2019-10-07 12:35:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Federal Reserve reduces the interest rate by another key quarter point to the target range of 1.75%-2% in September 2019. In accordance with the Federal Reserve dot plot of interest rate expectations, 5 FOMC members favor the prior status quo of 2% to 2.25%.

The same flagship dot plot suggests that 5 FOMC members support a quarter point cut with no more rate cuts through the remainder of the current calendar year. The dot plot further indicates that 7 FOMC members support at least one more interest rate cut in late-2019. The U.S. monetary policy committee cites the implications of global trade frictions and other regional clouds of both fiscal policy uncertainty and asset price normalization for the current economic outlook. Low inflation remains the root cause of the second interest rate cut. The recent dovish monetary policy stance accords with the Federal Reserve dual mandate of maximum sustainable employment and price stability.

Federal Reserve Chair Jerome Powell indicates that it may be essential for most market participants to raise the bar for any further interest rate reductions due to tighter financial constraints in the foreseeable future. Data dictate future moderate moves in the monetary policy space.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-07 12:33:00 Wednesday ET

Conor McGregor learns a major money lesson from LeBron James. This lesson suggests that James spends about $1.5 million on his own body each year. The $1.5

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no

2020-08-12 07:25:00 Wednesday ET

Most sustainably successful business leaders make a mark in the world, create a positive impact, and challenge the status quo. Jerry Porras, Stewart Emer

2020-08-19 10:32:00 Wednesday ET

Corporate strategies, portfolio choices, and management memes add value and drive business process improvements over time. Andrew Campbell, Jo Whitehead,

2017-12-19 09:39:00 Tuesday ET

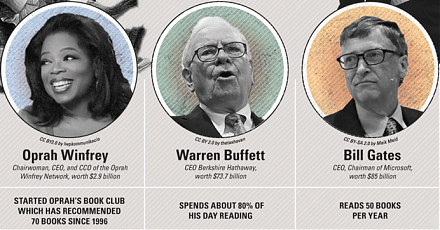

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi