2020-08-01 07:28:00 Sat ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt bankruptcy currency dollar renminbi payment technology paypal alibaba tencent facebook covid-19 employment inflation fintech global macro outlook

The recent rise in U.S. unemployment, record fiscal debt and deficit, and corporate debt dynamism have raised alarm bells about the future of the greenback. Several global macro economists and commentators suggest that the American dollar may soon lose its exorbitant privilege and singular status. In a worst-case scenario, the greenback may inadvertently cease to be the global standard reserve currency as the Chinese renminbi and the Euro can gradually become the regional newcomers in their respective trade blocs.

However, the U.S. dollar pull remains huge within the global macrofinancial system. The greenback continues to be the safest store of value and medium of exchange worldwide. This distinction makes the Federal Reserve the macro metronome of global financial markets. The Federal Reserve provides interest rate swaps to most OECD central banks and then allows them to borrow U.S. dollars against their own currencies during cash crunches such as the Global Financial Crisis of 2008-2009 and the economic recession of 2001-2002. As panic grips global financial markets again amid substantial Covid-19 economic policy uncertainty, the Federal Reserve expands this offer of interest rate swaps to many non-OECD countries. In practice, the Federal Reserve further widens the scope of inter-bank swaps to most central banks and key international institutions to exchange their American debt securities against greenbacks. These endeavors help stall the stampede in the meantime.

The current global financial infrastructure remains within the American orbit. About 11,000 SWIFT members ping one another at least 30 million times daily. Most of the international wire transfers ultimately go through New York by most American correspondent banks to CHIPS, which serves as a clearing house that settles $1.5 trillion of payments per day. Moreover, Mastercard and Visa process almost 70% of credit card payments worldwide. American investment banks capture more than half of global investment banking fees from year to year. American banks, insurers, and credit card companies continue to dominate in the global financial system. The major U.S. financial institutions can hence help uphold the greenback as the global reserve currency for cross-country inter-bank settlement.

At least 3 major structural shifts drive changes in the global financial system. These structural shifts include geopolitical risks around trade and terrorism, technological advances such as mobile payments and many other smart fintech innovations, and Covid-19 virus infections and fatalities in recent times. First, American centrality allows most Western allies to cripple geopolitical rivals by denying them access to global credit and liquidity supply. Through bilateral fair trade agreements, America manages to set reciprocal trade terms and conditions with China, Europe, Canada, Mexico, and several other major trade partners. Further, the Trump administration continues to impose economic sanctions on nuclear nations such Iran and North Korea. The Trump administration further attempts to target some key multinational corporations that seek to build a major pipeline to transmit Russian gas into Europe. Since 2008, America has fined different European banks $22 billion for anti-money laundering compliance, fraud, tax evasion, and many other systemic breaches of financial crime enforcement (out of $29 billion in total). In the short run, the opaque nature of global finance maximizes the punitive impact of economic sanctions. In turn, this impact creates a strong incentive for others to look for workarounds. From time to time, high technology increasingly provides new and non-obvious tools and instruments for building these workarounds.

Second, several global tech titans such as Alibaba, Apple, Facebook, Google, and Tencent etc have sights on almost 2.3 billion people worldwide with little access to financial services. These tech titans retain plentiful capital under permissive rules and regulations, develop cost-effective mobile payment apps and digital currencies, and aim to enable trade and commerce in core regions where credit cards are rare but mobile phones are common. These mobile payment apps, digital wallets, and even cryptocurrencies empower individual users to spend their way without actual money.

Non-OECD economies such as China, Brazil, India, Russia, and so on attempt to rebalance the status quo with hefty population dividends. These countries borrow abroad and thus price their exports in American dollars. Whenever the greenback appreciates, aggregate demand declines to make up for more expensive sovereign debt. A stronger American dollar suggests that these trade partners can only afford fewer products and services. As aggregate demand falls, it becomes dearer for the non-OECD countries to repay their debt contracts in U.S. dollars. In fact, the non-OECD stock of U.S. dollar debt has doubled to almost $3.8 trillion since 2010. This sovereign debt burden can constrain individual state fiscal deficits that help finance high government expenditures for better containment of the recent rampant corona virus pandemic outbreak.

Third, the current corona virus pandemic outbreak can be the next inflection point. Covid-19 continues to cause numerous infections and fatalities in recent months. Global trade is likely to fragment further due to higher tariffs, quotas, or embargoes in some specific bilateral arrangements. As this disruption far away can cause local shortages and repercussions, several states seek to shorten global supply chains. As an upstream supplier for Apple iPhones and iPads, for instance, Foxconn has agreed to establish new liquid crystal display plants in Wisconsin and Pennsylvania to bring smart phones and tablets to American consumers with minimal distance. However, the current U.S. economic fallout due to Covid-19 and the fiscal impact of $2.7 trillion stimulus measures may dent investor confidence in its ability repay sovereign debt. This repayment capability often underpins its public bond issuance and global reserve currency. Corona virus infections and deaths demonstrate that the U.S. real economy can be quite vulnerable to external shocks.

The U.S. must strive to promote global economic prosperity. This state guarantee can often serve as the glue that holds the global macrofinancial order together. As the Trump administration may gradually lose legitimacy to keep the U.S. dollar as the global reserve currency and new gold standard, fresh assaults seem inevitable on the current global financial system. When all remains quiet on the western front, the U.S. big banks, Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo etc, continue to serve as the foot soldiers that uphold the current global financial order.

Most American banks continue to gain traction from European banks. Asia seldom receives an honorable mention. Some Chinese financial institutions have generally proven incapable of expanding worldwide due to many cross-cultural barriers. One of the largest American banks, Morgan Stanley, acquires the online broker E-Trade with $13 billion cash in recent times. This financial acquisition has been the biggest one by a Wall Street bank since the Global Financial Crisis of 2008-2009. In reality, Chinese and European banks cannot compete with their American counterparts in large-scale mergers and acquisitions both nationwide and worldwide.

As the recent corona virus investor fever arises in the broader context of Covid-19 economic policy uncertainty around the U.S. Treasury and Federal Reserve, most mega bank shares depreciate by about 45% in a few weeks (soon after their recent surge of at least 30% from 2019 to early-2020). To the extent that the corona virus pandemic outbreak exposes the U.S. real economy to external threats and forces, American banks and other conglomerates may face competitive pressure from key Chinese and European financial institutions.

Chinese banks are substantial in terms of both stock market capitalization and net asset valuation. As of mid-2020, their total assets surpass the total assets of both American and European banks. Chinese banks now offer more cross-border credit, which serves as the bread and butter of international banks. The sum of loans that Chinese banks originate to international debtors has grown by about 11% per year since 2016. In fact, several Chinese banks now acquire new credit clout in the key interwoven universe of global capital markets. Chinese banks now earn at least 3 times more investment banking fees than all East Asian rivals outside Japan. Now Chinese banks garner almost 15% of global investment banking fees (up from less than 1% back in 1999).

Since the Lehman Brothers bankruptcy, the subprime mortgage meltdown, and the Global Financial Crisis of 2008-2009, British and European banks have collectively cut cross-border credit from $35 trillion to $30 trillion. As global regulators require these banks to hold higher rainy-day equity capital, most of these European banks issue new equity capital or retain more net income. As a result, the European and British banks trim their balance sheets, sell net assets overseas, and shut far-flung offshore branches and subsidiaries. European banks now generate subpar returns on tangible equity (ROTE) of 6%-7% in 2019-2020, whereas, most global investors expect at least 10% ROTEs to be on par with international bank standards. In stark contrast, the top 6 American banks post double-digit ROTEs in 2019-2020.

Many financial economists and economic media commentators suggest that China may miss out as a distant third. With almost $40 trillion total net assets, the Chinese banking system now surpasses both the American and Eurozone counterparts. A list of 30 global systemically important banks by the G20 Financial Stability Board now includes the top 4 banks in China: Bank of China, Industrial and Commercial Bank of China, China Construction Bank, and Agricultural Bank of China. However, some skeptics point out that these Chinese mega banks sit on dud loans at home. Also, state ownership and control continue to be tight and close within the Chinese financial system. Foreign ownership is rare and low in the Chinese financial system. For this reason, Chinese banks share 98% of domestic loans with minimal foreign bank competition. This status quo reflects robust and stable state support in favor of the mega banks as national champions in China.

In recent years, however, the Chinese mega banks have been on a stealthy prowl. These banks follow their large corporate clients, which intend to grow beyond their home market of high saturation. In effect, these banks facilitate cross-border trade, take foreign deposits from offshore Chinese corporate subsidiaries, and then serve their mundane operational needs (i.e. cash management and foreign exchange). The Chinese mega banks further fund offshore infrastructure in new Belt-and-Road blue-ocean markets. Thanks to their firm fortress balance sheet strength and inside institutional knowledge of contractor history, these Chinese mega banks often out-compete foreign peers.

As the Chinese mega banks spread their tentacles, these banks now operate more than 600 offshore branches outside the mainland. Since 2015, their share of global cross-border loans has risen from 5% to 7%. Foreign assets account for only about 9% of their balance sheets. In contrast to their western peers, most Chinese banks supply almost 70% of cross-border loans in new non-OECD Belt-and-Road blue-ocean markets in East Asia, Russia, South Africa, Turkey, and the middle east etc. President Xi Jinping and his administration can present the Belt-and-Road offshore infrastructure program as a new catalyst for Chinese mega banks to further spread their tentacles outside the mainland. Since 2013, these Chinese mega banks have lent almost $600 billion to about 820 official Belt-and-Road offshore infrastructure projects. Bank of China alone has lent more than $140 billion to 600 Belt-and-Road offshore infrastructure projects from 2013 to mid-2019 (whereas, the other Chinese mega banks decline to disclose such figures). Commercial banks share the labor-intensive work with the policy banks such as China Development Bank and Export-Import Bank. These policy banks tend to fund low-yield infrastructure projects such as ports and railways. The Chinese mega banks often focus on bankable amenities around these offshore infrastructure projects (such as shopping centers, malls, and residential real estate properties). Some non-bank subsidiaries of Chinese banks further offer offshore loans for several other purposes.

The near-term fallout from Covid-19 can draw the Chinese mega banks further out. Chinese multinational corporations make up 24% of Fortune 500, are second only to their American counterparts, and hence may focus on Asia where these Chinese companies retain natural competitive moats and first-mover advantages. However, the Chinese big banks may be fighting the wrong fight. Since the Global Financial Crisis of 2008-2009, a larger number of high net-worth people and firms try to fund their own capital investment projects by issuing new securities such as stocks and bonds on global capital markets. Such high net-worth people and firms shun banks and many traditional lenders for shadow banks and institutional investors such as pension funds and insurers etc. Most of these non-bank financial institutions have been amassing assets twice as fast as banks since mid-2008. Overall, the Chinese shadow banks and institutional investors now account for $185 trillion or half of the global financial system. Many issuers of offshore securities continue to rely on the Chinese mega banks, but the structural shift favors the underwriters that earn fees from both net issuances and advisory services (rather than new interest payments on offshore loans on their balance sheets).

Chinese banks try to make some great leaps in recent years. Chinese home-grown companies are eager to diversify their capital sources and so amass firepower for mergers and acquisitions overseas, and thus these Chinese companies have been rapidly raising American dollar debt. Net issuances have increased from $70 billion in 2016 to more than $300 billion in 2019-2020. Chinese banks underwrite the net issuances as solo arrangers and so strengthen the tighter links with domestic titans such as Alibaba, Baidu, and Tencent etc. At the same time, these Chinese banks start to build closer contacts with foreign high net-worth people, venture capitalists, institutional investors, and public companies. Some Chinese banks also outsource specific financial services such as derivative sales and electronic trades to western banks and non-bank financial institutions. As of Summer 2020, China cements its current status as the financial center of gravity for the East Asian and Asia-Pacific regions as the Chinese banks have successfully boosted their investment banking revenue from $550 million in 2000 to $12 billion in 2019-2020.

China continues to open new doors to attract foreign investors and other outsiders. In recent times, Chinese regulators clear the way for full foreign takeovers of local banks. This deregulation empowers foreign banks to expand their presence in the mainland without going through complex rules to set up offshore subsidiaries there. Also, Chinese regulators allow foreign banks and other outsiders to control wealth management firms, pension fund managers, and brokers. In recent times, Chinese regulators further lift foreign ownership caps on securities firms. Nowadays, global money managers, institutional investors, and venture capitalists team up with local subsidiaries in the hope of grabbing a fair share of the Chinese $43 trillion market for financial services.

America wields more clout than other sovereign states because the U.S. dollar is central to the global financial system. On the 3 key roles of international currencies, universal unit of account, medium of exchange, and stable store of value, the U.S. dollar ranks high. The vast majority of key states worldwide denominate commodity contracts in terms of the greenback. The American dollar further represents half of cross-border interbank claims, international payments, and at least 63% of central bank reserves. Almost everyone rushes to buy American dollars during the typical financial crisis (even if Wall Street might be the culprit or root cause of the subprime mortgage meltdown, the subsequent Global Financial Crisis of 2008-2009, as well as the recent rampant corona virus recession worldwide in 2019-2020).

In recent years, China strives to open up its $13 trillion bond market. In this unique fashion, the Middle Kingdom may be able to mint the Chinese renminbi as the next dual global reserve currency in addition to the American dollar. There are at least 3 types of benefits to the issuer of a global reserve currency. First, any issuer of a global reserve currency can reduce interbank transaction costs. Banks can access central bank credit and liquidity at free will. Multinational corporations can borrow at lower costs of capital overseas and so suffer less foreign exchange risk.

Second, the issuer of a global reserve currency can enjoy greater macroeconomic flexibility. Global hunger for the greenback empowers the U.S. to fund fiscal deficits with its own money instead of forcing residents to spend less. This macroeconomic flexibility helps reduce the essential need for the U.S. government to balance cash flows in and out of the country. In this important way, both the Treasury and Federal Reserve can better coordinate their fiscal and monetary policy decisions. In recent times, for instance, the Federal Reserve swiftly combines near-zero interest rates and large-scale asset purchases (aka quantitative easing (QE) bond programs) to provide central bank credit and liquidity for better yield curve control. The $2 trillion Federal Reserve monetary supply complements the $2 trillion Paycheck Protection Program from the Treasury in response to the recent rampant Covid-19 pandemic outbreak.

Third, the U.S. has substantial leverage as the financial world is highly dependent on the greenback. This advantage empowers America to extract concessions by rewarding allies with vital credit and liquidity. In comparison, America can use this leverage to deny access to bank credit and liquidity to foes. For example, monetary clout grants influence on international regulations: European banks often complain that global bank capital requirements are harsher on them than on American banks. At the same time, China and several other East Asian tigers such as Hong Kong, Taiwan, and Singapore need to pledge swift compliance when American regulators suspect them of flouting either anti-money laundering rules or economic sanctions on nuclear nations such as Iran and North Korea.

Being the global money master incurs costs too. Robust demand for the American dollar boosts its value relative to others. This persistent currency appreciation hurts U.S. exports. Given the perennially strong dollar, the Federal Reserve often has to contend with liquid debt overhang overseas. In turn, this debt overhang leaves the domestic economy hostage to sudden movements of capital. Such mysterious and inexorable trade-offs help explain why some rich countries such as Britain, France, Germany, and Japan tend to shy away from turning their fiat money or legal tender into international reserve currencies. As the Trump administration begins to isolate the U.S. from multilateral free trade agreements (such as TPP, CPTPP, TTIP, and RCEP), the E.U. attaches new value to monetary autonomy in the trade bloc. Since 2018, the European Commission has started pushing for a stronger international role for the euro. In the utopian world, minting the euro as a global reserve currency becomes the ultimate goal.

With no fiscal union, however, the Eurozone lacks liquid supranational bonds. Also, core European banks typically hold 25% to 35% of domestic debt securities in their respective home nations. Europe now needs both large and liquid capital markets, government bonds, and sovereign debt instruments to build up foreign exchange reserves. European countries further face the requisite, obstacle, or necessary evil that the euro needs to be ubiquitous in trade as central banks accumulate domestic cash to buy imports from time to time. On balance, the European Commission has to further integrate European banks with fiscal union to break the doom loop, which may inadvertently arise from a major sovereign debt crisis.

Since 2005, there has been a sharp increase in the number of offshore investment products in Chinese renminbi terms. Also, Chinese renminbi deposits continue to spread worldwide around $145 billion. In Hong Kong, the daily turnover of foreign exchange instruments has doubled to $109 billion since 2013. Britain accounts for 37% of all foreign exchange trades in Chinese renminbi, and France and America have both acquired double-digit shares. China now lists its renminbi stocks, bonds, gold futures, and real estate investment trusts in the major financial hubs such as Shanghai, Shenzhen, and Hong Kong.

China continues to use its vast Belt-and-Road trade and investment network to fan out its fiat. In recent years, China settles 15% of its foreign trade in renminbi terms in 2019-2020. The Chinese renminbi has made it easier for the national champions to use the domestic currency in their wire transfers to foreign subsidiaries (such as day-to-day cash outlays and new capital injections).

Since its inclusion in the IMF special drawing rights (a key basket of elite currencies) in 2016, the Chinese share of global reserves has risen to more than 2% in 2019-2020. Some central banks use gold as a halfway house to buy Chinese renminbi once the Chinese bank supervisors lift capital controls. Further, China has signed $500 billion currency swap agreements with more than 60 countries. Some central banks and other financial institutions have pledged to allocate at least 10% of their stash to the Chinese renminbi. The pledge would boost the Chinese share of global reserves from $210 billion to more than $800 billion.

At least 2 major factors can help designate the Chinese renminbi as the dual global reserve currency in addition to the American dollar. First, Chinese renminbi seems to cause exchange rate fluctuations around the world. Recent IMF research shows that the renminbi trade bloc accounts for 30% of global GDP. This impressive and remarkable progress is only second to the greenback at 40% of global GDP. Most central banks pick reserve currencies that closely mimic their trade mixes.

Second, China has opened a fresh breach in its capital controls, and money starts to stream into the real renminbi economy. Popular index providers and global credit rating agencies begin to phase Chinese stocks and bonds into their benchmarks. These recent events help draw $60 billion foreign capital into Chinese government bonds in 2019-2020. Even the corona virus cannot stop this novel stream of capital from non-mainland economies.

Foreign institutional investors now own only 3% of Chinese bonds and only 9% of Chinese government bonds. This fresh appetite can gradually increase over time. In comparison to American stocks and bonds etc, Chinese securities offer decent yields and diversification benefits. In the future, top asset management companies can move into this uncharted territory of Chinese stocks, bonds, and other financial instruments. BlackRock, Vanguard, State Street, Fidelity, and PIMCO etc already start mulling over their next investments in China. At any rate, China needs to build up new digital systems for both banks and fintech enterprises to process safe and smooth cross-border payments.

As America remains ready to close the liquidity taps on rivals, China now invests time and money in building a private track. China has already rolled out its mobile payment systems Alipay and WeChat Pay to complement SWIFT. In the meantime, Alibaba and Tencent serve as the tech titans in China, Hong Kong, and Macao etc. These Chinese tech titans have built parallel mobile payment systems. Their digital wallets amass more than 1 billion users each and now account for half of in-store payments and almost 75% of online sales in China. In the next few years, we can expect these tech titans to continue to enrich the digital lives of residents in China, Hong Kong, Macao, and some other parts of the Asia-Pacific region.

Cross-border payments often cause headaches. Rules and standards differ across countries. The world lacks a universal central bank, so there is no global ledger on which correspondent banks record the cross-border wire transfers via SWIFT. For large-value cross-border payments, the conventional fix entails the correspondent banking system. Under often reciprocal arrangements, one bank in its home nation holds deposits held by another bank in another nation. When a retail customer of the former wants to pay someone at the latter, the bank instructs its correspondent to use the inter-bank deposits.

However, many banks lack these direct global links. To get to the final destination, the money must make stopovers. This online process requires a unique ID for each bank, a secure messaging system with digital encryption, and a common language. Built over many decades, SWIFT provides all of these features and functions. It is difficult for most wire transfer processors to replicate this global network ecosystem. This network complexity often makes cross-border payments slow and expensive. For the most part, SWIFT banks must keep idle funds in foreign currency (almost $10 trillion worldwide) to meet near-term wire transfer demands.

Several lean startups attempt to ameliorate such concerns by reducing the number of interactions between banks and consumers with cross-border wire transfers via SWIFT. PayPal empowers both consumers and companies to initiate cross-border online payments via both bank accounts and credit cards. A fintech firm Airwallex relocates from Australia to Hong Kong to concentrate on the substantial increase in the regional demand for Chinese renminbi cross-border transfers. An American fintech firm Ripple builds a new cryptocurrency as an intermediary for cross-border payments in different currencies from the American dollar to the Chinese renminbi. China now leads a solo effort to file more than 100 fintech patent applications for a new sovereign digital currency. In this important way, China attempts to pre-empt Libra or the cryptocurrency that Facebook intends to launch in the next few years. Overall, intense competition can breed better efficiency in fintech innovations.

In China, the mobile payment apps Alipay and WeChat Pay continue to dominate the domestic digital payment system. Alipay belongs to Ant Financial Group or the fintech arm of the global e-commerce tech titan Alibaba, and WeChat Pay belongs to another Internet tech titan Tencent. These tech titans seize 92% of peer-to-peer transfers in China, and Chinese mobile purchases reach $49 trillion in 2019-2020. After the Chinese consumer loads digital wallets from his or her bank account, the user can pay for almost anything from meals and bills to dental appointments. The digital wallets charge no fee to users, but tax these users when they move money out. In this unique fashion, everyone has the incentive to stay in his or her universe. For Alibaba and Tencent, their ultimate goal is to eventually design an international cross-border mobile payment platform.

These Chinese fintech innovations compete with credit cards, wire transfers, and traditional interbank payment systems. Due to low interest rates and high overhead costs of building digital payment systems, Chinese banks seek to borrow scale by moving into the cloud. These banks store their user data on large cloud servers by third-party specialist service providers. On cloud infrastructure, Alibaba dominates again in this new space, provides more than 20% of cloud services in Asia, and so outperforms its U.S. rivals Amazon and Microsoft. On software, Alipay focuses on the unique QR code format, and both Alipay and Tencent WeChat Pay apply facial recognition tools for user authentication with error rates of less than one in a million (whereas, the human eye has a 1% error rate on average).

Many skeptics doubt that China can provide the world with a new reserve currency in light of its strict capital controls and substantial positive current account balances. However, the latter current account surplus has shrunk substantially since its peak in 2007. A current account deficit is likely to become the new norm for China in the next decade. The Chinese ageing population saves much less. The incumbent Xi administration seeks to boost domestic consumption with higher imports. Stagnant western markets can mean sluggish Chinese exports in the next few years. From now to 2030, China needs at least $200 billion per year in net foreign capital inflows to plug the current account gap. China now starts to ease capital controls. Foreign reserve managers see value in Chinese renminbi currency stabilization.

A more diverse financial system can be quite beneficial to the Chinese economy. Relying on a single dominant reserve currency, the American dollar, may threaten the world with cash crunches in rare times of severe financial stress. More efficient cross-border payments drive down costs. Dual reserve currency stabilization thus can help make the whole global financial infrastructure more resilient.

Since 2005, China has become the third-largest creditor worldwide in terms of net international investment positions (behind Japan and Germany). China lends a bit less than $1.6 trillion, whereas, Japan and Germany respectively lend $2.8 trillion and $1.6 trillion on balance. China also holds $4.2 trillion foreign investment assets, and this net worth now exceeds the Chinese central bank stash of foreign reserves. The rapid growth of Chinese financial markets offers greater alternative choices to global banks, insurers, pension funds, mutual funds, and asset management firms etc. Even if China tries to decouple renminbi trade finance from the American dollar system, this gradual transition need not mean full deglobalization.

There are at least 3 risks in light of the Chinese renminbi transition toward the next dual reserve currency. First, Chinese reserve currency coronation can accelerate the inadvertent balkanization of financial markets worldwide. Most countries react to financial crises by enacting new rules and regulations. Most of these new rules and regulations contribute to the soundness and efficiency of the financial system. However, many watchdogs seem more active in trying to restore local control since global resilience remains a minor concern to domestic financial regulators. These regulators often ring-fence multinational banks and insurers by requiring them to establish local subsidiaries (not just branches). These regulators also require most multinational banks and insurers to be able to run the vast majority of core business operations such as cross-border payment settlement, liquidity creation, and capital provision on a standalone basis. In other words, the local subsidiaries must retain major operational capabilities with no or little capital support and interference from their offshore parent banks and insurers. Extraterritoriality imposes multiple layers of obligations on these multinational banks and insurers.

Second, geopolitical risks and tensions exacerbate this drift toward the inadvertent balkanization of global asset markets. The recent rampant corona virus pandemic outbreak focuses most money and attention within the home markets. This home bias tilts investment portfolios toward less international diversification. Global asset market fragmentation can shave almost 1% off global GDP. Regional policies that compel multinational banks, insurers, and corporations to relocate their data within China, India, Russia, Brazil, Turkey, South Africa, and other countries can reduce future gains from international diversification and digitalization. Localization rules and regulations also prevent better data exchange for risk management purposes. With dual reserve currencies, a broken-up global financial system can become less secure. Multiple nodes and links between banks, insurers, and fintech startups etc offer more points of entry for cyber attacks. In sum, geopolitical risks and tensions can create inadvertent consequences and systemic breakdowns. As push comes to shove, the law of inadvertent consequences counsels caution.

Third, the global financial system can gradually become a new apparatus with dual heads but no benevolent leader. The U.S. dollar system seems to have contributed to decades of maximum sustainable economic growth and employment worldwide. Yet, America sometimes is less keen in the common good than the economic rent that the U.S. financial hegemon can extract from its dominance of the international monetary system with the help and guidance of supranational institutions such as the World Bank and International Monetary Fund. In recent years, U.S. lawmakers even sponsor a bipartisan bill that the Federal Reserve taxes foreign capital inflows to help weaken the American dollar with greater exports.

In stark contrast to the U.S. dollar system, China seems ready to embrace global leadership with a dual reserve currency. China strives to open up its financial asset markets although new entrants are unsure if unwritten rules and regulations might block them in the future. China lacks a free press, common law, and a fair judiciary that can help protect the public interest with little state control and interference. In practice, such doubts and concerns can undermine the Chinese sphere of financial influence. China can choose to reassure the global financial community that the Xi administration strives to undertake prompt corrective actions to solve problems in new international finance and dual reserve currency stabilization. Both the Chinese renminbi and American dollar systems can complement each other. When the laws of gravity dictate global financial policy coordination, China can perhaps fill part of the vacuum. Profits are good, and promises must be met. It would be much better for both financial powers to collaborate in their peaceful coexistence.

As the private sector pulls back amid the current corona virus pandemic outbreak, the Trump administration strives to bridge the gap through substantial increases in government expenditures. In the current macrofinancial environment of both weak aggregate demand and economic growth, it cannot be inflationary for the Treasury to run large fiscal deficits on top of national debt mountains. In reality, most OECD countries such as America, Britain, France, Germany, and Japan need not worry about inflation at this stage of the business cycle. With flexible exchange rates and dovish interest rate adjustments, these rich countries can continue to provide fiscal support as hospitals, biotech firms, and pharmaceutical titans etc develop vaccines and medications to curb Covid-19 infections and deaths. Subpar economic growth may correlate with sovereign debt accumulation over time. However, the causation likely goes the other way from low economic growth rates to high debt thresholds. In the short run, it is difficult for most macro economists to appreciate how higher fiscal deficits would lead to weaker economic growth. In fact, higher fiscal deficits often deliver more stimulus to the real economy ceteris paribus. In the meantime, U.S. consumers, firms, and financial institutions need substantial fiscal stimulus at this stage of the business cycle as the corona virus crisis continues to unfold.

The novel corona virus Covid-19 may mutate to cause airborne transmission. Most people should take precautions to wear face masks with some safe social distance from others to prevent Covid-19 infections and deaths. When push comes to shove, the universal law of inadvertent consequences counsels caution.

The current trajectory of both corona virus infections and fatalities depends on how fast the government imposes further restrictions to contain the pandemic outbreak. As hospitals and pharma firms develop new effective vaccines and treatments, this progress can help flatten the corona virus growth curve. At this stage, it is important for both the Federal Reserve and Treasury to coordinate their fiscal and monetary stimulus programs (i.e. near-zero interest rates, large-scale asset purchases, and government expenditures) to get through the current crisis. In the next few quarters, the Trump administration expects American unemployment to normalize back to single digits from late-2021 to 2022. There is still time for the Federal Reserve and Treasury to provide at least $5 trillion stimulus for the structural shift toward fiscal consolidation. In recent months, the $2+ trillion Federal Reserve monetary supply complements the $2+ trillion Paycheck Protection Program from U.S. Treasury in response to the recent rampant Covid-19 global pandemic outbreak.

From a fundamental perspective, the Federal Reserve has no real limit in terms of its ability to fund large government deficits through large-scale asset purchases (or quantitative easing (QE) unconventional monetary policy measures). Yet, political constraints loom in light of the historical concern that perennial fiscal deficits may encourage irresponsible fiscal policies. In addition to the Federal Reserve, several central banks in Britain, Eurozone, France, Germany, and even Italy etc share this concern. The current coronavirus crisis hits specific sectors exceptionally hard. In practice, these sectors include air travel, tourism, entertainment, energy, and retail consumption etc. At any rate, the Federal Reserve is unlikely to introduce negative interest rates anytime soon. The recent FOMC minutes reveal that each one of the members suggests that if any further economic deterioration warrants more central bank actions, the Federal Reserve System should prefer QE and forward guidance to negative interest rates. Federal Reserve Chair Jerome Powell further reiterates that this current FOMC view remains relevant amid substantial Covid-19 economic policy uncertainty.

In economic history, there can be a significantly negative correlation between debt and economic growth for all the rich countries with at least 90% debt-to-GDP ratios. Even if we discard the econometric problem of reverse causation, there are at least 2 key reasons for the current expansionary fiscal and monetary policy coordination. First, different countries tend to show different structural transformations and other fundamental features that collectively make their economic growth paths more or less vulnerable to high fiscal deficits and debt levels. The U.S. differs substantially from Britain and some European countries such as France, Germany, Greece, Italy, and Spain etc. Second, losing some long-term economic growth due to high debt is nowhere near the main worry. During the current coronavirus crisis, U.S. output probably declines double-digits and cannot return to the pre-crisis levels in the next few years. Retaining a robust and solid central bank balance sheet can contribute to aggressive fiscal debt usage as the economy enters a full-on recession.

When the interest rate persists below the nominal growth rate, even a big bulge in fiscal deficits and debt levels cannot be worrisome because the debt-to-GDP ratio is likely to fall over time. It is indeed common for the interest rate to be lower than the nominal growth rate. Over the past 200 years, this economic scenario has been the case for more than half the time in the rich countries. For this reason, the wedge between the interest rate and the nominal growth rate cannot help inform whether the U.S. is likely to experience a sovereign debt crisis (despite the aggressive fiscal deficits in recent times).

The American dollar can continue to enjoy substantial advantages and exorbitant privileges at the epicenter of the global financial system because the greenback is the de facto reserve currency. The U.S. government often tends to borrow more at a lower interest rate. As U.S. debt rises over time, however, this equilibrium steady state becomes more fragile, and as a result, the American dollar begins to become more vulnerable to exogenous shocks (such as the Global Financial Crisis of 2008-2009 and the current coronavirus crisis of 2019-2020). In light of the recent rise of the Chinese renminbi, deglobalization may reinforce this systemic fragility.

Fiscal deficits are typically cyclical and tend to surge during economic recessions. During the current recession, many economists expect to see sharp hikes in debt issuance in all regions. At the same time, most recessions often boost demand for safe assets such as Treasury bills and other government bonds. In the neutral light, the recent global surge in sovereign debt supply can be offset by a global surge in demand. Many macro economists now expect the U.S. deficit-to-GDP ratio to rise to 20% (or the highest level in the post-war period). China, Europe, and Japan etc may end up running fiscal deficits about 10% of GDP (or the highest levels in recent decades). After all, a fair bit of fiscal discipline can be essential in the long run.

The Federal Reserve is likely to buy almost $2.5 trillion of the recent $4 trillion U.S. debt issuance. The other U.S. sovereign debt buyers include money market funds, banks, insurers, pension funds, and foreign institutional investors etc. These other buyers can probably bridge the $2.5 trillion fiscal gap in American debt issuance. This fresh debt supply can steepen the U.S. Treasury yield curve because the risks of bond duration are asymmetric. In America, Treasury bill yields can rally only so much near the zero lower bound, but there is no theoretical limit to how much bond holders can sell off if the economic recovery turns out to be much faster. Therefore, most investors require bond premiums as compensation for duration risk at the low yields. As the Treasury adds more bond duration than most market expectations, this duration risk helps steepen the yield curve. In this unique fashion, the Federal Reserve can use QE and forward guidance for better yield curve control. In terms of fiscal-monetary policy coordination, a large fraction of sovereign debt issuance can end up on both American and European central bank balance sheets to ensure asset market normalization. Fiscal discipline is quite essential in the long run.

The sudden stop from the current corona crisis inflicts severe costs on both public corporations and small-to-medium enterprises. The recent development can cause a fresh wave of U.S. corporate bankruptcies. This new corporate bankruptcy wave can have profound implications for future near-term economic recovery. Covid-19 hits hard some specific sectors such as air travel, tourism, energy, entertainment, and retail consumption etc.

The Federal Reserve corporate credit facilities can unquestionably help reduce the risk of massive defaults among creditworthy companies. Fed Chair Jerome Powell refers to these defaults as avoidable insolvencies. However, the corporate default decision is usually a strategic one. The senior management teams often come to the realization that holistic corporate reorganization has become the only feasible solution to repair their fortress balance sheets due to persistent and unsustainable corporate debt burdens. In practice, the American corporate default rate is likely to substantially increase from 5% in mid-2020 to double digits in 2021-2022. This key threshold is on par with high corporate default rates during earlier recessions. For instance, the corporate default rate reaches the rare peak of 14% during the Global Financial Crisis of 2008-2009. Many economists and corporate bankruptcy lawyers expect to see a similar corporate default pattern in the next few years.

Higher corporate leverage combines with low near-term liquidity to cause the next wave of both massive corporate defaults and bankruptcies. For some parts of the real economy, the current corona virus shock is likely to result in sluggish demand for goods and services. Due to Covid-19 and its broader economic repercussions, this permanent disruption probably extends the fresh wave of American corporate bankruptcies as bankruptcy court congestion may inadvertently lead to more small business liquidations.

The post-pandemic global economy is likely to be anemic, especially in many rich countries such as America, China, and Europe that have failed to contain the fatal corona virus outbreak. Several international economic institutions such as the IMF, World Bank, and OECD etc project –5% economic growth worldwide in 2020-2022. The current economic outlook comprises at least 3 fundamental viewpoints. First, aggregate demand declines substantially so that both household consumption and firm-specific capital investment weaken balance sheets with a rash of bankruptcies amid rare hard times of severe financial stress due to Covid-19. The novel corona virus acts like a new tax on economic interactions that involve close human contact. In brief, the resultant structural transformation tilts global human capital from labor-intensive sectors to skill-intensive ones. However, there is no easy way for states and corporations to convert airline workers to Zoom software engineers at least in the short run.

Second, this broad structural transformation induces both income and substitution effects. Both consumers and producers experience a sharp decrease in disposable income. As a consequence, these economic agents spend less and so aggregate demand falls further. At the same time, these economic agents tend to smooth out their intertemporal consumption over time. This substitution effects suggests lower permanent income, consumption, and capital investment over time.

Third, the corona virus cannot infect machines, so autonomous machines become relatively more attractive to employers. This automation is particularly valuable in the high-skill data economy. As low-income people must spend a larger fraction of their net income on basic goods and services than the rich at the top of the income pyramid, any automation-driven rise in economic inequality can be contractionary. Both fiscal and monetary policy decisions can provide stimulus to ease temporary credit and liquidity constraints. However, these policy instruments cannot eradicate solvency problems. Sooner or later, America and some other rich countries would need to face the reality of conservative objections to substantial fiscal deficits and debt levels. After all, fiscal discipline can be quite essential during these rare hard times of severe financial distress due to Covid-19 infections and deaths, trade and tech tensions, and greenhouse gas emissions.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the recent period from February 2017 to February 2020, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

We update and refresh part of memetic financial information on a sporadic basis. We aim to facilitate this information exchange only for illustrative purposes. Some information may be stale and incomplete. Therefore, we recommend each member to consult the respective external website(s) for more up-to-date information.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

The conventional disclaimers apply to this key case where each freemium member bewares, understands, and acknowledges the service terms and conditions for our courteous fintech network platform. Any omissions, errors, or other blemishes do not necessarily reflect the official views and opinions of our AYA fintech platform orchestrator. We make a conscious effort to keep most major omissions to 1% to 5% of the fintech information for about 6,000 U.S. stocks on NYSE, NASDAQ, and AMEX. These omissions tend to concentrate around some rare corporate events (e.g. IPO, delisting occurrence and recurrence, abrupt trading suspension, and M&A initiation etc). Overall, these disclaimers, terms, and conditions of our service should be viewed as baseline house rules for fintech network platform usage and development.

Under pending subsequent patent-law confirmation, the relevant legal text protects our proprietary alpha software technology for ubiquitous knowledge transfer. Each freemium member enjoys his or her interactive usage and information exchange on our AYA algorithmic fintech network platform with sound and efficient dynamic conditional asset return prediction.

Our AYA fintech network platform helps promote better financial literacy, inclusion, and freedom of the global general public with an abiding interest in core economic reforms, financial markets, and stock market investments. In this broader context, each freemium member can consult our mission statement that provides more in-depth explanatory details on our long-term aspiration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-25 16:42:00 Thursday ET

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: i

2020-03-19 13:39:00 Thursday ET

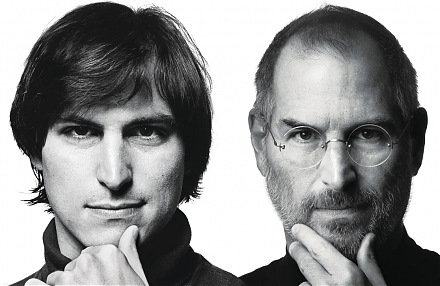

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2018-08-29 10:37:00 Wednesday ET

In an exclusive interview with Bloomberg, President Trump criticizes the World Trade Organization (WTO), proposes indexing capital gains taxes to inflation

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new

2019-08-09 18:35:00 Friday ET

Nobel Laureate Joseph Stiglitz maintains that globalization only works for a few elite groups; whereas, the government should now reassert itself in terms o

2017-11-05 09:45:00 Sunday ET

President Trump criticizes the potential media merger between AT&T and Time Warner, the latter of which owns the anti-Trump media network CNN. President