2018-09-05 08:34:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestrated taking Tesla private to burn investors. This lawsuit alleges that Musk might have inadvertently engaged in stock price manipulation via his premature tweet. Musk may prefer Tesla to go private such that he can steer business decisions without worrying about near-term share price gyrations.

However, taking Tesla private entails large lump-sums of equity funds from outside venture capitalists. This lawsuit sheds skeptical light on whether Musk's premature tweet on funding Tesla to go private should be subject to S.E.C. regulatory scrutiny.

Short-sellers serve as an effective alternative corporate governance mechanism that helps discipline corporate management in major business decisions. Not only do short-sellers pose a major effective threat to incumbent entrenchment and rent protection, but they can also improve stock price efficiency and information content. Short-sellers short shares at artificially high prices, wait a while for negative news about the company, and then buy back these shares at lower prices to earn short-term gains.

The Citron lawsuit against Tesla and Elon Musk represents a classic example of fraudulent stock price manipulation that proves to be detrimental to short-sellers.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-09-13 10:35:00 Wednesday ET

CNBC reports the Top 5 features of Apple's iPhone X. This new product release can be the rising tide that lifts all boats in Apple's upstream value

2018-12-01 11:37:00 Saturday ET

As the solo author of the books Millionaire Next Door and Richer Than Millionaire, William Danko shares 3 top secrets for *better wealth creation*. True pro

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2018-12-22 14:38:00 Saturday ET

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra

2018-08-11 14:35:00 Saturday ET

The Trump administration imposes 20%-50% tariffs on Turkish imports due to a recent spat over the detention of an American pastor, Andrew Brunson, in Turkey

2017-10-03 18:39:00 Tuesday ET

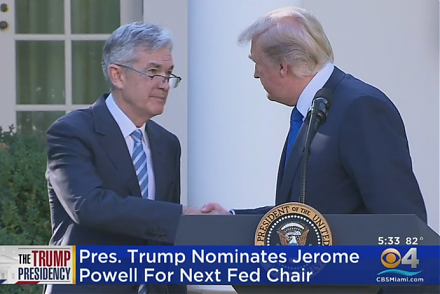

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's