2018-06-08 13:35:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inflationary pressures. This decision reflects robust economic revival in America. With sound price stability, the U.S. economy now operates near full employment with 2.1% inflation and 3.8% unemployment (i.e. the lowest unemployment rate since 2000). The current real economic growth trajectory accords with the Federal Reserve's dual mandate of maximum employment and price stability.

The Federal Reserve pencils in subsequent interest rate hikes later in 2018 (2%-2.25% in September 2018 and then 2.25%-2.5% in December 2018). This gradual acceleration of interest rate increases helps contain inflation with steady gains in the labor market. The current interest rate hike might disappoint President Trump who would otherwise prefer dovish monetary policy accommodation (in contrast to hawkish inflation containment).

However, the Federal Reserve reiterates monetary policy independence and thus continues the current interest rate hike as the U.S. economy moves along the long-run steady-state economic growth path of healthy fundamental recalibration. On balance, it is now quite plausible for America to achieve 3%+ real GDP economic growth to better balance the U.S. fiscal budget that helps neutralize both trade and budget deficits in the medium term.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-11-03 08:30:00 Tuesday ET

Agile lean enterprises break down organizational silos to promote smart collaboration for better profitability and customer loyalty. Heidi Gardner (2017

2019-08-24 14:38:00 Saturday ET

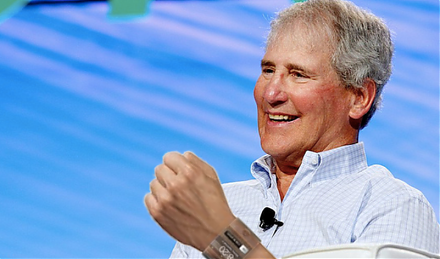

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2022-03-05 09:27:00 Saturday ET

Addendum on empirical tests of multi-factor models for asset return prediction Fama and French (2015) propose an empirical five-factor asset pricing mode

2022-02-05 09:26:00 Saturday ET

Modern themes and insights in behavioral finance Shiller, R.J. (2003). From efficient markets theory to behavioral finance. Journal of Economi

2020-11-22 11:30:00 Sunday ET

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2024-10-14 11:33:00 Monday ET

Stock Synopsis: Video games continue to take both screen time and monetization from many other forms of entertainment. We are broadly positive about the