2024-02-05 11:26:00 Mon ET

stock market technology competition free trade fair trade multilateralism neoliberalism regulation compliance economic growth asset management cold war finance federalism congress supreme court inclusive institutions

In the U.S. government assessment, China poses new economic, technological, and military threats to the U.S. and its western allies. As China vies to surpass the U.S. in comprehensive national power, the middle kingdom seeks to combine whole-of-government efforts to secure deference to its own preferences from its East Asian neighbors such as Japan, South Korea, Vietnam, and the Philippines. President Xi Jinping envisions China as the preeminent power in East Asia and further as a new superpower on the world stage. The Chinese Communist Party (CCP) often preempts challenges to its reputation and legitimacy, undercuts American influence, drives wedges between Washington and western trade partners, and forms new global norms in better alignment with the CCP’s authoritarian system. Most significantly, the People’s Republic of China (PRC) continues to press Taiwan on reunification. This particular effort creates critical frictions with the U.S. and many western countries. Despite the recent economic setbacks in the property sector, China’s leaders maintain statist economic policies to steer capital toward some high-tech sectors. This statist approach can help China reduce reliance on foreign technology for better military modernization.

China views Washington’s competitive measures against Beijing as part of U.S. diplomatic, economic, military, and technological efforts to contain the recent rise of the middle kingdom. This broader approach helps the U.S. government undermine the CCP’s authoritarian rule, and then further prevents the PRC from achieving its global power ambitions. Nevertheless, China’s leaders now seek opportunities to avoid geopolitical tensions with Washington when these leaders believe the broader economic policies protect the core interests of Beijing.

Many CCP leaders have long believed that China’s high-tech-driven economic growth would outpace the U.S. and many other western countries. Also, China continues to compete with the U.S. and western allies on the economic and technological fronts, from trade and finance to semiconductor microchip production and high-speed 5G broadband Internet connectivity. However, China’s economic growth almost certainly continues to slow down due to massive demographic changes and recent declines in both consumer and investor sentiments in light of the hardline economic policies from Beijing.

In addition to its domestic challenges, China’s coercive hardline economic, diplomatic, and military tactics toward Taiwan and most other East Asian countries further hamper the global power ambitions of PRC leaders. Specifically, China’s own economic reforms have led many countries and multinational corporations to accelerate decoupling-and-de-risking from some key sectors. This acceleration further helps restrict exports of sensitive technology to China. In addition to the Trump tariffs on Chinese imports, the Biden administration further imposes restrictions on the potential unlawful transfer of high technology in semiconductor microchips, quantum sciences, high-speed 5G broadband telecoms, and global defense applications.

The PRC seeks to integrate its economic might with its growing military power and diplomatic and technological dominance for better coordination to strengthen the CCP’s current rule of man. In this broader context, the PRC further attempts to secure what it regards as its own sovereign territory (such as Taiwan, Diaoyu, and Spratly Islands). In East Asia, China often makes diplomatic and economic efforts to project regional influence and preeminence in the lofty pursuit of global power. Beijing specifically applies these whole-of-government tools to compel Asian neighbors to acquiesce to its own preferences; and these preferences include Beijing’s long prevalent assertions of sovereignty over Taiwan.

After Taiwan’s presidential election in early-2024, Beijing continues to apply both economic and military pressures to reinforce the propaganda that Taiwan has been historically part of China. The PRC’s recent economic reforms help promote longer-term cross-strait economic and social integration to induce Taiwan to move toward reunification. Taiwan is a significant potential flashpoint for confrontation between China and the U.S. as Beijing claims that the U.S. uses Taiwan’s technological, economic, and democratic assets to undermine the recent rise of China. In the worst-case scenario, Beijing would use even stronger measures to push back against the perceivable increases in U.S. support to Taiwan.

In the South China Sea, Beijing continues to leverage its growing military and other maritime capabilities to try to intimidate rival claimants (primarily from Vietnam and the Philippines). In recent years, Beijing seems intent to signal that China has control over many contestable waters. In a similar vein, China continues to press Japan over Diaoyu and other contestable islands in the East China Sea.

Beijing aims to expand its sphere of influence abroad. The CCP leaders project China to be a champion of global development through many multinational forums and PRC initiatives. These initiatives include the recent Belt and Road Initiative for building infrastructure in Asian and African countries; the Regional Comprehensive Economic Partnership (RCEP) for freer trade; the Global Development Initiative for climate-driven economic growth; and the Global Security Initiative for better cross-country conflict resolution. Further, China promotes a key alternative to the extant American-led international development and security forums in favor of Chinese norms, which support state sovereignty and place political stability over individual human rights. As part of this broad toolkit, Beijing seeks to champion economic development and security in the global south because China shares with Asian neighbors many historical experiences under colonial oppression. In this unique fashion, Beijing builds global influence, demonstrates Chinese leadership, and expands its own troika of economic, diplomatic, and military tools.

In the next few years, China’s economy may further slow down due to structural supply-side obstacles and PRC leaders’ lack of commitment to introduce aggressive fiscal and monetary stimulus measures to boost economic growth, employment, and technological advancement. PRC leaders understand these structural problems on the economic front, but these leaders seem to avoid structural supply-side reforms because such reforms may not perfectly accord with the Xi administration’s prioritization of state investments in the manufacturing industry. A slower Chinese economy would probably depress commodity prices worldwide. Moreover, slower Chinese economic growth may erode export competitiveness of the U.S. and western allies. Although this slower Chinese economic growth may impact the world economy, PRC leaders would not curtail current state investments in the major priorities for Beijing. These major priorities include semiconductor microchip production, quantum science, high-speed broadband Internet connectivity, and modern military defense.

In China, widespread deflation usually manifests in lower product prices, job cuts, and salary reductions. Chinese consumers lack sufficient wealth and income to spend more on a broad basket of goods and services, and Chinese companies lack capital to invest in further wealth creation with sufficiently high dividends and capital gains. As of early-2024, the headline CPI inflation rate has gradually rebounded from –0.8% to 0.7%. In the same time frame, the food CPI deflation rate persists at –2.7%, and the PPI deflation rate continues to be significantly negative at –2.8%. This sluggish rebound shows virtually no or little momentum for China’s economy to grow well beyond 5%. The total GDP growth rate has further declined from 5.2% to 4.8% as of early-2024, whereas, China enjoyed double-digit percentages in annual GDP growth just about 20 years ago. This ubiquitous lack of economic momentum translates into fragile consumer and investor sentiments across Mainland China, Hong Kong, and Macao. When push comes to shove, the PRC leaders somehow seem to refrain from launching bold fiscal and monetary stimulus measures to orchestrate the next economic recovery in China. This pervasive economic slowdown contradicts the macro economic outlook for China about 15 to 20 years ago. In a fundamental view, China needs both structural supply-side reforms and bold fiscal and monetary stimulus measures: low, zero, or even negative interest rates, food tax credits, and quantitative-easing (QE) large-scale asset purchases. Perhaps China’s central bank and treasury should heed helpful lessons from the U.S. responses to the Global Financial Crisis of 2008-2009.

In the low to mid single-digit percentages, China’s slower economic growth may create world resource constraints in the long run. These constraints may further force PRC leaders to re-prioritize both state investments and fiscal expenditures on homeland industrial policy, social surveillance, military defense, and dollar diplomacy in the common form of aid to Belt-and-Road countries. Over the medium to longer term, the Xi administration prioritizes what PRC leaders view as high-quality economic growth. This growth includes greater self-sufficiency in strategic tech-savvy sectors and a far more equal distribution of wealth and income across the mainland. This latter policy target for better economic reforms helps mold China into the lofty pursuit of common prosperity. In the next elusive quest for high economic growth, China seeks to mitigate the triple threats of U.S. tariffs, sanctions, and tech export controls.

China seeks to become a world superpower in science and technology. PRC leaders intend to use this technological superiority for economic, political, and military gains. Beijing further implements whole-of-government efforts to substantially boost both indigenous innovation and tech transfer for better self-reliance. In terms of technological advancement, China now prioritizes artificial intelligence (AI), fully electric power and renewable energy, biotechnology, quantum science, and semiconductor chip design and production. In the meantime, Beijing attempts to fast-track its technological development through massive state subsidies, state investments, intellectual property acquisitions, cyber operations, scientific-academic grants, and even illicit procurements.

In recent years, a key PRC state enterprise has signaled its intention to channel at least $13 billion into new industries such as generative AI, semiconductor design, biotechnology, and new materials such as rare earths, lithium batteries, and active pharmaceutical ingredients. In early-2024, China has reiterated its Global AI Governance Initiative to bolster international support for the PRC vision of AI disruptive innovation within the mainland.

Today, China rivals the U.S. in DNA-sequencing equipment and some foundational research in medicine and biotechnology. With its current population of more than 1.4 billion people as of early-2024, China holds a large volume of genetic data and therefore potentially positions itself to lead in precision medicine and agricultural biotechnology worldwide. In this positive light, the resultant technological advancement helps reduce social disparities in health care and education across the mainland.

China continues to make great strides in manufacturing microchips for cryptocurrencies and smart mobile devices at the 7-nanometer level with extant equipment. However, China may face new technical challenges in achieving the high-quality and large-scale production of 3-nanometer semiconductor microchips without access to extreme ultraviolet lithography tools. By 2035, we can expect China to produce about 40% of all 28-nanometer legacy microchips. However, the technical production of 3-nanometer semiconductor microchips continues to concentrate in only several oligarchs in America, Germany, Japan, South Korea, and Taiwan. These oligarchs include Nvidia, TSMC, ASML, ARM, AMD, Micron, Broadcom, Qualcomm, Intel, Samsung, SK Hynix, and Tokyo Electron.

China remains intent on orienting its current nuclear posture for strategic rivalry with the U.S. because the PRC leaders still regard their nuclear capabilities as insufficient as of mid-2024. As Beijing’s nagging concerns show, bilateral tension, U.S. nuclear modernization, and the People’s Liberation Army’s (PLA) recent advancement of modern nuclear capabilities seem to have significantly increased the likelihood of a U.S. first strike. Whether the PLA’s current capabilities suffice to secure further retaliation remains an open controversy. As its nuclear force grows, Beijing successfully enhances nuclear deterrence against the U.S. and western allies. This deterrence would probably bolster the PRC leaders’ resolve and confidence. As a result, the PRC leaders may more aggressively apply military defense tools in conventional conflicts in the East China Sea and South China Sea.

In recent years, China has probably completed the construction of more than 300 new inter-continental ballistic missiles (ICBM). These ICBMs may be the first military tool for China to launch a war against Taiwan, especially if Taiwan declares or pursues de jure independence. In the worst-case scenario, the U.S. would react to any missile attacks from China to Taiwan by applying the Patriot missile defense system from Okinawa, Japan, and the Terminal High-Altitude Area Defense (THAAD) anti-missile system from South Korea.

In the meantime, China focuses on building a fully modern national defense force by 2035. The PLA further plans to develop a world-class military force by 2049, or 100 years after the CCP won the Chinese civil war against the KMT party, the latter of which retreated to Taiwan and established a democratic government there as part of the third wave of democratization worldwide from the early-1980s to mid-1990s. In the meantime, the CCP hopes to leverage the PLA to secure what China claims is its sovereign territory: Taiwan, Diaoyu, and Spratly Islands. This leverage empowers the CCP to assert its preeminence in Asia-Pacific regional affairs. This leverage further allows the CCP to project power on the world stage, particularly by being able to counter any form of intervention by the U.S. in a potential cross-strait conflict over Taiwan. Indeed, the far-flung fear of retaliation effectively deters any nuclear first strike in the current arms race between the U.S. and China.

However, China faces a lack of recent warfare experience in the post-war period. This major deficiency would weaken the PLA’s efficacy, and the CCP leaders would probably be much less intent to initiate a cross-strait conflict over Taiwan. In terms of domestic challenges, the PRC leaders face widespread concerns about the ongoing impact of corruption on the PLA’s military capabilities in light of the recent purge of high-level CCP cabinet members (such as the former Minister of Defense Li Shangfu).

The PLA has fielded many modern air force and naval systems to conduct joint amphibious operations. Indeed, these operations pose new threats to the U.S. and many western allies in the western Pacific region. In this region, the U.S. now operates 2 aircraft carriers with a host of ballistic cruise missiles, in addition to the DF-17 hypersonic glide vehicle. At the same time, the U.S. further fields fifth-generation fighter aircraft along the navigational first island chain.

The PLA’s ground forces have further conducted increasingly realistic cross-strait scenarios and war games to improve their readiness and reliability to carry out amphibious operations, all in preparation for a potential cross-strait invasion. In addition to these ground forces, the PLA continues to research various military applications with AI, particularly for smart missile guidance, target detection, and semi-autonomous missile control. Further, the PLA attempts to accelerate the recent inclusion of command information systems to provide ground forces and commanders with better situational awareness and decision support. This support helps the PLA’s ground forces more effectively carry out joint missions and operations.

China commits to becoming a world-class space leader and then continues to demonstrate its growing prowess by deploying increasingly capable space systems with state-of-the-art scientific features and functions. Over the next decade, the PLA continues to improve space intelligence, surveillance, and reconnaissance (ISR), as well as outer space navigation and satellite communication. As of early-2024, China’s Space Agency reiterates its intention to land astronauts on the moon around 2030. China’s Space Agency continues to engage core countries (such as Russia, Vietnam, and North Korea) to join its lunar research station efforts as part of its broader attempt to develop an alternative bloc to the U.S.-led Artemis Accords.

China’s commercial space sector continues to grow quickly and is now on pace to become a major global competitor by 2030. Specifically, China now designs its own low-orbit satellite Internet services to compete with the U.S.-led western commercial satellite Internet services. Counterspace operations remain integral to PLA military campaigns. China’s counterspace weapons and military capabilities continue to target the satellites from the U.S. and western allies. To disrupt target satellites, China has already fielded numerous ground counterspace capabilities such as electronic warfare systems, energy weapons, and anti-satellite missiles. All of these space efforts help the PLA close the current gap between the U.S. and China in terms of military missions in the outer space.

China remains one of the most active and persistent cyber threats to the U.S. government, private sector, and critical infrastructure networks. In Beijing, both cyber espionage pursuits and its industry’s exports of information communication technology (ICT) would increase the potential threats of aggressive cyber operations against the U.S. and many western allies, in addition to the covert and furtive suppression of the free flow of information in cyberspace. Should Beijing believe a major conflict with the U.S. were imminent, China would consider aggressive cyber operations against U.S. critical infrastructure networks and military assets. This first strike would probably deter U.S. military actions by impeding U.S. decision support, inducing societal panic, and interfering with the deployment of U.S. forces.

China continues to lead the world in applying social surveillance and censorship to monitor its population in order to repress dissent. Beijing carries out cyber operations and intrusions to affect U.S. and non-U.S. citizens beyond borders. The primary targets include dissidents, journalists, and high net-worth individuals who the PRC leaders view as threats to the CCP’s actions, agendas, policies, and geopolitical relations.

Today, Beijing continues to expand its global covert influence posture to better support the CCP’s ulterior motives, goals, and policies. In recent years, the PRC attempts to sow doubts about U.S. leadership, democracy, and the western culture. Further, China demonstrates a higher degree of sophistication in its influence activities by experimenting with generative AI. TikTok accounts run by a PRC propaganda arm might target candidates from both political parties, Biden and Trump, during the U.S. presidential election cycle from mid-2023 to 2024. In response, the U.S. House overwhelmingly passed a new bill in March 2024 to require the Chinese parent company, ByteDance, to divest all the U.S. assets of the short-video-sharing app, TikTok, within 6 months.

Beijing continues to intensify joint efforts to mold U.S. public discourse, particularly on core sovereignty and territory issues in association with Hong Kong, Taiwan, Tibet, and Xinjiang. The PRC monitors Chinese students abroad for dissident views, mobilizes Chinese student associations to conduct social surveillance activities on behalf of Beijing, and then influences policy research by U.S. academic professors and think-tank experts. The PRC continues to advance the CCP’s goals, mandates, and ambitions abroad through public propaganda.

China continues to expand its global covert intelligence posture to advance the CCP’s goals, ambitions, and even Marx-Lenin ideologies. In a unique way, China challenges U.S. national security and global influence, quells any potential regime threats worldwide, and then steals trade secrets and intellectual properties (patents, trademarks, and copyrights) to bolster the indigenous tech industries across the mainland. These key industries include semiconductor chip design and production, high-speed broadband Internet connectivity, precision medicine, post-Covid health care, and high-tech applications in cross-strait military missions.

The Xi administration now seems to prioritize political stability and security for the CCP. This prioritization dictates and further reflects the proper form of communist government in China. Indeed, these priorities undermine the PRC’s ability to solve complex domestic problems in terms of both corruption and economic malaise. All these constraints combine to impede the PRC’s longer-term goal of becoming a new superpower on the world stage. Specifically, the PRC leaders cannot cope with corruption, demographic imbalances, and fiscal struggles all at the same time. All these fundamental forces affect economic performance and the quality of life in China, both of which factors underpin the domestic support for the CCP government, legitimacy, and political stability.

Beijing’s focus on national security has led to new laws and regulations on data security and anti-espionage for foreign firms, as well as a crackdown on PRC tech titans such as Alibaba and Tencent. This focus further calls for all PRC society to participate in counterintelligence activities.

The Xi administration reprimands, warns, investigates, and even fires high-level officers on the basis of corruption. However, broad anti-corruption efforts would probably never uproot these socio-economic problems due to the long prevalent power of PRC leaders. President Xi insists that the party apparatus retains exclusive power to fight corruption.

Despite the recent removal of the one-child policy, China’s birth rate continues to decline in recent years. Marriage rates are on a similar downward trajectory. All of these demographic imbalances help reinforce negative population trends with a much smaller labor force.

Beijing still dictates a hardline approach to potential separatism in Hong Kong, Taiwan, Tibet, and Xinjiang. Further, Beijing imposes broad crackdowns on dissent and religion across the mainland. All of these efforts have already generated widespread global criticisms of China’s human rights abuses (in addition to extraterritorial interference outside the mainland).

Beijing attempts to assert sovereignty claims over islands in the South China Sea and East China Sea. These efforts result in persistently high geopolitical tensions between China and several Asian neighbors such as Japan, South Korea, Vietnam, and the Philippines. All the alternative sovereignty claims by these East Asian neighbors may increase opportunities for miscalculation, even though Beijing probably prefers to avoid all direct conflicts and frictions. Beijing maintains a maritime presence near these contestable islands and waters in the East China Sea and South China Sea. Further, Beijing continues to expand its military bases in the Spratly Islands in order to provide the necessary capabilities to rapidly react to any crises in the South China Sea.

In early-2024, the PRC Coast Guard used water cannons and afloat barriers to block Filipino access to contestable islands and waters in the South China Sea. The PRC’s collisions with Filipino supply ships generated media attention, and this media attention highlighted China’s aggressive behaviors toward Vietnam and the Philippines. Manila would not likely relinquish its outpost at Second Thomas Shoal. These diplomatic frictions present more opportunities for inadvertent escalation by either side.

Geopolitical tension between China and Japan over the Senkaku Islands (Diaoyu) last flared up more than a decade ago. Since then, Chinese supply ships have constantly remained in the proximity of the contestable islands. These ships occasionally entered the territorial zone and then drove responses from Japan’s Self-Defense Force to monitor the activity. All these interactions create new opportunities for potential frictions and conflicts between China and its East Asian neighbors, Japan and South Korea, in the East China Sea.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh (online brief biography)

Co-Chair

AYA fintech network platform

Brass Ring International Density Enterprise ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-04-17 07:23:00 Friday ET

Clayton Christensen defines and delves into the core dilemma of corporate innovation with sustainable and disruptive advances. Clayton Christensen (2000)

2026-02-14 11:26:00 Saturday ET

Our AYA fun podcasts deep-dive into the current global trends, topics, and issues in macro finance, political economy, public policy, strategic management,

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2018-11-11 13:42:00 Sunday ET

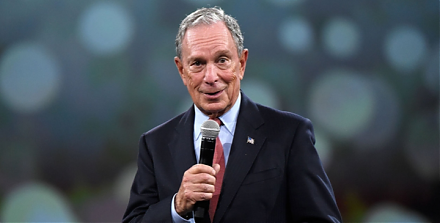

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2018-02-03 07:42:00 Saturday ET

Quant Quake 2.0 shakes investor confidence with rampant stock market fears and doubts during the recent Fed Chair transition from Janet Yellen to Jerome Pow

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational