2019-10-19 16:35:00 Sat ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and German hawkish dominance appear to interfere with European Commission public affairs against the long-term trend of economic integration. As a primary basis of Eurozone economic harmonization, the single market seems to fail to remove most E.U. barriers for goods, services, people, and capital flows. The European trade bloc faces fierce competition from global rivals such as North America, Australasia, and East Asia.

As of September 2019, only 7 of the 40 largest companies are European. These 7 companies are Allianz (Germany), BNP Paribas (France), HSBC (Britain), Royal Dutch Shell (Holland), Santander (Spain), and Volkswagen (Germany). Fewer lean enterprises originate from Europe as stock market investors and venture capitalists witness a generic decline in the European entrepreneurial spirit in recent times. If Europe attempts to rebuild world-class corporations in order to enhance broader economic prospects, the European Union not only has to reinvigorate the single market, but the E.U. should also rediscover the original vision of greater unity and harmony within the post-war trade bloc. This regional enhancement entails fewer trade barriers such as tariffs, quotas, and even embargoes.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2018-11-19 09:38:00 Monday ET

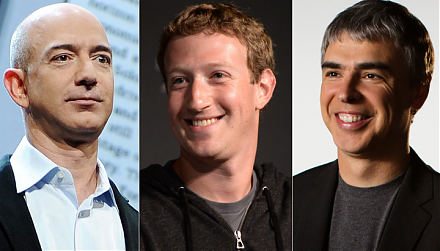

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-10-13 16:22:00 Sunday ET

Apple unveils 3 iPhone 11 models with new original video services and stars such as Oprah Winfrey, Jennifer Aniston, and Reese Witherspoon. Apple releases t

2025-06-13 08:23:00 Friday ET

What are the mainstream legal origins of President Trump’s new tariff policies? We delve into the mainstream legal origins of President Trump&rsquo

2019-04-15 08:37:00 Monday ET

Chinese Belt-and-Road funds large international infrastructure investment projects primarily in East Asia, Central Asia, North Africa, and Italy. Chinese Be