

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2025-09-16 09:27:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-08-19 14:43:00 Saturday ET

In a recent tweet, President Donald Trump criticizes Amazon over taxes and jobs. Without providing specific evidence, Trump accuses of the e-commerce retail

2023-02-07 08:26:00 Tuesday ET

Michel De Vroey delves into the global history of macroeconomic theories from real business cycles to persistent monetary effects. Michel De Vroey (2016)

2024-02-05 11:26:00 Monday ET

China poses new economic, technological, and military threats to the U.S. and many western allies. In the U.S. government assessment, China poses new eco

2019-01-04 11:41:00 Friday ET

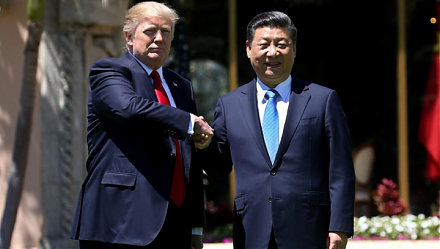

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin