2018-04-13 14:42:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Mike Pompeo switches his critical role from CIA Director to State Secretary in a secret visit to North Korea with no regime change as the North Korean dictator Kim Jong-Un intends to end the 65-year Korean War. Major U.S. and East Asian stock markets experience healthy gains in response to this positive result.

Pompeo is now the most senior U.S. diplomat who directly meets and approaches Kim. This secret visit signals the fact that President Trump sends goodwill to the North Korean leader prior to their bilateral peace summit. The recent core dialogue between Kim and Pompeo upholds the genuine belief that Trump can engage in productive negotiations with North Korea over its intercontinental ballistic missile programs. Trump-Kim direct talks help strengthen the plausible case for peace and denuclearization on the Korean peninsula in the next decade.

Pompeo remains optimistic about a Trump-Kim peace summit during his Senate confirmation testimony for his fresh post of State Secretary. At this stage, Pompeo expects the peace summit to happen for a positive diplomatic outcome with North Korea. This summit serves as an incremental step toward Korean denuclearization, and the current dialogue helps alleviate the current nuclear threat from North Korea. The Trump team plans to continue the current U.N.-driven economic sanctions on North Korea until its complete and comprehensive denuclearization.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-03 08:37:00 Sunday ET

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook explo

2019-09-23 12:25:00 Monday ET

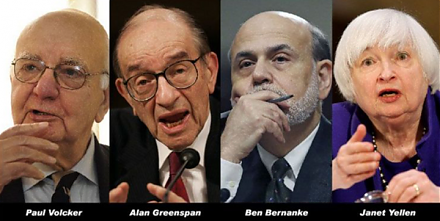

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2018-04-26 07:37:00 Thursday ET

Credit supply growth drives business cycle fluctuations and often sows the seeds of their own subsequent destruction. The global financial crisis from 2008

2018-11-13 12:30:00 Tuesday ET

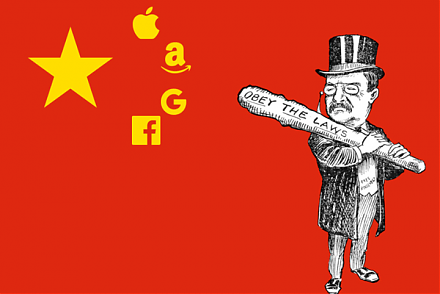

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2019-07-03 11:35:00 Wednesday ET

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2017-10-27 06:35:00 Friday ET

Leon Cooperman, Chairman and CEO of Omega Advisors, points out that the current Trump stock market rally now approaches normalization. The U.S. stock market