2019-09-07 17:37:00 Sat ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

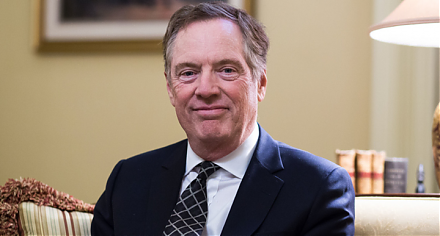

Federal Reserve Chair Jerome Powell announces the monetary policy decision to lower the federal funds rate by a quarter point to 2%-2.25%. This interest rate cut is the first rate reduction since December 2008. For most American investors, the rate cut can mean a reprieve in the average cost of capital. Powell reiterates that this interest rate reduction cannot be misconstrued as a one-time rate cut or the first in a series. Stock market analysts may view Federal Reserve monetary policy independence in a negative light as the FOMC approves the interest rate cut under pressure from a vocal president. The interest rate cut sends a shiver through global markets, and the intricate nuances of Powell language reverberate in response to persistently low inflation in America.

Powell faces direct and confrontational questions on why a rate cut is necessary when the U.S. economy remains robust with high employment. The current U.S. inflation rate hovers in the reasonable range of 1.5%-1.7% below the 2% monetary policy target, and the current U.S. unemployment rate persists at 3.7% per annum. The recent interest rate cut may inadvertently limit the Federal Reserve monetary policy adjustments in response to a future financial downturn.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod

2018-04-13 14:42:00 Friday ET

Mike Pompeo switches his critical role from CIA Director to State Secretary in a secret visit to North Korea with no regime change as the North Korean dicta

2018-07-09 09:39:00 Monday ET

The Federal Reserve raises the interest rate again in mid-2018 in response to 2% inflation and wage growth. The current neutral interest rate hike neither b

2018-11-03 11:36:00 Saturday ET

Apple adds fresh features to its new iPad Pro and MacBook Air in addition to its prior suite of iPhone XS, iPhone XS Max, and iPhone XR back in September 20

2018-03-17 09:35:00 Saturday ET

Facebook faces a major data breach by Cambridge Analytica that has harvested private information from more than 50 million Facebook users. In a Facebook pos