2018-04-02 07:33:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

China President Xi JinPing tries to ease trade tension between America and China in his presidential address at the annual Boao forum. In his vulnerable attempt to avert the Sino-American trade war, President Xi announces multiple plans to open China. These plans include curtailing tariffs on automobile imports, enforcing the legal protection of intellectual properties of foreign companies, and filing pragmatic complaints against the Trump tariffs on steel and aluminum.

However, several sources suggest that it is unlikely for China to completely retreat from the international free trade system. Should the Trump administration insist on imposing tariffs on Chinese imports, China can follow suit to counterbalance this strategic act with retaliatory tariffs. In effect, this rare game of chicken weakens the bilateral trade negotiations between China and America.

President Xi's speech strikes a positive tone and serves as a reconciliatory gesture toward the Trump administration. Chinese doves attempt to assuage the cold war mentality of Trump hawks, whereas, the Trump administration can threaten China with new tariffs. The Sino-U.S. trade relations may become the ancient Thucydides trap that significant shifts in relative strength of core powers can be a primary cause of bilateral conflict.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-06-21 05:36:00 Wednesday ET

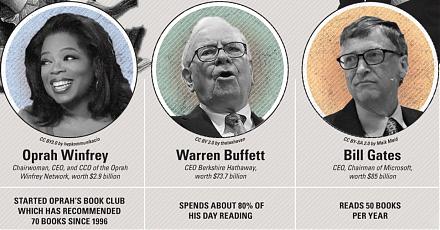

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2019-12-19 14:43:00 Thursday ET

JPMorgan Chase CEO Jamie Dimon views wealth inequality as a major economic problem in America. Dimon now warns that the rich Americans have been getting wea

2018-01-10 08:40:00 Wednesday ET

President Trump considers imposing retaliatory economic sanctions on Chinese products and services in direct response to China's theft and infringement

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2019-06-29 17:30:00 Saturday ET

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, socia